Part 3 of a 3-Part CNaaS Blog Series:

We should look at history to predict seismic shifts in the IT equipment industry.

Campus NaaS is poorly defined in the industry, leading to market confusion. In this series of blogs, Siân Morgan explores the differences and similarities of the offers on the market and proposes a set of definitions to help enterprises and vendors speak the same language.

In 1998, when Netflix shipped its first DVD (Beetlejuice), not many foresaw the impact that the company would have on the entertainment industry. It took nine years for Netflix to shift from DVD rental to streaming, and another 18 years for streaming to eclipse broadcast and cable TV viewing combined, in 2025. In September, KPop Demon Hunters became Nextflix’s most watched title, with 325 million views in the first 91 days.

The cloud delivery model transformed television and has the potential to transform the LAN equipment industry (although ideally without any soul-sucking demons).

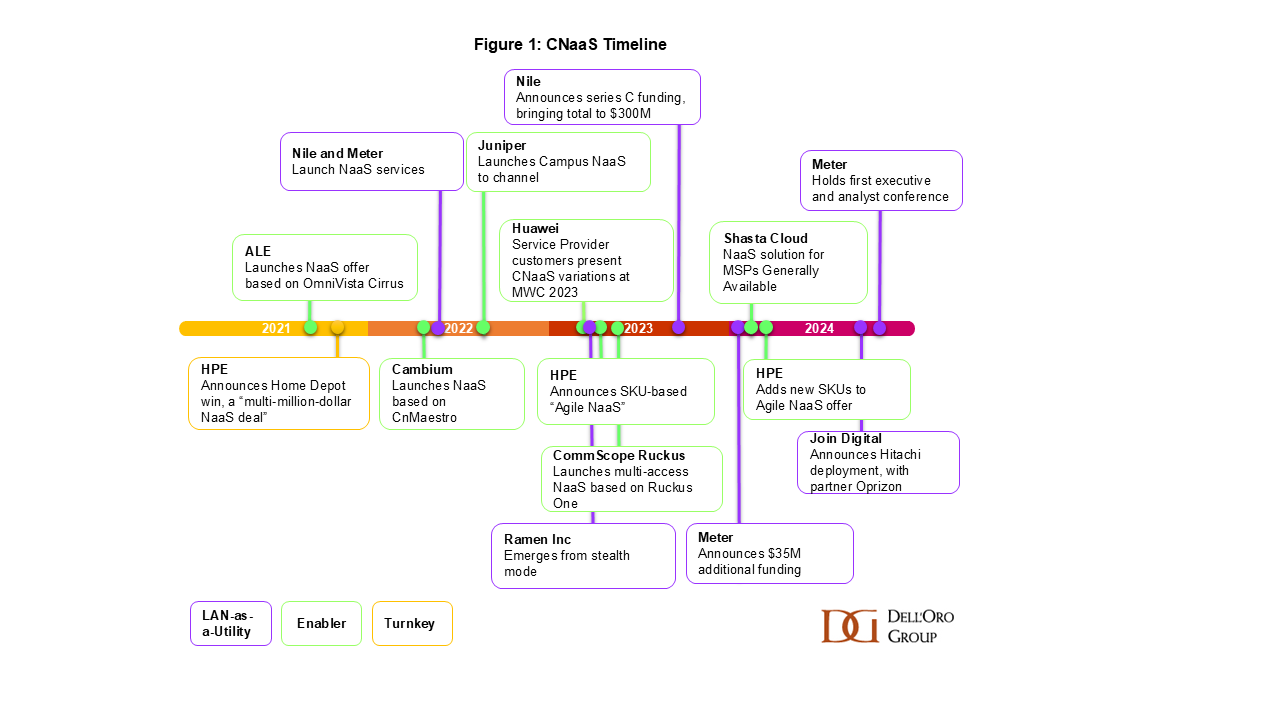

CNaaS has already outpaced Netflix’s nine-year runway. Some of the LAN-as-a-Utility vendors began developing hardware in stealth mode in 2015, and the first CNaaS revenue was recognized in 2018. In 2021, HPE brought the concept of a cloud-inspired LAN offer to mainstream when it announced its deal with Home Depot. Figure 1 shows a few of the key milestones in the short history of CNaaS.

Like the streaming market was in 2014, CNaaS is still a relatively new concept, and most enterprises can be forgiven for struggling to visualize how the offer may change their business.

Like the streaming market was in 2014, CNaaS is still a relatively new concept, and most enterprises can be forgiven for struggling to visualize how the offer may change their business.

In the first blog of this series, I introduced the characteristics that appear in cloud-inspired offers, including “as-a-Service” offers for LAN connectivity, which we label as CNaaS or Campus Network as a Service. To different degrees, CNaaS offers are outcome-oriented, elastic, priced as opex, and maintenance-free. In the second blog, I explained that the CNaaS offers can be classified into three categories:

-

- Turnkey CNaaS, which are bespoke offers to large enterprises,

- Enabler CNaaS for which vendors deliver enhancements to MSPs to expand the service providers’ addressable market, and

- LAN-as-a-Utility CNaaS, for which vendors have developed LAN hardware to automate many operational tasks and to allow the vendors to provide ongoing network monitoring for enterprises.

There is another dimension by which available CNaaS offers vary: by scope of technology. CNaaS vendors include a mix of technologies such as LAN, WAN, data center connectivity, private cellular, firewalls, ZTNA, as well as higher-order applications, such as workflow management and software for smart-building management.

Can the CNaaS opportunity be quantified?

To quantify the opportunity for CNaaS vendors, we first reduce the service to a “core offering,” that is, the common elements present in every vendor’s service: Wireless LAN and Campus Switching. This allows market growth of the core to be baselined and tracked as it evolves. However, it will not represent the total opportunity for a vendor who includes other technologies such as firewalls, ZTNA, or an ISP marketplace, not to mention the professional services that can be bundled with the offers.

Next, this core CNaaS market must be defined in relation to other existing markets. We consider whether its trajectory will be independent, or whether it will evolve as a subset of a larger market, subject to the same prevailing trends as its parent. All of the CNaaS on the market are constructed with Public Cloud-managed LAN technology, and so we consider CNaaS to be a subset of the Public Cloud-managed LAN market. (Public Cloud-managed LAN is made up of LAN offers with management or control applications that are hosted in the cloud facilities of the vendor or a third party). Analyzing the manner in which the Public Cloud-managed LAN market grew and became widely adopted can provide valuable insights into the CNaaS trajectory.

Although it is a subset of the Public Cloud-managed LAN market, CNaaS has one very important difference: the way in which revenue is recognized by vendors. Whereas Public Cloud-managed LAN vendors, such as Cisco, HPE, and CommScope already recognize a material amount of recurring software revenue, nearly all of their hardware revenue is recognized in the quarter in which it is shipped.

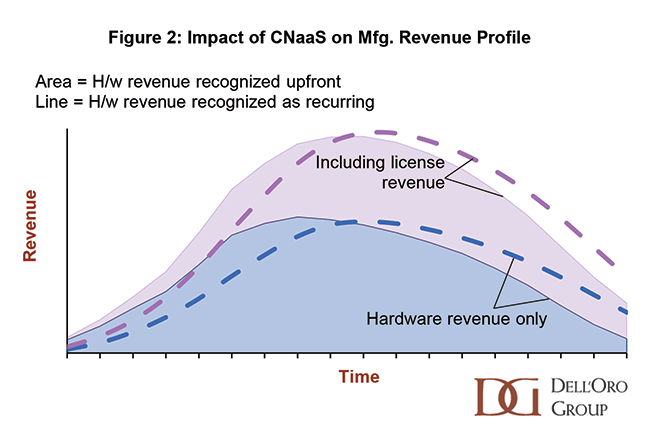

CNaaS offers reduce the revenue recognized in the early years of a contract; as vendors sell more CNaaS, the revenue for past shipments accumulates. Figure 2 compares the theoretical revenue profile of a vendor selling CNaaS with the revenue profile of the same equipment sold as capex. This principle is captured by the “fish model” proposed by Thomas Lah in his blog.

Finally, to quantify the CNaaS opportunity, we must consider whether it is accretive to the total market: will it result in an expansion of overall spending on LAN equipment, or is it a competitive tool to win share of existing market revenues?

I have identified three accretive opportunities related to CNaaS:

-

- The CNaaS opportunity is expected to increase enterprise spending on AIOps software features designed to simplify and automate network operations. This will shift spending from human resources, growing overall LAN-related software revenue.

- Simplification of the MSP workflow delivered by Enabler CNaaS will result in an expansion of MSP revenue from a broader segment of enterprises.

- Vertical-specific CNaaS solutions blending different technologies and higher order applications (such as smart buildings, private wireless/WLAN networks, or the digitization of manufacturing) will drive new use cases and expand enterprise IT spending.

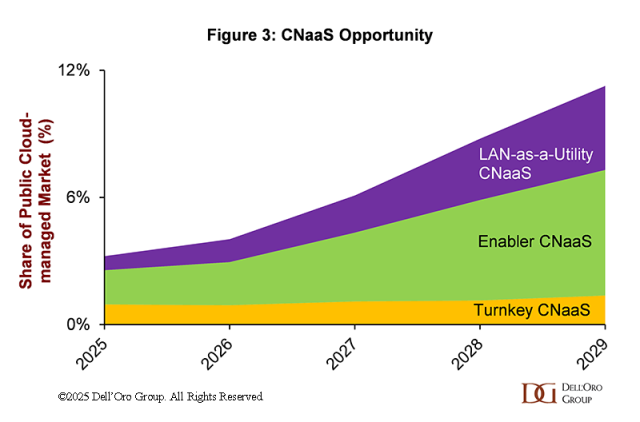

The CNaaS opportunity can be sized by considering the factors described above, alongside an analysis of shipment data, historical trends, and interviews with vendors, enterprises, and channel partners. The conclusion of this analysis is that a shift in LAN delivery model can take several years, but the opportunity it brings is alluring. Increased margins, a deeper, ongoing relationship with customers, and the future stability of a higher total contract value will drive vendors to develop rich CNaaS offers. The commoditization of connectivity and the increasing complexity of networks will drive adoption by enterprises. I predict that in 2029, a mere 11 years after the offer became commercially available, it will represent over 10% of the Public Cloud-Managed LAN market.

With the broadest access to MSPs as a channel of delivery, we expect Enabler CNaaS to remain the largest category. LAN-as-a-Utility CNaaS will remain the fastest growing variant, with the growth driven by new entrants gaining scale.

With the broadest access to MSPs as a channel of delivery, we expect Enabler CNaaS to remain the largest category. LAN-as-a-Utility CNaaS will remain the fastest growing variant, with the growth driven by new entrants gaining scale.

In his explanation of the “fish model”, Thomas Lah laid out two critical steps for SaaS companies wanting to “swallow the fish”, and these recommendations also ring true for CNaaS vendors. First, make sure to align sales compensation to the subscription model, without inflating incentives and associated costs. Second, focus on ensuring a high rate of subscription renewals. As Netflix is well aware, customer churn determines whether a recurring revenue business succeeds or fails.