With around 40 vendors rushing into coolant distribution units, liquid cooling is surging—but how many players can the market sustain?

The AI supercycle is not just accelerating compute demand—it’s transforming how we power and cool data centers. Modern AI accelerators have outgrown the limits of air cooling. The latest chips on the market—whether from NVIDIA, AMD, Google, Amazon, Cerebras, or Groq—all share one design assumption: they are built for liquid cooling. This shift has catalyzed a market transformation, unlocking new opportunities across the physical infrastructure stack.

While the concept of liquid cooling is not new—IBM was water-cooling System/360 mainframes in the 1960s—it is only now, in the era of hyperscale AI, that the technology is going truly mainstream. According to Dell’Oro Group’s latest research, the Data Center Direct Liquid Cooling (DLC) market surged 156 percent year-over-year in 2Q 2025 and is projected to reach close to $6 billion by 2029, fueled by the relentless growth of accelerated computing workloads.

As with any fast-growing market, this surge is attracting a flood of new entrants, each aiming to capture a piece of the action. Oil majors are introducing specialized cooling fluids, and thermal specialists from the PC gaming world are pivoting into cold plate solutions. But one product category in particular has become a hotbed of competition: coolant distribution units (CDUs).

What’s a CDU and Why Does It Matter?

CDUs act as the hydraulic heart of many liquid cooling systems.

Sitting between facility water and the cold plates embedded in IT systems, these units regulate flow, pressure, and temperature, while providing isolation, monitoring, and often redundancy.

As direct-to-chip liquid cooling becomes a design default for high-density racks, the CDU becomes a mission-critical mainstay for modern data centers.

At Dell’Oro, we have been tracking this market from its early stages, anticipating the shift of liquid cooling from niche to necessity. Our ongoing research has already identified around 40 companies with CDUs within their product portfolios, ranging from global powerhouses to nimble specialists. The sheer number of players raises an important question: is the CDU market becoming overcrowded?

Who is currently in the CDU market?

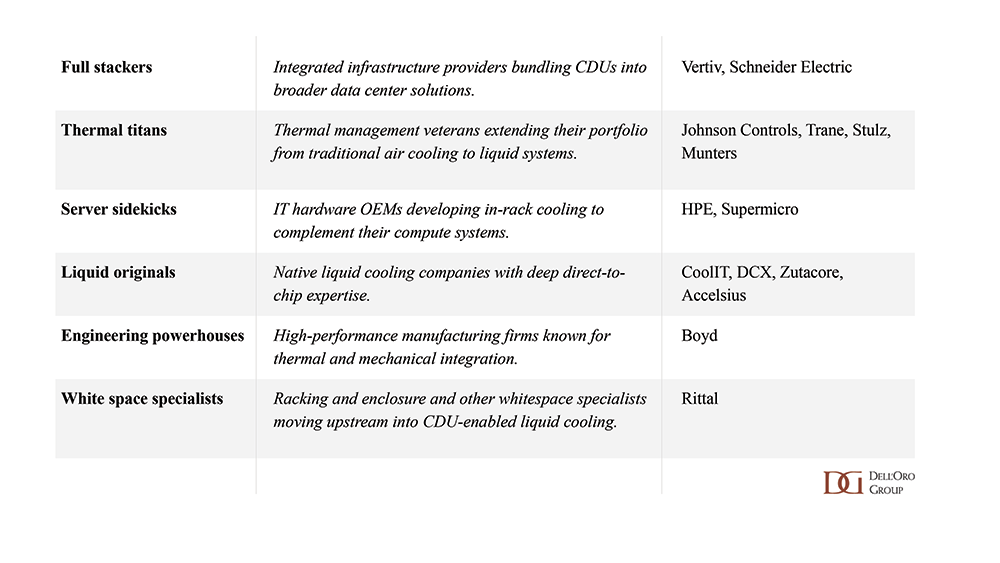

The CDU market is being shaped by players from a wide variety of backgrounds. Some excel in rack system integration, others in high-performance engineering, and others in manufacturing and scalability prowess. The variety of approaches reflects the diversity of the players themselves—each entering the market from a different starting point, with distinct technical DNA and go-to-market strategies.

Below is a snippet of our CDU supplier map—only a sample of our research to be featured in Dell’Oro’s upcoming Data Center Liquid Cooling Advanced Research Report, expected to be published in 4Q 2025. Our list of CDU vendors is constantly refreshed—it has only been three weeks since the latest launch by a major player, with Johnson Controls announcing its new Silent-Aire series of CDUs.

Not all companies in this list have arrived here organically. The momentum in the CDU market has also fueled a wave of M&A and strategic partnerships. Unsurprisingly, the largest moves have been led by physical infrastructure giants eager to secure a position, as was the case with Vertiv’s acquisition of CoolTera in December 2023 and Schneider Electric’s purchase of Motivair in October 2024.

Not all companies in this list have arrived here organically. The momentum in the CDU market has also fueled a wave of M&A and strategic partnerships. Unsurprisingly, the largest moves have been led by physical infrastructure giants eager to secure a position, as was the case with Vertiv’s acquisition of CoolTera in December 2023 and Schneider Electric’s purchase of Motivair in October 2024.

Beyond these headline deals, several diversified players have taken stakes in thermal specialists—for example, Samsung’s acquisition of FläktGroup and Carrier’s investment in two-phase specialist Zutacore. Private equity has also entered the fray, most notably with KKR’s acquisition of CoolIT. Together, these moves underscore the growing strategic importance of CDU capabilities, even if not every partnership is directly tied to them.

Who will win in the CDU market?

Our growth projections are robust, and there is room for multiple vendors to thrive. In the short to medium term, we still expect to see new entrants. Innovators are likely to emerge, developing technologies to address the relentless thermal demands of AI workloads, while nimble players will be quick to capture share in underserved geographies and verticals. Established names such as Vertiv, CoolIT, or Boyd will need to maintain their edge as data center designs and market dynamics evolve.

By the end of the decade, we expect the supply landscape to consolidate as the market matures and capital shifts toward other growth segments. Consolidation and exits are inevitable. We expect fewer than 10 vendors to ultimately capture the lion’s share of the market, with the remainder assessing the minimum scale neede d to operate sustainably while meeting shareholder expectations—or exiting altogether.

Who will win? There is no single path to success, as data center operators and their applications remain highly diverse. For instance, some had forecast the demise of the in-rack CDU as a subscale solution misaligned with soaring system capacity requirements. Many operators, however, continue to find value in this form factor. Slightly lower partial power usage effectiveness (pPUE) can be offset by advantages in modularity, ease of off-site rack integration and commissioning, and containment of faults and leaks.

Similarly, liquid-to-air (L2A) systems were often described as a transitional technology destined to be quickly superseded by more efficient liquid-to-liquid (L2L) solutions. Yet L2A CDUs have maintained a role even with large operators—ideal for retrofit projects in sites heavily constrained by legacy design choices, with accelerated computing racks operating alongside conventional workloads.

In-rack CDUs, L2A solutions, and other design variations will continue to play a role in a market that is rapidly evolving. GPU requirements are rising year after year, and liquid cooling systems are advancing in step with the capacity demands of next-generation AI clusters. Amid this market flux, several factors are emerging as critical for success.

First, CDUs are not standalone equipment: they are an integral element of a cooling system. Successful vendors take a system-level approach, anticipating challenges across the deployment and leveraging the CDU as hardware tightly integrated with multiple elements to ensure seamless operation. Vendors with proven track records and large installed bases—spanning multiple gigawatts—enjoy an advantage in this regard, as their experience positions them to function as a partner and advisor to their customers, rather than a mere vendor.

Second, success is not just about having the right product—it is about understanding the problem the customer needs solved and developing suitable solutions. Operators face diverse challenges, and a single fleet may need everything from small in-rack CDUs to customized L2A units or even fully skidded multi-megawatt systems. Breadth of portfolio helps hedge across deployment types, but it is not the only path to success. Vendors with a sharp edge in specific technologies can also capture meaningful share.

Lastly, scale and availability are often decisive. As builders race to deliver more compute capacity, short equipment lead times can create opportunities for nimble challengers. Availability goes beyond hardware—it also requires skilled teams to design, commission, and maintain CDUs across global sites, including remote locations outside traditional data center hubs.

As the market evolves, one key question looms: which vendors will adapt and emerge as leaders in this critical segment of the AI infrastructure stack? The answer will shape not just the CDU landscape, but the broader liquid cooling market. We will be following this closely in Dell’Oro’s upcoming Data Center Liquid Cooling Advanced Research Report, expected in 4Q 2025, in which we provide deeper analysis into these dynamics and the broader liquid cooling ecosystem.