Sameh Boujelbene

Vice President

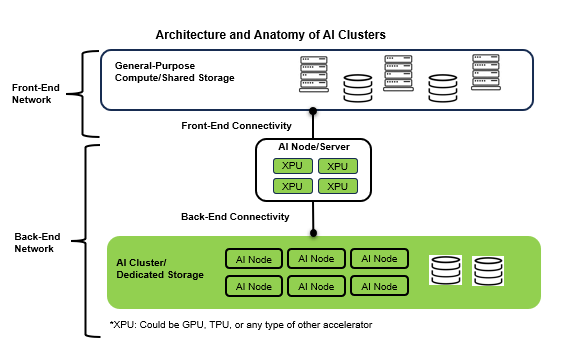

The AI industry is currently undergoing a significant inflection point, marked and defined by the rapid rise of emerging large language models and generative AI applications, such as OpenAI’s ChatGPT. What sets these emerging AI applications apart is the sheer number of parameters they must manage. Some of them deal with billions—or even trillions— of parameters, necessitating the use of thousands or tens of thousands of GPUs, TPUs, or other types of accelerated processors. Connecting these accelerated servers into large clusters requires a data center-scale fabric known as the AI back-end network. This network differs from the traditional front-end network used to connect general-purpose servers.

This Data Center Switch – AI Back-end Networks report includes Ethernet and InfiniBand switches deployed in the AI back-end networks.

The chart below explains the definition of front-end networks and back-end networks.

The Data Center Switch – AI Back-end Networks report aims to answer critical market questions such as:

- What are the unique requirements of AI Networks?

- What is the total market opportunity for AI back-end networks?

- What is the current and future share of Ethernet vs. InfiniBand and what are the use cases driving each of these protocols?

- What is the vendor landscape in Ethernet AI back-end networks and how is it different from the front-end networks? Who is gaining share? Who is losing share?

- How is the speed migration to 400 Gbps, 800 Gbps, 1600 Gbps, and ≥3200 Gbps different from the front-end networks?

- What is the additional spending on optics and NICs (Network Interface Cards) in AI back-end networks?

To answer these and other important questions, Dell’Oro Group currently delivers both quarterly reports and 5-year forecasts for this market segment.

Data Center Switch – AI Back-end Networks Quarterly Reports

Dell’Oro Group publishes Data Center Switch – AI Back-end Networks quarterly reports with in-depth market-level and detailed vendor market share information by customer and technology segments:

- InfiniBand vs. Ethernet

- Different form factors: Modular, Fixed Managed and Fixed Unmanaged by Port Speed (combined and separately)

- Different Port Speeds: 1/10/25/40/50/100/200/400/800/1600 Gbps/ ≥3200 Gbps

- Different customer segments: Top 4 U.S Cloud, Top 3 China Cloud, Rest of Cloud, Large Enterprises, Rest of Enterprises.

- Different Regions: Mfg. Revenue only, including North America, EMEA (Europe, Middle East, and Africa), APAC (Asia Pacific), APAC excluding China, China, and CALA (Caribbean and Latin America)

- Supplemental information on optics and NICS (Network Interface Cards)

For a comprehensive view of the entire data center, we offer a package of data center equipment research including Data Center Switch – AI Back-end Networks , Data Center Switch – Front-end Networks, Data Center IT Capex, Data Center IT Semiconductors & Components, Data Center Liquid Cooling, Data Center Physical Infrastructure, and Ethernet Adapter & Smart NIC.

Data Center Switch – AI Back-end Networks 5-Year Forecasts

Dell’Oro Group publishes Data Center Switch – AI Back-end Networks 5-year forecasts offering a complete overview of the market with historical data from 2020 to present. The forecasts provide a comprehensive overview of market trends and include tables covering revenue, port shipment, and average selling price forecasts for the following:

- InfiniBand vs. Ethernet

- Different form factors: Modular, Fixed Managed and Fixed Unmanaged by Port Speed (combined and separately)

- Different Port Speeds: 1/10/25/40/50/100/200/400/800/1600 Gbps/ ≥3200 Gbps

- Different customer segments: Top 4 U.S Cloud, Top 3 China Cloud, Rest of Cloud, Large Enterprises, Rest of Enterprises.

- Different Regions: Mfg. Revenue only, including North America, EMEA (Europe, Middle East, and Africa), APAC (Asia Pacific), APAC excluding China, China, and CALA (Caribbean and Latin America)

- Supplemental information on optics and NICS (Network Interface Cards)

Click here to contact us for more information about the Ethernet Switch – Data Center research program or about purchasing option.