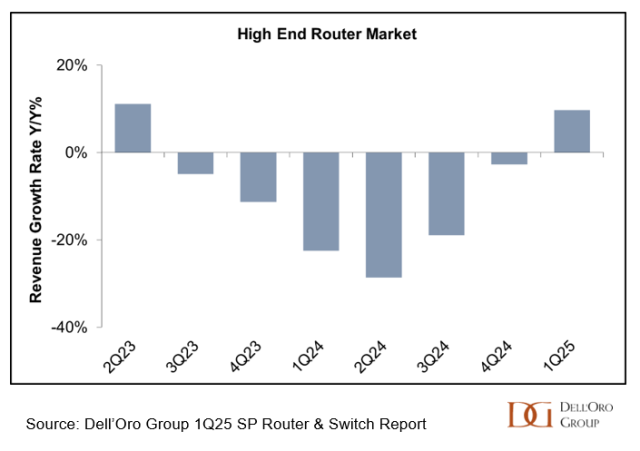

The High End Router market posted its first positive year-over-year (Y/Y) growth rate, officially ending the market contraction phase that began in 3Q 2023, which was caused by excess customer inventory of systems and deteriorating macroeconomic conditions. We estimate that the High End Router market grew 10% Y/Y in the quarter, with growth across all segments, particularly in service provider Core and Edge Routers. Additionally, every major region contributed to the strong revenue increase this quarter.

Four vendors held more than 10% of the High End Router market share in 1Q 2025: Huawei, Cisco, Nokia, and Juniper. Among these suppliers, Huawei outperformed the market, growing revenues 23% Y/Y, thereby gaining 3 percentage points of share. Juniper and Nokia also performed well, with revenue growth of 16% and 14%, respectively. Among the top four vendors, only Cisco posted router revenue in 1Q 2025 that was below its revenue a year earlier. However, Cisco did grow its Core Router revenue both Y/Y and quarter-over-quarter (Q/Q), driven by the success of selling its routed optical networking (RON) solution with 400 Gbps ZR/ZR+ Optics.

The first quarter of the year came in stronger than we anticipated it would just three months ago. As a result, we raised our 2025 market outlook. However, market uncertainty remains elevated due to U.S. government initiatives that may increase costs and slow economic growth.

The Dell’Oro Group Service Provider Router & Switch Report offers complete, in-depth coverage of the Service Provider Router and Switch market for current, future, and historical periods. The report includes qualitative analysis and detailed statistics for manufacturing revenue by region, customer type, use cases, average selling prices, and unit and port shipments. To purchase this report, please contact us by email at dgsales@delloro.com.