Private wireless growth continues to outpace the flattish trends in the public RAN market. Preliminary findings from the recently updated Private Wireless report suggest that the positive momentum driving the roughly 40% increase in 2024 extended into 1H25, with worldwide private wireless Radio Access Network (RAN) revenues accelerating rapidly in the first half.

The trajectory of private wireless stands out within the broader RAN landscape. Even though year-over-year comparisons will become more challenging in the second half, private wireless remains on track to grow around 20% for the full year 2025. In contrast, total RAN revenues—including both public and private segments—are expected to remain flat this year.

Although private 5G adoption is still in its early stages and will take time to materially impact the overall RAN market, we estimate that private RAN accounted for a mid-single-digit share of total RAN revenues in 1H25, up from a low single-digit share in 2022.

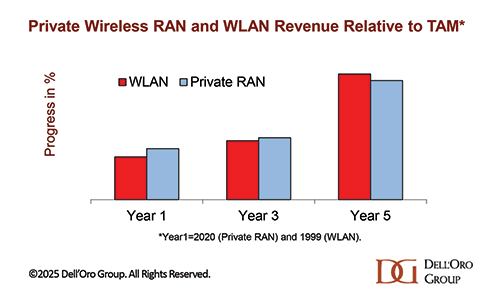

Looking ahead, private wireless adoption continues to progress at a healthy pace. Notably, private wireless as a share of the total addressable RAN market is tracking closely with the trajectory of enterprise Wi-Fi adoption during its first five years.

The expanding scope of private wireless, combined with the fact that the private wireless RAN opportunity remains largely untapped, is fueling interest from a wide range of ecosystem participants. Although the number of RAN vendors is smaller today than it was five years ago, more than 50 private RAN and 5G core suppliers and system integrators are betting that ongoing investments will eventually pay off.

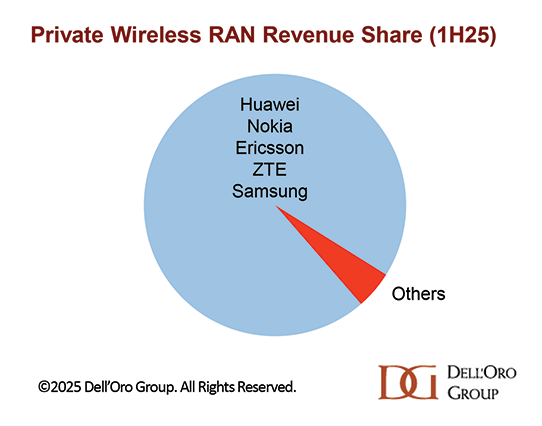

Still, the Private Wireless RAN market remains highly concentrated. The same five leading public RAN suppliers continued to dominate the private RAN landscape in 1H25. This overlap reflects the market’s pivot away from traditional enterprise environments toward industrial applications, where scale, performance, and integration requirements favor established vendors.

Additional highlights from the September 2025 Private Wireless Report:

- Growth in 1H25 was driven both by campus and wide-area deployments, though wide-area led the growth.

- China was the largest country in 1H25 by revenue. Growth outside of China, however, was accelerating at a faster pace.

- Top 3 Private Wireless RAN suppliers by revenue in 1H25 include Huawei, Nokia, and Ericsson.

- Top 3 Private Wireless RAN suppliers by revenue in 1H25, excluding China, include Nokia, Ericsson, and Samsung.

- Nokia is the leading Campus Network Private Wireless RAN supplier in 1H25, while Huawei is the leading Wide-Area Private Wireless RAN supplier over the same time period.

- The high-level message that we have communicated for some time has not changed—private wireless is a massive opportunity. Still, it will take some time for enterprises to embrace private cellular technologies. Private Wireless RAN revenue is expected to grow at a 15 to 20 percent CAGR and account for 5 to 10 percent of total RAN by 2029 (public RAN is expected to decline at a 2 percent CAGR over the same period).

Dell’Oro Group’s Private Wireless Advanced Research Report includes both quarterly vendor share data and a 5-year forecast for Private Wireless RAN by coverage, technology, and region. To purchase this report, please contact us at dgsales@delloro.com.