AI and the Economy: Sorting Through Mixed Signals

In the first half of 2025, a fresh breeze blew through the Enterprise Networking market — a welcome change after the doldrums of 2024 and the gales of 2023.

Rock ’n Roll Trajectory

Rock ’n Roll Trajectory

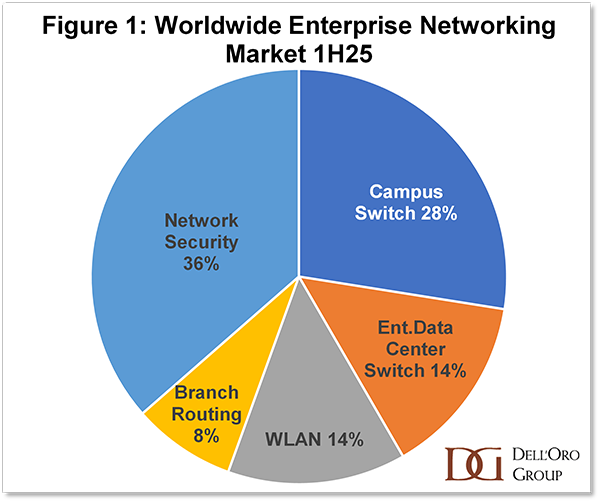

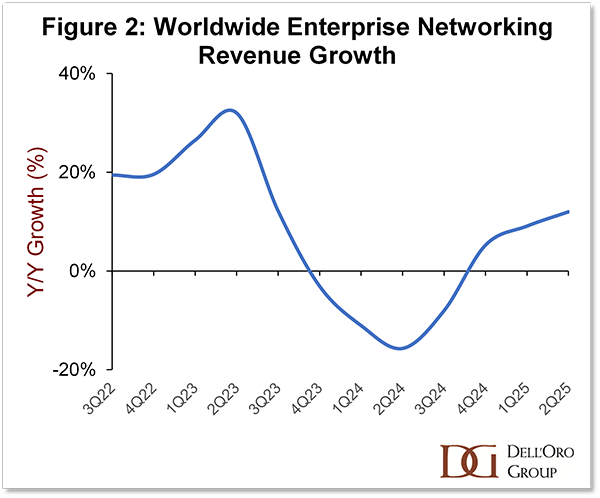

The worldwide Enterprise Networking market, made up of the segments depicted in Figure 1, hit a growth peak of 32% Y/Y in 2Q23. In that quarter, vendors began to deliver on the large backlogs that they had built up during the post-pandemic supply constraints. Hardware orders were particularly affected, with the result that Campus Switch and WLAN shipments flooded the market, and the revenue growth from these two domains dominated.

Two quarters later, the slide downward began, with the winners from 2Q23 pulling the market down to a double-digit contraction (Figure 2). Network Security was immune to the 2024 drop; the large share of software and as-a-service delivery in this segment did not get tangled in the supply constraint problems, and cybersecurity threats continued to drive sales.

Finally, in 4Q24, the digestion of excess equipment came to an end, and Enterprise Networking revenue grew for the first time in four quarters.

But is it likely to last?

Since the turnaround, market growth has accelerated. In 2Q25, data center switch sales to large enterprises surged. Enterprises resumed their networking projects and began upgrading to Wi-Fi 7, leading to 12% growth of worldwide Enterprise Networking revenue in the second quarter.

Since the turnaround, market growth has accelerated. In 2Q25, data center switch sales to large enterprises surged. Enterprises resumed their networking projects and began upgrading to Wi-Fi 7, leading to 12% growth of worldwide Enterprise Networking revenue in the second quarter.

Meanwhile, the industry is awash with mixed signals. With global trade tensions, inflation and tariffs, uncertain economic outlook, a flush of merger and acquisition activity, and double-edged promise/threat of AI, industry participants have been left guessing as to which way things will head for the rest of the year.

Puts and Takes

In 2Q25, US hyperscalers pulled in purchases of data center server components in order to get ahead of tariffs. However, the impact of global trade tensions on the Enterprise Networking market has been muted. Whereas some segments, such as WLAN, may have seen a small bump in sales by companies aiming to avoid price hikes, overall spending has not risen significantly due to advanced ordering.

Instead, the impacts of global trade tensions are being felt in the form of an unease in the face of macroeconomic uncertainty. With fixed IT budgets and strategic demands on cash flow, enterprises often choose to hold back on IT purchases when the outlook for future revenues is murky.

Trends to Shape the Market

Meanwhile, the arrival of AI – with its vast array of impacts on enterprises – has the potential to both fuel and slow network spending. We predict the following four trends will shape Enterprise Networking revenue for the remainder of 2025.

-

AI FOMO (fear of missing out) will lead to cautious spending

Enterprise leaders are under pressure to stay competitive amidst an AI revolution. Companies and institutions have embarked on AI proofs of concept but are struggling to measure tangible benefits. The best first step is to lock down strong network performance and prepare for an onslaught by AI-fueled hackers. The need to move forward in this era of AI will drive enterprises to spend on networking and security as they develop their roadmap of AI use cases. But enterprises will also be looking to allocate spending to the pursuit of AI projects once they’ve been fleshed out. Depending on where they find the budget, spending on Local Area Network equipment could take a hit when AI projects are ready to be implemented. Data center switch spending by enterprises could grow, depending on the extent to which companies choose to run workloads on premises, instead of in the cloud.

-

Network Automation is an Easy Win

Implementing AIOps functionality will become a differentiator for enterprises looking to gain competitive advantage. Whereas the ROI on many AI projects has been elusive, it is fairly straightforward to capture the savings associated with fewer trouble tickets, faster time to problem resolution, and simpler network configuration. This will help drive investment in the latest network technology, since most vendors are offering AI-fueled operations features.

-

Software and Recurring Fees Provide Added Flexibility

Automating operations and outsourcing network maintenance are two ways for an enterprise to refocus on becoming more competitive, but both of these initiatives usually come with recurring fees.

Having witnessed the innovation catalyzed by cloud computing, many enterprises are becoming more accepting of the recurring license model. These fees drive up the cost of network equipment, but enterprises that take a holistic approach can count increased labor efficiency as compensation.

-

SASE is the battleground for Network-Security Convergence

As bad actors adopt AI, cybersecurity risks are growing, and enterprise spending on security will need to keep pace. Network Security vendors are jostling for position, each aiming to take share of the growing opportunity. However, the increased addressable Network Security market is not going unnoticed by WLAN and Campus Switch vendors.

Today, the Local Area Network (WLAN and Campus Switch) and Network Security segments are dominated by different vendors. As security threats become amplified by AI, the two types of vendors are greedily eyeing each other’s markets.

In 2Q25, traditional LAN equipment vendors, such as Cisco, HPE, and Juniper, accounted for only 11% of the Network Security market. On the flip side, the only traditional security vendor in the network market (Fortinet) accounted for an even smaller portion of LAN equipment sales. It is in the Branch Routing market that the two solitudes meet. Security vendors, with strong SSE offers, made up nearly 30% of the Branch routing market in 2Q25.

In 2025, the convergence of network and security will continue to occur mainly in the Wide Area Network, with single-vendor SASE offers. However, in the longer term, if larger enterprises choose to merge their NetOps and SecOps departments and seek to streamline the number of suppliers, vendors will have opportunities to expand and may also face threats from newcomers to the market.

Which Way is Up?

When we weigh growth trends and headwinds, we are cautiously optimistic for 2025, calling for 9% growth for the year. It’s not a growth rate to rival the double-digit highs of 2022 and 2023, but after the upheaval of the last five years, it feels pretty good.