Dell’Oro Group’s telecom market research covers a wide array of topics in the telecommunications infrastructure industry, including advanced reports on topics like 5G/6G, Cable Outside Plants, Coherent Optics, Fixed Access Wireless, Open RAN, Private Wireless

Optical Transport Market Grew to $16 Billion in 2025, According to Dell’Oro Group

RAN Market Stabilized in 2025, According to Dell’Oro Group

MCN Market Roared Back in 2025 With 15 Percent Growth, According to Dell’Oro Group

Hyperscale AI Investment Cycle Anchors Accelerator-Led Infrastructure Spending, According to Dell’Oro Group

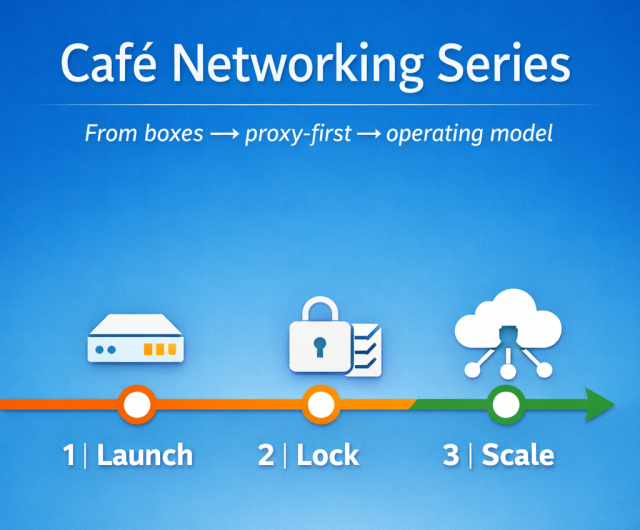

Scaling up café networking: From microsites to campus

Café networking: Decisions to lock before you scale (Part 2)

Stay in the Know

Get Hot Topics delivered to your inbox.

ACCESS DELL’ORO GROUP RESEARCH

Dell’Oro Group offers market research packages for each client’s individual needs, including a full-year subscription service and single reports.

How to BuyGo Beyond The Data

From custom reports, webinars to white papers to consulting, Dell’Oro Group provides the data, insights, and platforms to help you achieve your business and strategic goals.

Hundreds of companies around the world have relied on Dell’Oro Group’s decades of experience in providing accurate and timely market data and forecasts. Now, you can take those insights and strengthen your messaging and product positioning by leveraging Dell’Oro Group’s world-class team of analysts and global customer reach.

Let's Start a Conversation

Learn more about how our industry-leading data and research can help your organization develop better strategies for the future.

Contract Us