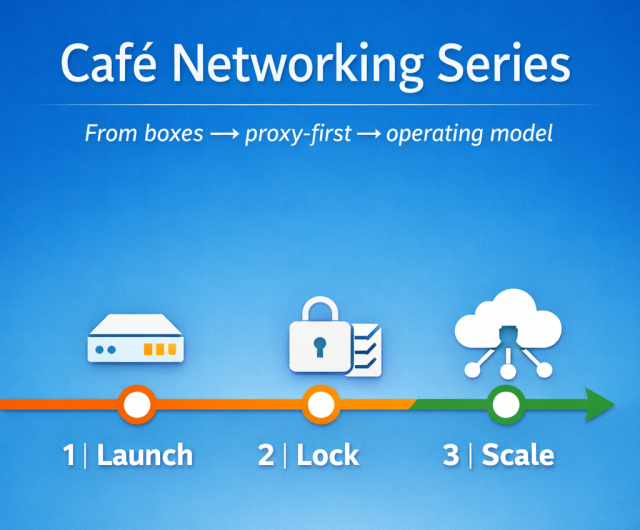

Telecommunications, Security, Enterprise Networks, and Data Center Infrastructure Market Research

The trusted source for enterprise networks, data center, security, and telecommunications infrastructure market research, Dell’Oro Group provides detailed quantitative information on revenues; port and/or unit shipments; and average selling prices. Dell’Oro Group’s cutting-edge, accurate information on the direction of market movement enables our clients to make strategic business decisions with confidence and maintain a competitive edge.