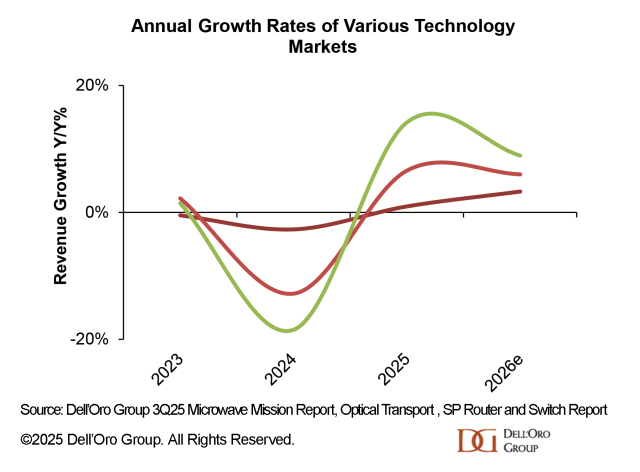

The Microwave Transmission market has gone through some ups and downs, but at a high level, it has been relatively stable and less volatile than the other network equipment markets I track.

Past: 2024

For the full year 2024, the Microwave Transmission market declined by only 3%. While this was a decline, it was minor compared to the double-digit declines in the other markets, where customers pulled back new orders as they digested the excess equipment purchased during the pandemic. In fact, the Microwave Transmission market decline in 2024 was slightly better than we anticipated at the start of the year. The reasons for the market contraction were as follows:

- Sharp decline in E-band equipment purchases in India, following a massive deployment cycle the previous year.

- Procurement delays and order flow disruptions that followed the acquisition of Siklu and NEC’s microwave business (Ceragon acquired Siklu, and Aviat acquired NEC’s microwave business).

- Slowdown in rolling out 5G networks as operators began to question its return on investment (ROI).

- Weaker macroeconomic conditions, including:

- slower GDP growth in many countries

- lower currency exchange rates against the U.S. dollar, and

- higher borrowing costs.

Present: 2025

We just concluded data collection through 3Q25, and so far, the Microwave Transmission market is poised to post a very small increase driven by sales in emerging markets and a stable North American market. However, within the year, things were rocky: strong growth in the first half was followed by weakness in the second half, leading us to reevaluate the year repeatedly.

Two things are helping the market this year:

- Mobile backhaul deployments in emerging markets are increasing. Although many operators are cautious about the ROI, they are still deploying 5G and mobile backhaul, albeit at a slower, steadier pace.

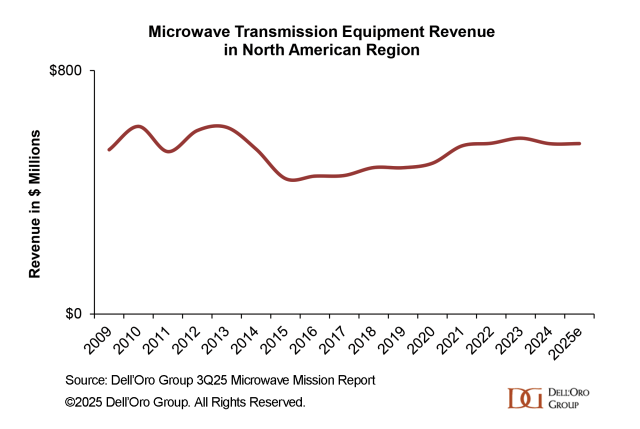

- A stable level of demand in North America, which I had always thought would decline. It is actually one of the most fascinating things for me. I have tracked Microwave at Dell’Oro Group since 2008, and everyone (myself included) thought the revenue in this region would shrink with the shift to fiber. This chart shows the microwave revenue in North America between 2009 and 2025. I think the past 15 years have proved us all wrong about North America and that microwave backhaul use would decline.

Unfortunately, offsetting this growth is the weaker Verticals market, which we think is due to lower government funding and delays in project starts.

Future: 2026

We envision the Microwave Transmission market returning to a more normal state in 2026, driven by growth in both mobile backhaul and the Vertical markets.

One major assumption is that we expect demand for mobile network capacity to return to high double-digit growth rates. The demand for bandwidth slowed due to the pandemic, the shift to remote work, weak economic conditions, and reduced travel. However, this all reversed, and we expect network demand to revert to historical growth rates as the world pushes for normalcy. Additionally, integrating AI applications like ChatGPT on mobile devices may increase network usage more than before.

The Microwave Transmission market will not have the high growth rates of the other markets I track, but it won’t have the steep declines either. It is expected to have steady growth in 2026. Operators, especially those in emerging markets still expanding their 5G footprint, are expected to continue adding new cell sites and capacity to their backhaul networks for a few more years. We also believe the Vertical markets may return to growth in 2026, helped a little by rural broadband expansion, which is economically more feasible with wireless links that do not require months of trench digging to bury fiber.