In the most recent 3Q25 market study, the Optical Transport market posted a 15% year-over-year (Y/Y) gain, moving us to raise our full-year outlook for 2025 and 2026.

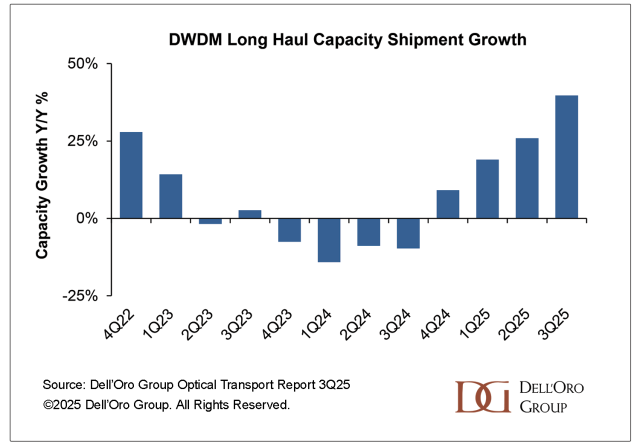

It was more than just the market’s growth rate that led us to raise our forecast; it was the bandwidth. What I mean is that network capacity demand or bandwidth was back on the rise after two years of stalling. Here is a chart on DWDM Long Haul capacity shipment growth on a Y/Y basis for the past 3 years. As shown, new installations on backbone networks grew at a rate below the historical average of 25% to 30% for 9 quarters. This changed in the middle of 2025, and growth rates are now back above 25%.

Data center interconnect (DCI) accounted for most of the bandwidth growth over the past year, driven by large deployments from cloud providers. This trend is expected to continue through 2026 and remain a key market driver. However, it will now expand beyond traditional DCI. The new outlook suggests that the largest cloud providers are nearing a performance ceiling in some geographies due to power grid limitations. The good news is that a solution exists: scaling across multiple data centers to create a larger virtual AI factory.

Hence, we believe that, beginning in 2026, cloud providers will expand their AI data centers across multiple buildings about 100 km apart, requiring 800 ZR+ optics and optical line systems (OLSs) to tap into different electricity grids to run their power-hungry GPU compute clusters.

The optical equipment of choice for building new DCI networks, including for scale-across, will likely remain Disaggregated WDM, which accounted for nearly 40% of total Optical Transport market revenue during the first nine months of 2025 (the other 60% of revenue was mainly from large integrated systems). Also, as many of you know, the idea of disaggregating the WDM network originated with cloud providers.

For those unfamiliar with what we call Disaggregated WDM, here is a description: Disaggregated WDM is a product and architecture that promotes the independence of the main elements in a WDM network—transponders and optical line systems. As transponder technology continuously improved and reduced in size, the natural progression was to sell these subsystems as optical pluggable modules for use in WDM systems, routers, and switches. Additional factors that characterize Disaggregated WDM include open interfaces to eliminate vendor lock-in and small form-factor chassis to better align with a pay-as-you-grow model. We track the Disaggregated WDM market in the following major categories:

- Transponder Units: Compact form factor that mainly houses the embedded or pluggable WDM transponders and is used in long-haul and metro deployments.

- Optical Line Systems: Small chassis that mainly houses the amplifier (EDFA and/or RAMAN), optical add/drop multiplexer (OADM), and mux/demux.

- IPoDWDM ZR/ZR+: In an IPoDWDM architecture, the pluggable WDM transceiver is placed in a router or Ethernet switch rather than a Transponder Unit. We account for the ZR/ZR+ optical plug portion in Disaggregated WDM.

Alongside DCI, we expect the positive trend among communication service providers (CSPs) to continue into 2026. In the third quarter of 2025, non-DCI revenue for DWDM Long Haul rose 14% Y/Y, indicating that demand for network backbone capacity goes beyond just cloud providers and AI expansions. We believe this non-DCI growth is particularly significant because it suggests that CSPs’ inventory correction is complete and their network bandwidth is starting to grow again. This likely means that CSPs will purchase even more optical transport equipment in 2026.

We have an optimistic outlook for 2026 and believe that the Optical Transport market will build on the positive momentum in 2025. We are eagerly looking forward to witnessing this continued growth and development unfold in the coming months and years.