AWS’s In-Row Heat Exchanger (IRHX) is a custom-built liquid cooling system designed for its most powerful AI servers—system that initially spooked infrastructure investors, but may ultimately strengthen the vendor ecosystem.

On July 9, 2025, Amazon Web Services (AWS) unveiled its in-house-engineered IRHX, a rack-level liquid-cooling platform engineered to support AWS’s highest-density AI training and inference instances built around NVIDIA’s Blackwell GPUs.

The IRHX comprises three building blocks—a water‑distribution cabinet, an integrated pumping unit, and in‑row fan‑coil modules. In industry shorthand, this configuration is a coolant distribution unit (CDU) flanked by liquid‑to‑air (L2A) sidecars. Direct liquid cooling (DLC) cold‑plates draw heat directly from the chips; the warmed coolant then flows through the coils of heat exchangers, where high‑velocity fans discharge the heat into the hot‑aisle containment before the loop recirculates.

Data Center Physical Infrastructure vendors have offered DLC solutions with L2A sidecars for some time now, as a practical retrofit path for operators looking to deploy high-density racks in existing air-cooled environments with minimal disruption. Vertiv offers the CoolChip CDU 70, CoolIT provides a comprehensive line of AHx CDUs, Motivair brands its solution as the Heat Dissipation Unit (HDU™), Boyd sells in-row and in-rack L2A CDUs, and Delta also markets its own L2A options—just to name a few.

“When we looked at liquid cooling solutions based on what’s available in the market today, there were a few trade-offs,” says Dave Brown, VP of Compute & ML Services at AWS. “Between long lead times for building greenfield sites and scalability issues with off-the-shelf solutions, AWS chose to develop its own system. “The IRHX was designed to allow us to scale fast by standardizing our equipment and supply chain, and has been built to spec for our standard rack dimensions to fit within our existing data centers.” (Source: YouTube, https://youtu.be/u81NapG8yL0)

While the AWS approach resembles other industry solutions, it introduces several thoughtful innovations laser-focused on its specific needs. Most off-the-shelf systems integrate the pump and heat exchanger coil in a single enclosure, delivering a self-contained L2A unit for one or more racks. In contrast, AWS separates the pumping unit from the fan-coil modules, allowing a single pumping system to support a large number of fan units. These modular fans can be added or removed as cooling requirements evolve, giving AWS flexibility to right-size the system per row and site.

AWS is no stranger to building its own infrastructure solutions. From custom server boards and silicon (Trainium, Inferentia) to rack architectures and networking gear, the scale of its operations justifies a highly vertical approach. The IRHX follows this same pattern: by tailoring CDU capacity and L2A module dimensions to its own rack and row standards, AWS ensures optimal fit, performance, and deployment speed. In this context, developing a proprietary cooling system isn’t just a strategic advantage—it’s a natural extension of AWS’s vertically integrated infrastructure stack.

Market Implications

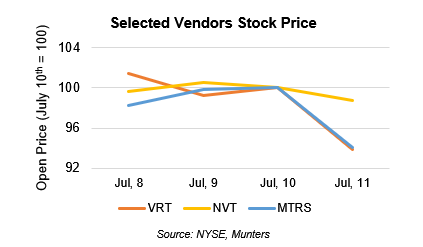

What does this mean for Data Center Physical Infrastructure vendors? The market reaction was swift—shares of Vertiv (NYSE: VRT) and Munters (STO: MTRS) dropped the day following AWS’s announcement. We do not view Amazon’s move as a threat to vendors in this space, however.

First, it’s important to recognize that the Liquid Cooling market remains buoyant, with considerable room for growth across the ecosystem. Dell’Oro Group’s latest research showed 144% year-over-year growth in 1Q 2025, and our forecast for the liquid cooling segment remains strong. As long as the AI supercycle continues—and we see little risk of it slowing down—the market is expected to remain healthy.

Second, while AWS is an engineering powerhouse, it rarely develops these solutions in isolation. It typically partners with established vendors to co-design its proprietary systems, which are also manufactured by third parties. IRHX may carry the AWS name, but it is likely being built in the facilities of well-known cooling equipment suppliers. Rather than displacing revenue from infrastructure vendors, the IRHX is expected to reinforce it—these vendors are likely playing a key role in its production, and their topline performance should benefit as a result.

Finally, although Dave Brown has stated that the IRHX “can be deployed in existing data centers as well as new builds,” we don’t expect to see it widely used in greenfield facilities designed from the ground up for artificial intelligence. L2A solutions are ideal for retrofitting sites with available floor space and cooling capacity, offering minimal disruption and lower upfront capex. They remain less efficient than liquid-to-liquid (L2L) systems, however, which are likely to stay the architecture of choice in purpose-built AI campuses designed for maximum thermal efficiency and scale.