Open RAN has made significant progress since the O-RAN Alliance was formed in 2018 to “reshape the RAN industry and ecosystem towards more intelligent, open, virtualized, and interoperable networks”. But the results have been mixed so far.

Cumulative Open RAN revenues are approaching $10 billion, the Open Fronthaul (OFH) interface has become an increasingly important requirement, and most leading operators now regard O-RAN, Cloud RAN, and AI-driven RAN as core pillars of their next-generation RAN roadmaps. However, multi-vendor RAN adoption and expectations remain limited. According to the latest 1H25 RAN report, market concentration—as measured by the Herfindahl-Hirschman Index (HHI)—is rising across several regions. The RAN market is now classified as “highly concentrated” (HHI > 2500) in five of the six tracked regions. This suggests that the supplier diversity element of the Open RAN vision is fading.

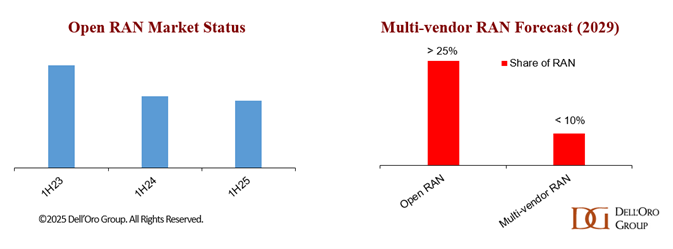

Market traction has also proven uneven. Open RAN initially scaled rapidly, fueled by large-scale deployments in Japan and the U.S. However, after this sharp rise, total Open RAN revenues declined by roughly 40% within two years, as activity outside early adopters failed to offset the slowdown in the U.S. and Japan. While some moderation was expected, the pace of deceleration was sharper than anticipated, in part because of weaker 5G investments overall.

Open RAN is beginning to show signs of stabilization. Preliminary data indicate that Open RAN revenues grew year-over-year (Y/Y) in 2Q25 and were nearly flat Y/Y in the first half, supported by easier comparisons, stronger capex tied to existing Open RAN deployments, and increased activity among early majority adopters.

Our long-term view has remained largely consistent since we began tracking the market in 2019. Long-term Open RAN growth prospects remain favorable. Although near-term headwinds and business case challenges persist, the broader trajectory continues to point toward greater openness, virtualization, intelligence, and automation across the RAN. We remain optimistic about the outlook for Open RAN and Cloud RAN in the latter part of the forecast period, though the attractiveness of the multi-vendor RAN model continues to be limited.

Additional highlights from the 2Q25 RAN report and August 2025 Open RAN 5-year forecast include:

- The top 3 Virtualized RAN suppliers based on worldwide revenue (2Q25, 4-Quarter Trailing) are Samsung, Rakuten Symphony, and 1Finity (formerly Fujitsu).

- Virtualized RAN revenue is expected to grow in 2025.

- Multi-vendor RAN is projected to reach $2 billion to $3 billion by 2029.

For more information about our RAN and Open RAN coverage, please visit https://www.delloro.com/advanced-research-report/openran/