Huawei recently held its annual MBBF Forum. Although the capacity and revenue-related challenges are typically part of the main agenda, energy efficiency and green energy were also front and center at this year’s event. Below we will share five RAN related observations including

1) Healthy customer participation

2) Connectivity is a profitable business

3) Plenty of room left with the sub 6 GHz spectrum

4) FWA is accelerating

5) Private 5G wireless revenues remain small but activity is on the rise

Healthy Customer Participation

The MBBF is a customer-driven event. With operators in countries that comprise nearly two-thirds of global GDP reassessing their Huawei RAN reliance, one could assume that operator participation would be significantly impacted. Though we are not keeping track of all the carriers that speak on a yearly basis at this event, our first impression was that operator participation remained healthy, including speakers from China Telecom, China Unicom, Dialog, DNA, Du, Entel, Elisa, Etisalat, Globe Telecom, Hellenic Telecommunications, Orange, Sunrise, Vodafone, Zain, and Zong.

Connectivity is Not Boring

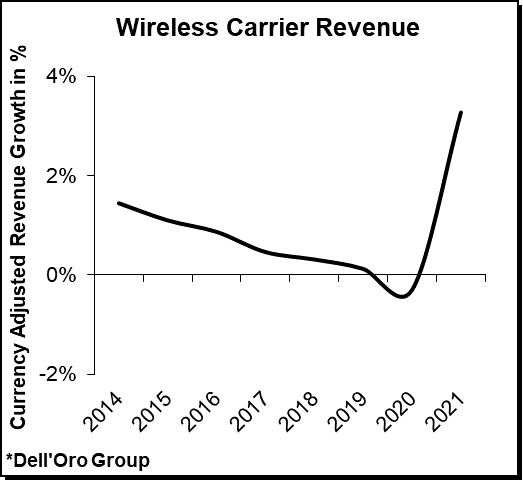

While there is no shortage of operators that have tried to move beyond connectivity into other areas to improve investor returns, operators are also slowly coming to terms with the fact that connectivity is a profitable business with upside potential.

More importantly, this new post-pandemic normal combined with the improved revenue growth trends during 1H21 and the fact that the ability to differentiate these connectivity offerings will only improve as the requirements evolve and connectivity spreads to verticals form the basis for the renewed connectivity enthusiasm. Or to quote Etisalat – it is not always about beyond connectivity, maybe it is time to focus more on smart connectivity.

It is worth noting that the projected revenue growth between 2020 and 2021 is partly reflecting lighter comparisons and changing behaviors as a result of the response to the pandemic. Some of the behavioral changes will be short-lived, however, the uncertainty surrounding non-transitory behavioral adjustments is contributing to the renewed optimism.

The Importance of the Sub-6 GHz Spectrum

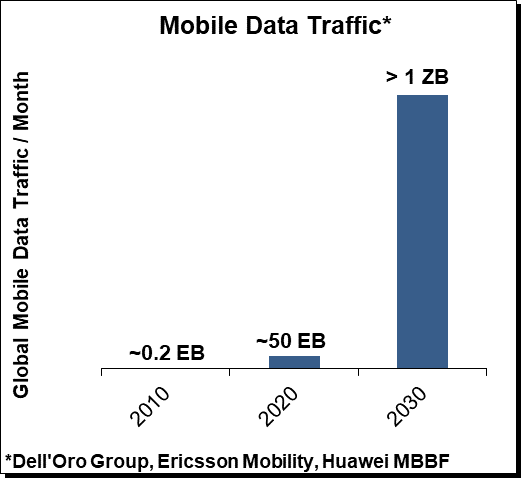

Data traffic continues to grow at an unabated pace. Huawei now estimates that the average user will consume 600 GB per month by 2030, implying total monthly mobile data consumption will approach 5 ZB per month. Regardless of whether we are talking 1 or 5 ZBs, the spectrum is a scarce resource. We simply need to optimize the spectral efficiencies with all the various 5G deployments to dimension the network for another potential 20x to 100x of growth between 2020 and 2030. And ideally, this would be done without growing the carbon footprint.

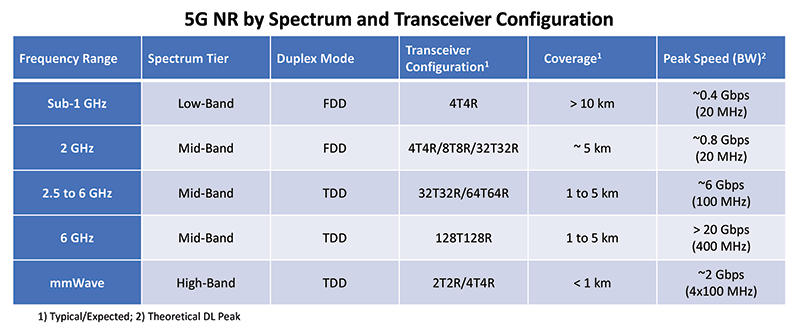

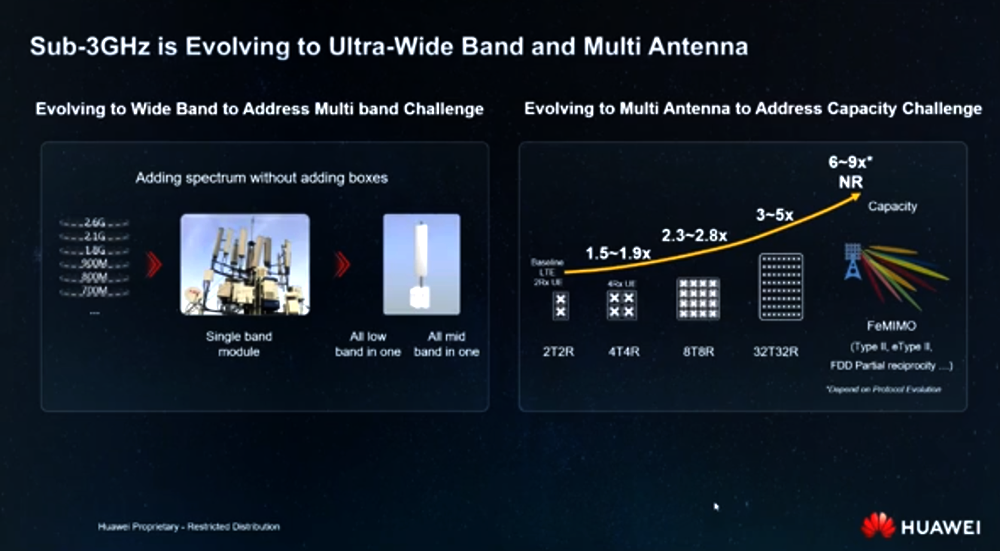

Balancing investments and the experience for all of the various 5G networks while keeping in mind that marketing is typically done on speed but the network is dimensioned for capacity will remain a challenge for the operators. The industry appears to be fairly aligned when it comes to selecting the antenna & transceiver configurations for upper mid-band Massive MIMO and sub-1 GHz deployments, however, there is still some uncertainty with the 2 GHz NR roadmap.

Huawei envisions the 8T8R radios can play an important role for the 2 GHz FDD bands. With gains of 2.3-2.8x relative to the 2T2R LTE baseline, 8T8R systems will make up some of the losses with DSS and provide a solid base layer foundation.

The challenges with FDD-based Massive MIMO in the 2 GHz spectrum are well known. In addition to the relative efficiency gap between FDD and TDD as a result of leveraging channel reciprocity in TDD systems, FDD-based solutions typically also operate in a lower spectrum band, increasing the physical size of the antennas. Still, Huawei continued to signal some optimism about the FDD Massive MIMO opportunity. And perhaps more importantly, this is not just a vision anymore – Huawei has already deployed more than 10 K FDD based Massive MIMO AAUs. Granted shipments remain small relative to TDD Massive MIMO. Still, the ascent is steeper than expected.

Huawei did not spend a lot of time talking about the 6 GHz opportunity during this event, though it was discussed extensively at the HAS 2021 event. Some of the European operators did reiterate that the 6 GHz (upper band) will play an important part with future 5G deployments, validating the message we have communicated for some time, namely that 6 GHz Massive MIMO deployments could result in another major 5G deployment cycle.

Not surprisingly, external challenges are not impacting Huawei’s ability to innovate and introduce new solutions/enhancements to its sub 6 GHz portfolio. This is not the right setting to list all of the enhancements but a few stood out. During the event, Huawei announced enhancements to its 8T8R portfolio leveraging its new “Hertz” antenna platform, resulting in improved capacity, simplified form factors, and high energy efficiency.

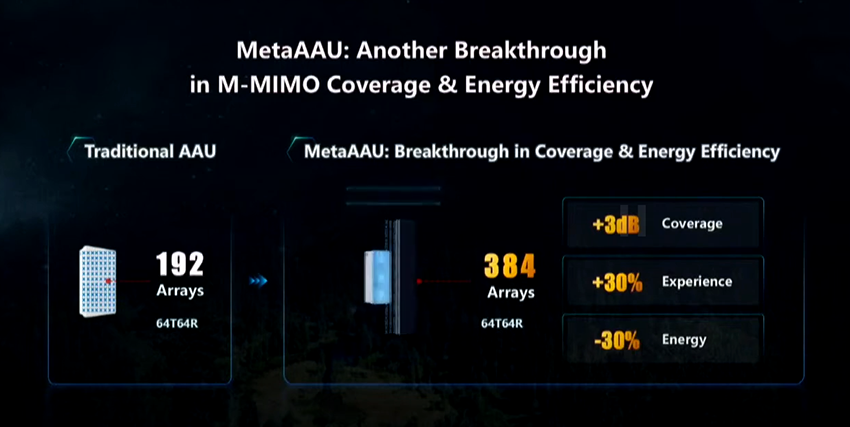

Huawei’s Massive MIMO MetaAAU expands the number of antenna arrays from 192 to 384, resulting in roughly 3 dB of additional coverage with the 64T64R configuration.

Also, Huawei announced a 32T32R Massive MIMO AAU (240W) weighing only 10 kg, or roughly 2 kg less than Ericsson’s recently announced 12 kg Massive MIMO radio.

FWA is Accelerating

With around ~500 operators globally offering LTE or 5G NR FWA and around 65 of these using 5G (GSMA), FWA was an important topic at the event. Three points that stood out was related to prices, the 5G ramp, and the long-term roadmap.

First, it was somewhat surprising to see how quickly 5G CPE prices are declining – Huawei expects 5G CPEs will approach the sub $150 range by 2022 (Tozed Kangwei is targeting $100 5G CPEs in 2022).

Next, 5G FWA connections are firming up. Huawei estimates the 5G FWA installed base is around 2 M, excluding North America, reflecting healthy activity in the MEA region.

With FWA adoption improving, it is important to keep in mind that the technology will make sense in some cases but it still just one piece of the larger broadband toolkit. Operators are still trying to figure out how to best balance the capacity requirements and the overall profitability over the near-term and long-term for the various FWA segments including the underserved, relatively served, and well-served markets.

One of the key questions with FWA is not only about the near-term potential, but also the role the technology will play overtime as fiber footprints improve.

Dialog has relied heavily on FWA technologies to improve broadband penetration across Sri Lanka. But what was really interesting was that this operator see FWA as a stepping stone and an important part of the planning for more accurate FTTX deployments – 5G FWA will help them identify broadband sites and over time improve the utilization of FTTx.

For more info about the FWA CPE LTE, 5G mmWave, and 5G Sub-6GHz markets, please see our Broadband Access Report. And for more information about how FWA is boosting the RAN market, please click here to read the article.

Private Wireless Activity is Improving

The broader trends remain fairly unchanged. MBB/FWA continues to drive the lion’s share of the overall 5G capex while private 5G investments remain small and the more upbeat near-term and long-term projections still hold, underpinned by five core drivers: (1) more countries are exploring how to allocate spectrum for private applications, (2) advances in technology are improving the business case by driving down the price, introducing more flexibility, as well as simplifying the way that private wireless is installed, operated, and managed, (3) enterprise awareness about the benefits of using cellular is improving, (4) public cloud providers are more actively seeking to partner with communication service providers (CSPs), and (5) new use cases are emerging that require cellular quality of service (QoS).

And although private 5G investments remain negligible, Huawei’s MBBF event bolstered the narrative that the industry is moving in the right direction. The IoT ecosystem is improving, operators are working with partners to develop 5G use cases, enterprises are interested to explore how 5G could help them, and private 5G activity is on the rise using both dedicated base stations and slices on the public mobile network – Huawei estimates there are now around 10k 5G B2B projects around the world, with roughly half of these located in China.

Vodafone, one of the leading IoT connectivity providers with around ~130 M connections, spent a good amount of time discussing its private 5G/IoT progress across a broad set of use cases including power networks, refineries, vehicle production, and real time communication between vehicles, to name a few.

In short, there is no shortage of opportunities in the mobile infrastructure segment. And as always, the event was a good reminder that the RAN field remains competitive. Open RAN provides an improved entry point. At the same time, this architecture does not change the underlying supply and demand challenges and the asymmetry between data traffic and revenue growth. At the end of the day, operators need to optimize TCO/energy consumption/spectral efficiency and work with suppliers that can help them tackle new opportunities while also supporting existing legacy networks.