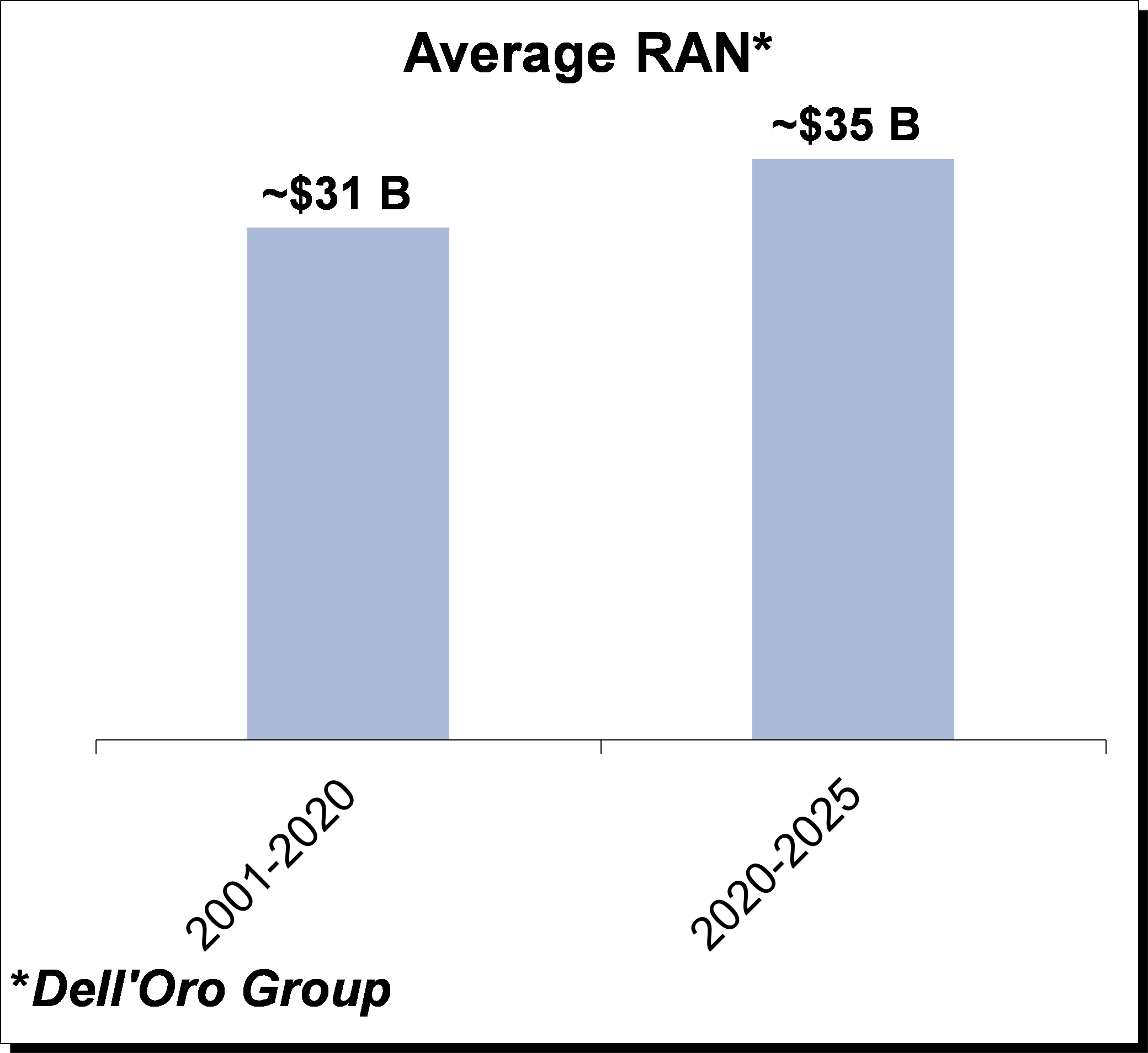

With the overall RAN market now growing at the fastest pace in nearly ten years and on track to approach revenue levels not seen since the Chinese operators rolled out 3G, one of the fundamental questions is simply whether there is more room to grow with this elevated baseline, keeping in mind the historically tight coupling between RAN revenue and wireless capital intensity. And if so—where will this growth come from?

We believe that there is room for expansion over the near term as the early adopters continue to roll out 5G at an extraordinary pace. The shift from 4G to 5G is accelerating at a torrid pace and much faster than expected. This is not because operators expect to raise ARPU or because they are anticipating significant near-term revenue upside from new applications. Instead, the main driver is on the supply side, and the ability of the operators to reduce cost-per-bit and to differentiate on the packaging with larger data plans.

After the RAN market reaches a new all-time high, we project that total RAN revenues will give up some gains in the post-peak MBB rollout phase. At the same time, we are anticipating a somewhat less severe pullback relative to the contractions following the 3G and 4G peaks in China.

While some deviation in the capital intensity ratio is expected in the peak coverage rollout phase, this forecast, with the post-peak pullback projected to approach two-thirds of previous declines, rests heavily on the assumption that the aggregate upside of these smaller non-traditional growth opportunities driven by new fixed and enterprise capex will curb the downside somewhat in the outer part of the forecast.

The main reason we remain excited about the opportunities ahead, even if we are still operating in uncharted economic territories, is the fact that the somewhat tepid high-level outlook is masked by all the ongoing parallel efforts taking place in addition to the shift from 4G to 5G, opening up opportunities for both the incumbents and new entrants.

Other takeaways from the January 2021 5-Year RAN Forecast include:

- The Asia Pacific region is expected to dominate the overall RAN revenue mix.

- Total macro and small cell radio shipments are projected to surpass 50 M over the forecast period.

- mmWave investments are growing rapidly, with total mmWave RAN revenues on track to more than double by 2025.

- Fixed Wireless Access (FWA) Radio Access Network (RAN) investments, including mobile network and dedicated fixed networks, are projected to comprise a growing share of the overall RAN capex envelope over the next five years, reflecting the size of the potential upside, various technological advancements, and improving market sentiment for both basic and high-performance connectivity.

- Private wireless RAN revenues are still small relative to overall MBB investments but activity is on the rise, underpinned by a new spectrum, an improving device ecosystem, technology improvements, and the emergency of new use cases that require cellular QoS.

- Open RAN is here to stay. Total Open RAN revenues are projected to account for more than 10% of the 2025 RAN market.

| About the Report

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the Mobile RAN industry by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue, transceivers or RF carrier shipments, unit shipments for 5G NR Sub 6 GHz, 5G NR mmW, and LTE macro and small cells. The report also include projections for Massive MIMO and Open RAN. Click here to learn more about the report or contact us (dgsales@delloro.com) for the full report. |

|