Mobile networks continue to advance to support changing supply and demand requirements. In order to manage the rise in mobile data traffic and the diversity of the use case requirements with new technologies, frequencies, and more agile networks without increasing the complexity and costs while still maintaining legacy technologies, mobile networks have to become more intelligent and automated, spurring the need for Intelligent RAN. In this blog, the goal is to update the Intelligent RAN blog we previously posted and review Intelligent RAN drivers, market opportunity, current status, and the ecosystem.

Intelligent RAN Automation Background

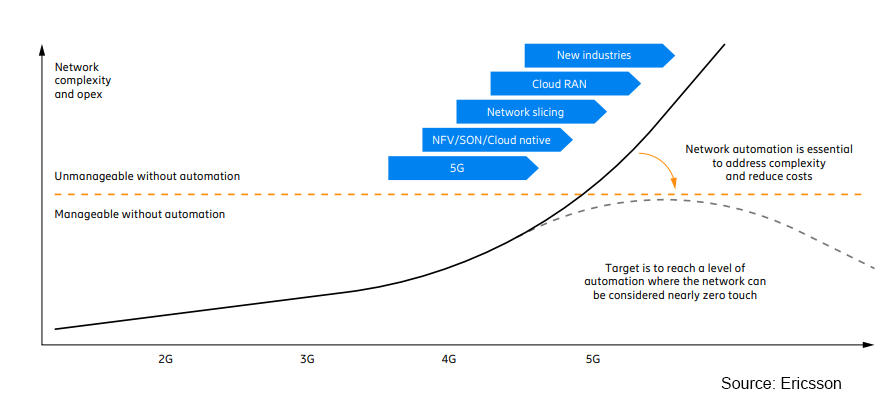

RAN automation and intelligence are not new concepts. In fact, both existing and new 4G and 5G networks rely heavily on automation to replace manual tasks and manage the increased complexity without growing operational costs. But the use of intelligent machine-learning-based functionality embedded in the management system and RAN nodes for real time and non-real time processing is new. The combination of machine learning and automation will enable operators to evolve their 5G networks to the next level by autonomously optimizing resources resulting in improved cost and energy budgets.

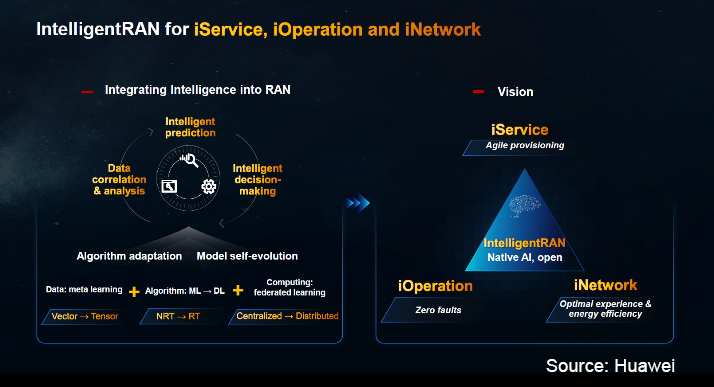

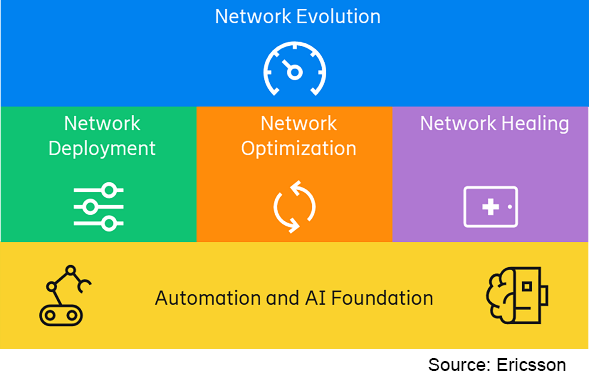

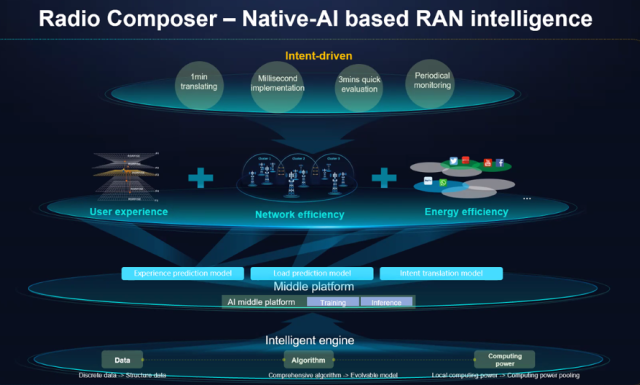

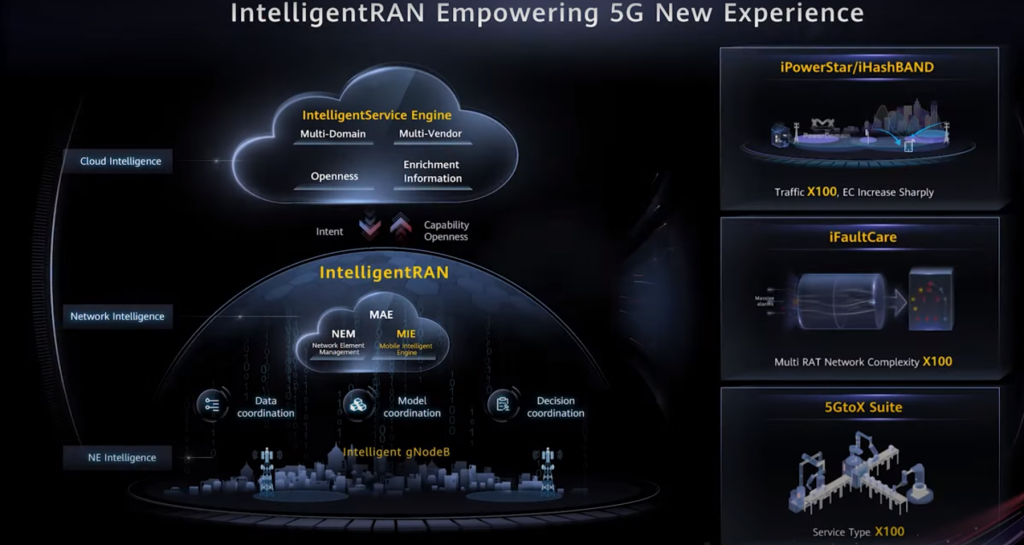

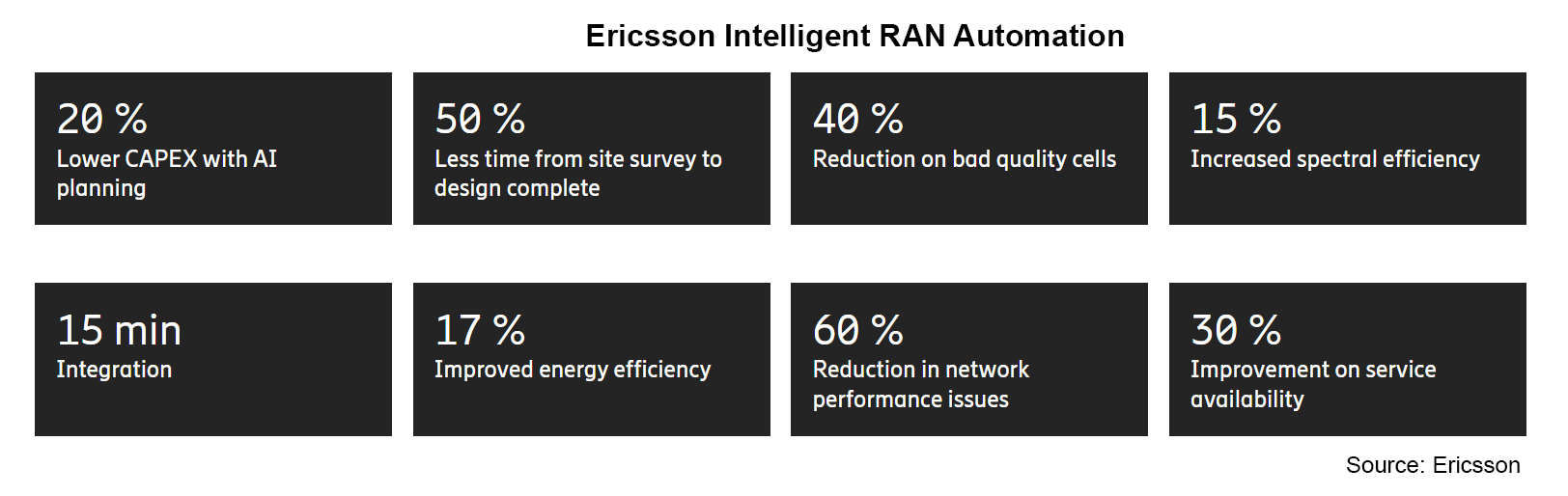

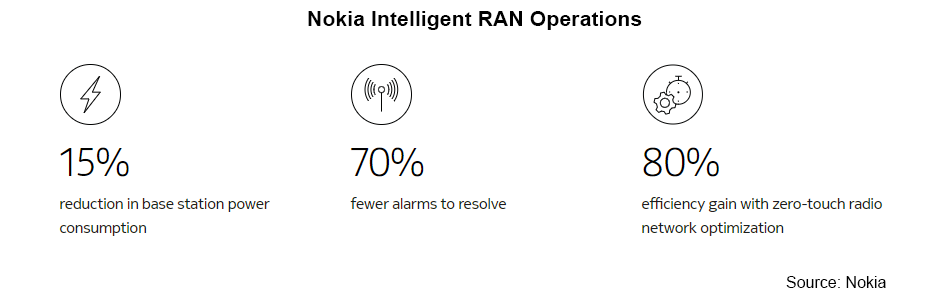

Intelligent RAN Automation is not confined to just the RAN infrastructure. Instead, these solutions will improve performance, reduce energy consumption, and lower costs across multiple infrastructure and service domains. Huawei envisions its IntelligentRAN portfolio will address three key areas, including networks, services, and operations. Similarly, Ericsson’s Intelligent RAN Automation solution is targeting four main areas: Network evolution, network deployment, network optimization, and network healing. And Nokia’s recently launched Intelligent RAN Operations is targeting operational efficiency gains and equipment power savings across multiple domains. ZTE’s radio composer is targeting three key domains, including user experience, network efficiency, and energy efficiency.

|

|

Why More RAN Intelligence and Automation?

Operators navigated the LTE era successfully with minimal RAN intelligence. And even if MBB and FWA are now driving the lion’s share of operators’ 5G revenues, we need to keep in mind that 5G is more diverse than LTE from a spectrum, technology, end-user requirements, and applications perspective.

As mobile data traffic continues to grow at an unabated pace while carrier revenue growth remains flat, operators have limited wiggle room to expand capex and opex to manage the increased complexity typically inherent with the technological and architectural advancements required to deliver the appropriate network performance while supporting more demanding and diverse end-user requirements.

Maturing AI capabilities taken together with recent technology advances which allow suppliers to place intelligence inside the base station forms the basis for the uptick in Intelligent RAN.

Leading RAN suppliers envision Intelligent RAN automation will deliver several key benefits:

- Maximize ROI on network investment

- Improve performance and experience

- Boost network quality

- Accelerate time to market

- Reduce complexity

- Reduce energy consumption

- Bring down CO2 emissions

The ongoing shift from proprietary RAN towards disaggregated Open RAN could accelerate innovation, however, costs and complexity of managing multi-vendor deployments could increase if the networks are not effectively managed. According to Ericsson, operator opex could double over the next five years without more automation across deployment and management & operations just to support the expected changes with MBB-driven use cases.

Performance gains underpinned by Intelligent RAN will vary depending on a confluence of factors. Ericsson estimates Intelligent RAN Automation solutions can improve the spectral efficiency by 15% while Huawei has been able to demonstrate that its IntelligentRAN multi-band/multi-site 3D coordination feature can improve the user experience by 50%, in some settings. ZTE and China Mobile have demonstrated a 3x throughput improvements at the cell edge plus a 50% reduction in handover delays.

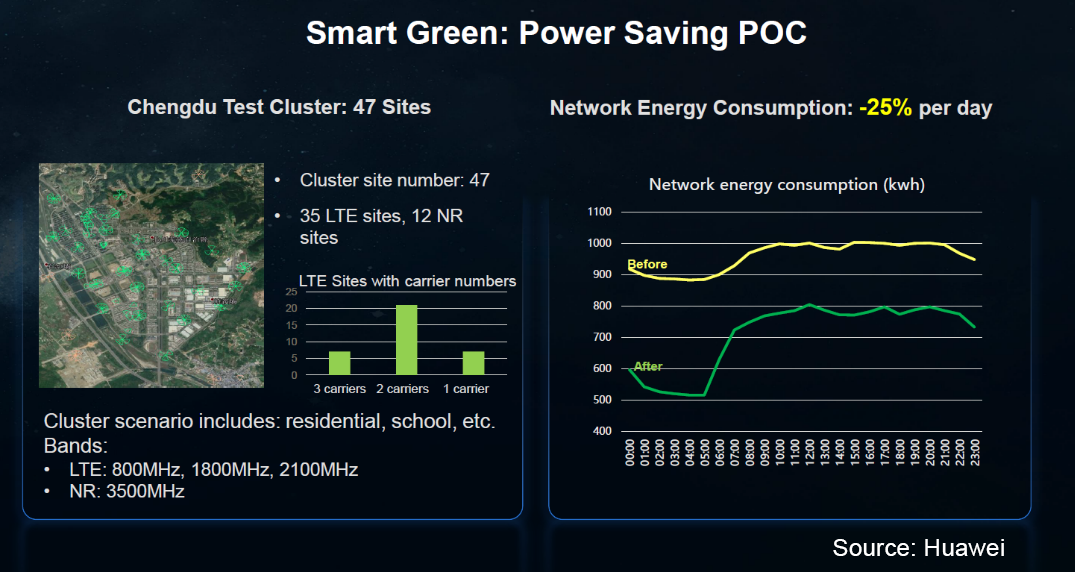

The intensification of climate change taken together with the current power site trajectory forms the basis for the increased focus on energy efficiency and CO2 reduction. Preliminary findings suggest Intelligent RAN can play a pivotal role in curbing emissions, cutting energy consumption by 15% to 25%.

It is still early days in the broader 5G transition, with 5G MBB and FWA in the early majority and early adopter phases, respectively. However, 5G IoT has barely started yet. As private 5G and IoT begin to ramp more meaningfully and diverse use cases comprise a greater share of the overall 5G capex, operators will need to evolve their networks to manage varying latency, throughput, UL, positioning, and reliability requirements. Ultimately it will be extremely challenging to deliver optimal network efficiency across the RAN spectrum with the current networks.

This is why RAN intelligence and automation are increasingly viewed as fundamental elements in the broader digital transformation and autonomy roadmaps. Operators agree AI and automation will be essential components in future networks.

Market Opportunity

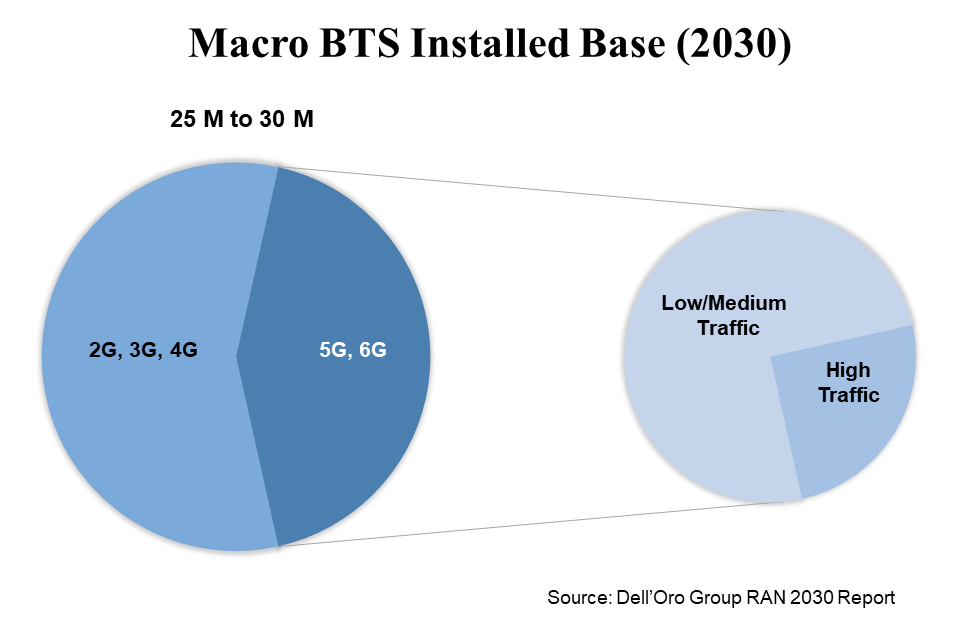

Global RAN revenues have grown at a torrid pace over the past couple of years. And even though RAN market is now entering a period of slower growth, total RAN revenues are projected to top $45 B by 2030, supported by 5G and 6G small cell and macro site expansions.

Intelligent RAN is not going to make sense in all base stations, at least for some time. However, the market opportunity is still significant, especially with high-traffic 5G and 6G sites.

The mix between distributed and centralized intelligence will to some degree be dependent on the fiber footprint as the amount of data to be processed is already large.

Relative to external AI, the local processing inherent with native AI could offer some benefits such as simplified network O&M and reduced costs, especially with low-latency and high-performance service requirements.

Intelligence and Automation Status

RAN Intelligence & Automation is a relatively nascent but growing segment. Rakuten Mobile’s focus on vRAN and automation has enabled the operator to deploy around 0.3 M macro and small cells while maintaining an operational headcount of about 250 people, which is a fraction of that of the typical operator. In the US, greenfield operator Dish is leveraging its cloud-native 5G network and IBM’s AI-powered automation and network orchestration software and services along with VMWare’s RAN Intelligent Controllers to manage costs and to improve performance and innovation for more diverse use cases.

Germany’s fourth operator, 1&1, is building a fully virtualized and open RAN network utilizing specially developed orchestration software to automate operations.

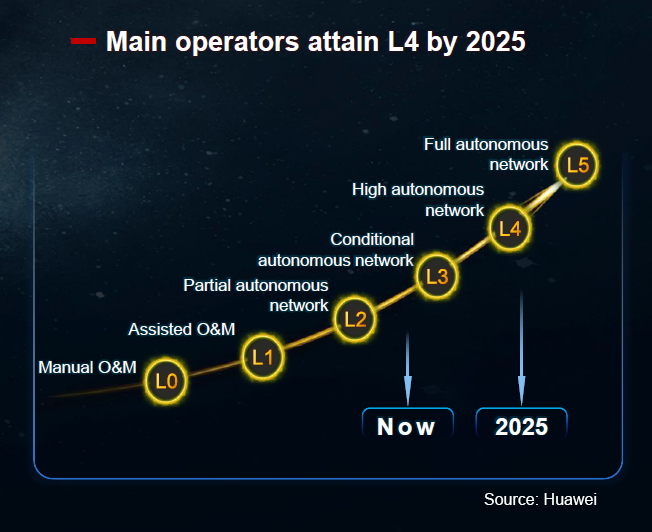

While most of the green field networks are clearly moving towards new architectures that are more automation conducive, change typically does not happen as fast with the brownfields – the average brownfield operator today falls somewhere in between L2 and L3 and still has some way to go before reaching high and full autonomy. Still, China Mobile remains on track for L4 automation by 2025. Per Huawei’s HAS2022 analyst event, the vendor remains optimistic L4 High autonomous network will be more prevalent by the 2025 timeframe. Rakuten Mobile previously said that its network could achieve L4 automation by the end of 2022.

Also, China Mobile has completed numerous AI-powered RAN trials, including one with Nokia’s RIC. The operator has already deployed 10K+ sites using ZTE’s Radio Composer. Meanwhile, China Unicom has implemented a commercial trial of ZTE’s AI solutions, increasing the average high-quality 5G experience duration by 30%.

Vodafone is using RAN Intelligence to boost network quality and to implement Zero Touch Operations. Deutsche Telekom believes the future of the RAN is open and intelligent – the operator is exploring how AI/ML can help with resource optimization and anomaly detections, among other things. Telefonica is working with Nokia to advance RAN intelligence and ultimately optimize the network using AI-based RIC.

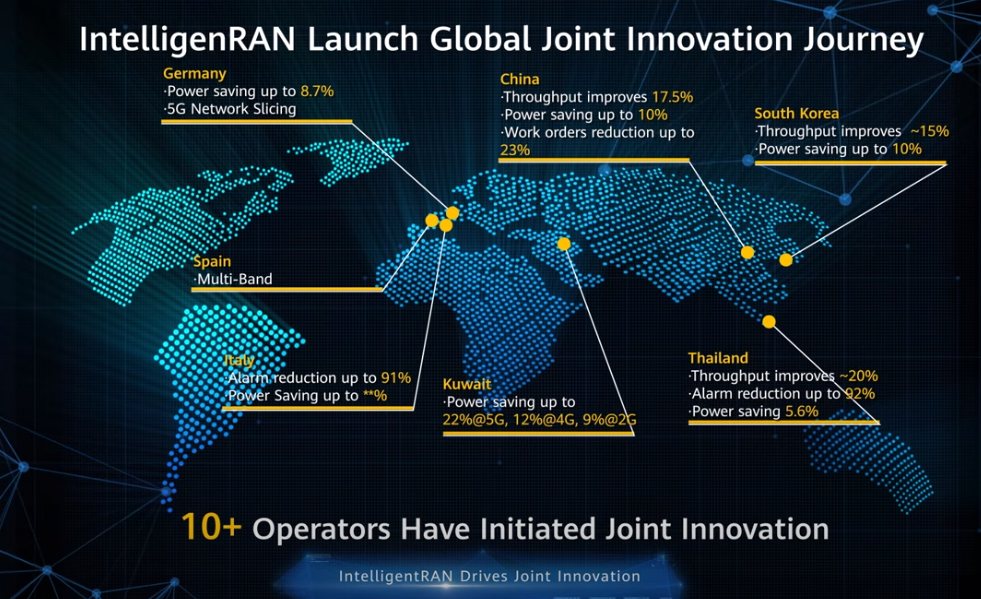

Also, Etisalat, Du, STC, and Zain announced at the SAMENA Telecom Summit that they are collaborating with Huawei to bring more AI into the RAN to improve the performance, reduce downtime, enhance the customer experience, and provide the right foundation for more RAN autonomy. At Huawei’s MBBF 2022 event, the vendor announced it has initiated joint innovation with more than 10 operators.

Vendor Ecosystem

The top 4 RAN players are also heavily focused on improving their Intelligent RAN Automation portfolios. Huawei recently released its IntelligentRAN portfolio and envision its solution, using the Mobile Intelligent Engine (MIE), will be more widely available for both the Site and Network layers by 2023.

Meanwhile, both Ericsson and Nokia have recently announced enhancements and additions to their Intelligent RAN solutions. Qualcomm recently announced its intent to acquire Cellwize, a RAN SMO and Non-RT RIC supplier.

ZTE’s Radio Composer brings AI-based intelligence into the RAN – the vendor has already successfully demonstrated significant performance improvements in large-scale deployments across China and Thailand.

In addition to the established RAN suppliers, the rise of Open RAN provides an entry point for both smaller RAN suppliers and Non-RAN players such as NEC, Mavenir, Fujitsu, Juniper, and VMware to enter the RIC segment.

AI in 3GPP

The 3GPP standard is continuously evolving to address the broader 5G vision. From an automation and AI perspective, 3GPP already offers a basic foundation that the suppliers can build on to differentiate their solutions.

The network data analytics function (NWDAF) within the 5G Core architecture and defined in 3GPP Release 16, collects data and improves analytics capabilities.

Release 17 adds MDA and Autonomous Networks. As the 3GPP is working on introducing additional AI/ML air interface and RAN improvements with Release 18, suppliers and operators are already bringing early explorations of these technologies to the base station and RAN management systems.

In summary, it is still early days in the 5G journey. Today’s networks are already leveraging automation to manage the increased network complexity. The network of the future will gradually include more automation and AI to provide operators and enterprises with the right tools to proliferate 5G connectivity efficiently. The revenue upside will be limited over the short term, reflecting the fact that it will take some time to overcome non-technology-related challenges including building trust and convincing people to embrace new technologies that ultimately might require humans to acquire new skills to stay relevant. However, the long-term prospects remain healthy.