Last August, we published a blog post providing insights into the proliferation of Fiber to the Room (FTTR) deployments across China and select countries. We highlighted how this new service offering was driving a new round of ONT purchases—particularly in China—where new fiber subscriber additions had begun to moderate a bit from their peak. By mid-2023, over 6 million FTTR ONT units had been purchased, the vast majority coming from China Unicom, which was the first of the three major fixed broadband providers in China to deploy the service. For China Unicom, traditionally trailing behind China Telecom and China Mobile in the FTTH market, FTTR was seen as a way to gain a competitive advantage over its rivals and to lock in subscribers to multi-year contracts with a service that solved some of the pesky channel interference issues seen with Wi-Fi in densely-populated MDUs.

With our most recent visit to China, we are now able to provide updated shipment figures for FTTR ONTs, as well as to provide some more detail on the types of ONTs being deployed, as along with some interesting revenue-generating applications used to upsell subscribers on the FTTR service.

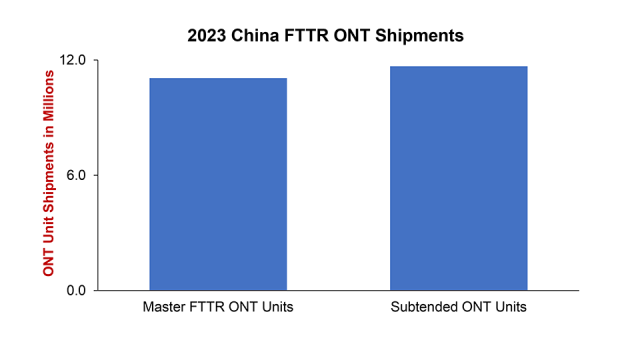

First, we now know that a total of just over 23 million FTTR ONTs were shipped to Chinese operators in 2023. Of these 23 million plus ONTs, there was nearly a 1:1 relationship between master ONT units and the subtended units. The ratio actually comes out to around 1:1.01 between master and subtended units. This means that the average deployment includes a single master unit and a single subtended unit, which makes sense, given the generally smaller dwellings in China.

In terms of PON technologies used, 90% of the master units are XG-PON, while nearly 100% of the subtended units are GPON-based. The first generation of ONTs deployed by China Unicom was based on Wi-Fi 6. However, both China Unicom and China Telecom are rapidly switching over to Wi-Fi 7 units with 2×2 MIMO capabilities. These units do not incorporate the full tri-band capabilities of Wi-Fi 7 because the 6GHz band has not been approved for use in China. Still, the software and modulation improvements of Wi-Fi 7 do provide a performance improvement over the Wi-Fi 6 units. Additionally, these dual-band Wi-Fi 7 units cost significantly less than full-featured, tri-band units.

In terms of PON technologies used, 90% of the master units are XG-PON, while nearly 100% of the subtended units are GPON-based. The first generation of ONTs deployed by China Unicom was based on Wi-Fi 6. However, both China Unicom and China Telecom are rapidly switching over to Wi-Fi 7 units with 2×2 MIMO capabilities. These units do not incorporate the full tri-band capabilities of Wi-Fi 7 because the 6GHz band has not been approved for use in China. Still, the software and modulation improvements of Wi-Fi 7 do provide a performance improvement over the Wi-Fi 6 units. Additionally, these dual-band Wi-Fi 7 units cost significantly less than full-featured, tri-band units.

Finally, we have also heard about FTTR ONTs that include 2TB hard drives for local storage of photos and videos, which can be automatically backed up to the cloud—a service China Telecom is calling as Cloud NAS. It remains to be seen what percentage of FTTR ONTs will include hard drives. Suffice it to say that China Telecom is at least thinking about additional services it can deliver to both generate more revenue per subscriber and differentiate its FTTR offering in a highly competitive market.

Surge Expected in 2024

Though 2023’s numbers look impressive, they won’t hold a candle to what we are now expecting this year. With China Unicom now humming along and adding hundreds of thousands of new FTTR subscribers, China Telecom is set to mount a furious comeback. China’s second-largest broadband provider closed 2023 with a tender requesting the purchase of 15 million FTTR ONTs in 2024. However, we believe that CTC will easily exceed that number, as we have heard that the operator is taking delivery of over 6 million units in the first quarter alone.

China Telecom was caught flat-footed by its rival, China Unicom, and is now aggressively trying to catch up before Unicom siphons away additional customers with offers of free FTTR installations, even if customers aren’t complaining about their in-home network performance. Again, the goal of FTTR isn’t necessarily to solve Wi-Fi issues, it is intended to accomplish four goals:

- Increasing ARPU (Average Revenue Per User)

- Reducing subscriber churn

- Reducing energy consumption in the home and throughout the network

- Reducing service and support costs by improving the quality of service

We estimate that the three operators closed in 2023 with approximately 35 million individual FTTR subscribers, and we expect that number to increase to anywhere from 48 to 53 million in 2024, finally reaching over 80 million by 2026. Admittedly, those are conservative estimates, which balance the actual expressed need for FTTR services by subscribers vs. upgrade offers that simply can’t be passed up.