Happy New Year! As usual, we’re excited to start the year by reflecting on the developments in the Ethernet data center switch market throughout 2023 and exploring the anticipated trends for 2024.

First, looking back at 2023, the market performed largely in line with our expectations as outlined in our 2023 prediction blog published in January of last year. As of January 2024, data center switch sales are set to achieve double-digit growth in 2023, based on the data collected up to the 3Q23 period. Shipments of 200/400 Gbps nearly doubled in 2023. While Google, Amazon, Microsoft, and Meta continue to dominate deployments, we observed a notable increase in 200/400 Gbps port shipments destined toward Tier 2/3 Cloud Service Providers (SPs) and large enterprises. In the meantime, 800 Gbps deployments remained sluggish throughout 2023, with expectations for acceleration in 2024. Unforgettably, 2023 marked a transformative moment in the history of AI with the emergence of generative AI applications, propelling meaningful impact and changes on modern data center networks.

Now as we look into 2024, below are our top 3 predictions for the year:

1. The Data Center Switch market to slow down in 2024

Following three consecutive years of double-digit growth, the Ethernet data center switch market is expected to slow down in 2024 and grow at less than half the rate of 2023. We expect 2024 sales performance to be suppressed by normalization of backlog, digestion of existing capacity, and optimization of spending caused either by macroeconomic conditions or a shift in focus to AI and budgets diverted away from traditional front-end networks used to connect general-purpose servers.

2. The 800 Gbps adoption to significantly accelerate in 2024

We predict 2024 to be a tremendous year for 800 Gbps deployments, as we expect a swift adoption of a second wave of 800 Gbps (based on 51.2 Tbps chips) from a couple of large Cloud SPs. The first wave of 800 Gbps (based on 25.6 Tbps chips) started back in 2022/2023 but has been slow as it has been adopted only by one Cloud SP. In the meantime, we expect 400 Gbps port shipments to continue to grow as 51.2 Tbps chips will also enable another wave of 400 Gbps adoption. We expect 400 Gbps/800 Gbps speeds to achieve more than 40% penetration by 2027 in terms of port volume.

3. AI workloads to drive new network requirements and to expand the market opportunity for both Ethernet and InfiniBand

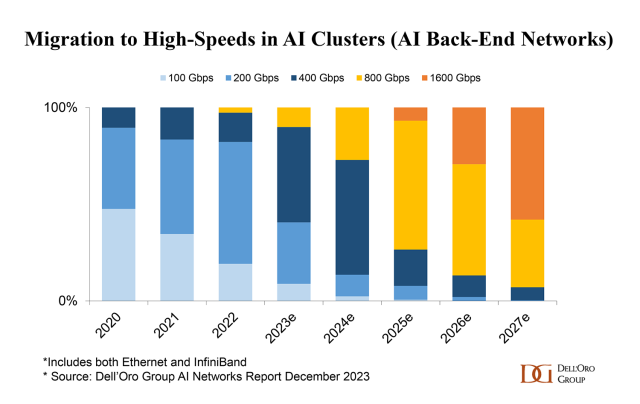

The enormous appetite for AI is reshaping the data center switch market. Emerging generative AI applications deal with trillions of parameters that drive the need for thousands or even hundreds of thousands of accelerated nodes. To connect these accelerated nodes, there is a need for a new fabric, called the AI back-end network, which is different from the traditional front-end network mostly used to connect general-purpose servers. Currently, InfiniBand is dominating the AI back-end networks but Ethernet is expected to gain significant share over the next five years. We provide more details about the AI back-end network market in our recently published Advanced Research Report: ‘AI Networks for AI Workloads.’ Among many other requirements, AI back-end networks will accelerate the migration to high speeds. As noted in the chart below, the majority of switch ports in AI back-end networks are expected to be 800 Gbps by 2025 and 1600 Gbps by 2027.

For more detailed views and insights on the Ethernet Switch—Data Center report or the AI Networks for AI Workloads report, please contact us at dgsales@delloro.com.