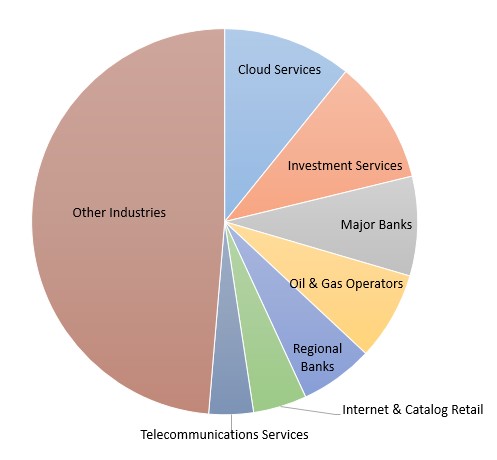

Unlike many enterprises that have been migrating their IT infrastructure to the Public Cloud in recent years, the financial sector continues to be an important contributor to purchasing and deploying IT, which includes data center infrastructure such as servers, storage, and networking equipment. Last year, we estimated that roughly 24% of the on-premise enterprise server installed base among Fortune 2000 firms to be attributed to the financial sector, with high-frequency trading among a major use-case. We expect the financial sector to gain share in the on-premise enterprise server installed base, as traditional enterprises in the areas of oil & gas, offline retail, travel, and hospitality, and healthcare are projected to reduce spending on IT this year due to weak economic outlook. Growth in those traditional enterprise industries tends to mirror that of the broader economy, and could face a sluggish road to recovery ahead.

On Premise Server Unit Installed Base by Fortune 2000 Industry Segment (2019)

Other observations related to data center capex trends in the financial sector:

- Data Center IT is moving to the Public Cloud (i.e. AWS, Microsoft Azure, and Google Cloud), and the pandemic has accelerated Cloud adoption as companies prefer an operating expenditure-based IT consumption model to conserve capital in uncertain economic times, and the ease in which cloud applications could be provisioned to a remote workforce. However, we expect the financial sector will be one of the last enterprise sectors to move the workload to the Cloud. Applications such as high-frequency trading will continue to be owned and operated by these enterprises due to proximity requirements and demands an ultra-low latency network. Regulations and data sovereignty requirements also dictate that certain data and workloads need to remain in on-premise data centers (and not move to the Cloud). We estimate that over 80% of the workloads for the financial sector have remained on-premise, versus, 20% of the workload outsourced to the Cloud.

- Some of these major financial institutions such as JP Morgan and Goldman Sachs own and operate their own data centers, which are also complemented by colocation data centers that are operated by Equinix for instance. In the first half of 2020, we estimate a 2% average Y/Y growth in revenue generated by the financial sector among the colocation providers. That is versus an estimate of 5% average Y/Y growth in 2019. While the 1H20 growth rate is conservative, the financial sector is expected to outperform that of other enterprise sectors when it comes to colocation infrastructure spending this year.

- The large financial institutions are innovators of server and data center architecture. While some have offloaded some requirements to the Public Cloud, they continue to invest in their own data centers. Some of the large firms operate hundreds of thousands of servers and would be able to benefit from economies of scale a Cloud service provider would. The more servers that these firms have, the more transactions and customers they can support. While this segment still purchases IT equipment from branded server and storage system vendors such as HPE, Dell, and IBM, some of the more sophisticated firms have customized servers in their data centers in an effort to streamline their architecture. They have also deployed accelerators such as Smart NICs (network interface cards) to reduce network latency necessary for high-frequency trading and to ensure secure connections. Specialized servers, equipped with accelerators such as GPUs for instance, are also deployed for AI-centric applications pertaining to predictive analysis and risk management computations.

In order to get additional insights and outlook for spending on servers and other data center center equipment by Cloud and Enterprise segments, please check out our Data Center Capex report.