Near the end of last year, there were a number of public announcements highlighting the growing adoption of 25GS-PON. Arguably the most important of these was Google Fiber’s announcement that it will be using 25GS-PON along with a Wi-Fi 7 router to deliver symmetric 20Gbps residential services through its Gfiber Labs Division. Currently, Gfiber Labs is delivering the 20Gbps service to the University of Missouri-Kansas City and the United Way of Utah County, but plans to expand availability to individual subscribers in select markets, including Kansas City, Raleigh-Durham, as well as markets in Arizona and Iowa.

The 20Gbps service tier is intended for power users and is priced accordingly at $250 per month. But as Wi-Fi 7 devices including phones, laptops, tablets, and TVs, begin to proliferate in the home, the need for each of these devices to access data at multi-gig speeds will also grow. As part of its announcement, Google shared a number of demonstrations designed to showcase what is available through the combination of 20Gbps of bandwidth and Wi-Fi 7, including a total throughput of 15Gbps across multiple devices using Wi-Fi 7’s MLO (MultiLink Operation) capability, and 25ms latency between a wired game console and a WI-Fi mesh extender.

Google’s cache as an innovative ISP, along with its demonstrated ability to change the competitive dynamics in the markets where it offers FTTH services has helped spark additional industry interest in 25GS-PON for not only high-end residential services but also services for enterprises, campus environments, access network aggregation, as well as wholesale connections.

Membership in the 25GS-PON MSA (Multi-Source Agreement) Group has grown substantially, now encompassing a diverse range of service providers, equipment vendors, and component suppliers. Most importantly, product development for critical equipment, including ONTs and coexistence elements, has accelerated. At least 10 different ONT vendors have joined the MSA. These vendors all have decades of experience designing ONTs as either OEMs or ODMs. Having a diverse vendor ecosystem for ONTs is critical for service providers to feel comfortable deploying the technology. In January, Actiontec announced its XVG-99SK, a 25GS-PON SFP ONT that is already in tests with customers and partners. We expect additional ONTs to be announced as the year progresses, likely corresponding with expected service provider field trials and deployments.

25GS-PON Window Staying Open Longer

One of the driving factors for the growing interest is 25GS-PON is its ability to coexist with GPON and XGS-PON without having to deploy additional feeder fiber, splitters, or other ODN elements. The other is the ability for service providers to expand the addressable markets of their PON networks to support residential, enterprise, mobile transport, and wholesale services over a shared infrastructure with sub-millisecond latency and guaranteed capacity.

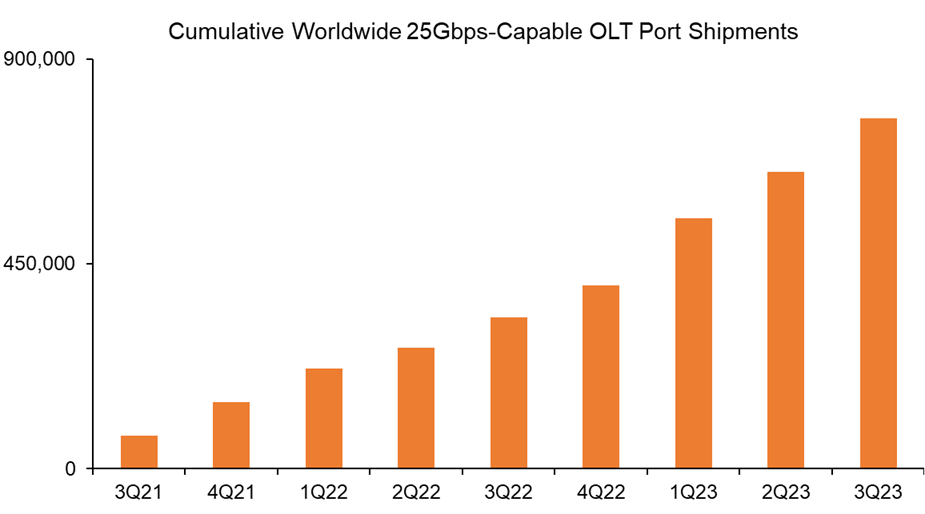

Those two factors are why there are now nearly 900KK 25Gbps-Capable OLT ports in service provider networks around the world. In our most recent 5-year forecast, published in January, we estimate that a total of 23,400 of these 25Gbps-capable OLT ports were actually purchased by service providers to support revenue-bearing traffic, with the bulk of these being purchased in North America and Western Europe.

We expect these purchases to increase to over 200k OLT ports by 2028, We see more scenarios now in which service providers are relying on on XGS-PON to deliver broadband to the vast majority of their residential subscribers while also layering on 25GS-PON to offer premium tiers of 10Gbps or more, as well as enterprise connectivity, all at just a small incremental increase in cost.

With average annual growth rates in bandwidth consumption returning to more normal, pre-pandemic levels, the need to dramatically increase billboard speeds has become less pressing. Instead, the focus for service providers now is how to maximize their access infrastructure investments to flatten the network and address more use cases and market segments, while also building sustainable networks that consume less power than their predecessors. These are the target characteristics of hybrid XGS and 25GS-PON networks.

Because of our more normalized expectations for bandwidth growth, along with conversations with both equipment vendors and service providers, we have reduced our short-term forecasts for 50G-PON, pushing out the ramp in adoption from 2026 to 2028. Though we do expect to see early deployments of asymmetric 50/25 PON, primarily in China, work to define the specification for symmetric 50G-PON is still underway. Symmetric speeds are what service providers want to deploy going forward, so the vast majority of those considering 50G-PON as their next step will likely have to wait until at least 2026 for product availability. Even then, there is no guarantee that the expected higher costs associated with the required transmitters, DSPs (Digital Signal Processors), and ADCs (Analog-to-Digital Converters) will be reduced with volume shipments.

The additional time required for all elements of the 50G-PON ecosystem to mature keeps the window open longer for 25GS-PON, as enterprises will demand symmetric 10Gbps+ speeds to their facilities to allow them to continue expanding their reliance on cloud-based services. Additionally, service providers, like Google Fiber, will continue to innovate their residential broadband offerings, staying in front of cable’s DOCSIS 3.1 Plus and DOCSIS 4.0 service offerings.