Today, Arista Networks closed its acquisition of the VeloCloud SD-WAN portfolio from Broadcom, turning a once-rumored transaction into a move that reshapes both companies’ positions in the enterprise SASE/SD-WAN arena. The deal is an asset-plus-talent carve-out: Arista receives the intellectual property and roughly half of VeloCloud’s ≈1,000 employees—primarily core engineering and technical staff—while most sales- and marketing-oriented roles were left behind. Although neither party disclosed financial terms, multiple press accounts still place the consideration “well under” $1 billion, in line with the May 2025 reporting from The Information that first surfaced the transaction.

To understand why this asset still matters—and how Arista might unlock its full potential—this blog traces VeloCloud’s journey in four parts. Section 1 reviews the company’s pre-SASE strengths, highlighting its rise from a 2012 start-up to capturing 16 percent of SD-WAN revenue by 2020. Section 2 explains how pandemic-era work-from-home trends and Broadcom’s extended VMware acquisition disrupted that growth. Section 3 evaluates what took place under Broadcom, where layoffs, partner resets, and price hikes diminished momentum and confidence. Finally, Section 4 explores the strategic upside and execution risks of VeloCloud’s next chapter under Arista.

- Pre-SASE Strength (Founding – 2020)

Launched in 2012, VeloCloud quickly distinguished itself as a cloud-delivered SD-WAN pioneer that could blend inexpensive broadband with MPLS-class reliability. Its Dynamic Multipath Optimization and active-active architecture delivered sub-second fail-over, a capability repeatedly validated in partner reference designs and field deployments. Leveraging a software-centric model, the company built more than 3,700 global gateways and rode the first wave of branch cloud adoption.

Go-to-market execution was equally strong. AT&T selected VeloCloud as its lead managed SD-WAN VNF on the FlexWare/x86 platform, giving the start-up access to thousands of enterprise sites without the expense of building a large direct sales force. Other carriers followed, cementing a robust service-provider (SP) channel that accounted for ~70% of bookings.

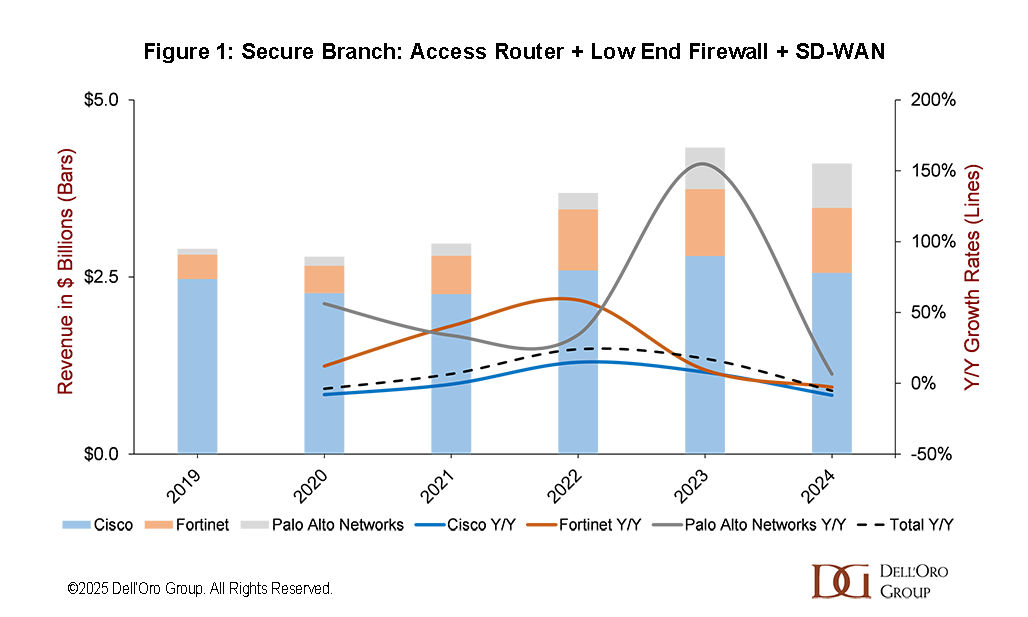

Market traction was tangible. Dell’Oro’s SD-WAN tracker projected VeloCloud’s revenue share to be in the mid- to high-teens by 2020, peaking around 16 percent, before the category began to broaden. VMware acquired the company in late 2017 for approximately $449 million, providing scale and an established enterprise brand while allowing VeloCloud to retain a degree of operational autonomy. By the eve of the pandemic, the platform was viewed as the de facto benchmark for “pure-play” SD-WAN.

- SASE Disruption and the Broadcom Transition (2020 – 2023)

COVID-19 radically reshaped network priorities. Instead of connecting thousands of branches, IT teams had to secure millions of remote workers. Buyers gravitated to software-only or cloud-native Secure Access Service Edge (SASE) offers that converged networking and security. Although VMware launched a work-from-home client and experimented with an OEM agreement with Menlo Security, the roadmap still revolved around appliance-centric SD-WAN. As a result, VeloCloud’s differentiation narrowed, while newcomers such as Palo Alto Networks set the pace in integrated SASE.

Strategic uncertainty intensified when Broadcom announced its intent to buy VMware in early 2022; the deal did not close until November 2023. Competitors exploited the 18-month limbo, and some enterprise buyers imposed vendor-selection moratoria until ownership was settled. During this window, VeloCloud’s share slipped steadily, moving from the teens toward single digits by late 2023.

- Post-Close Reality Inside Broadcom (4Q23 – Present)

Once the acquisition closed, Broadcom integrated VeloCloud into a newly formed Software-Defined Edge division and pivoted security to the Symantec portfolio, effectively scrapping the Menlo Security path. Broadcom also forced all VMware partners to re-qualify under its new program structure, alienating a historically loyal VAR base.

Cost-reduction took priority: VMware’s overall headcount was cut roughly in half within four months, and long-standing support teams were dispersed, triggering public complaints about ticket backlogs and inexperienced first-line engineers on public discussion forums. Customers already wary of double-digit price hikes on core VMware software (vSphere, vSAN, etc.) associated the same “Broadcom tax” with edge platforms.

The net effect was a visible erosion of business, lengthening release cycles, and a decline in Net Promoter Scores, according to channel feedback.

- A New Chapter at Arista – Opportunities & Risks

Strategic fit. Arista, renowned for its data-center franchise and burgeoning campus, lacks an enterprise-class WAN. In 2023, the “Arista WAN Routing System” entered limited trials but never reached broad availability. Acquiring VeloCloud instantly fills that gap with a production-proven SD-WAN architecture, 20,000-plus customers, and a seasoned SP channel. Cultural compatibility is high: both firms share a software-centric, telemetry-heavy design philosophy and emphasize deterministic performance.

Portfolio synergy. VeloCloud’s cloud gateways complement Arista’s EOS-based routing and CloudVision management, creating an end-to-end fabric that spans from the data center spine to the branch edge. In the near term, Arista can offer a best-of-breed SD-WAN overlay without re-platforming, while leveraging Untangle’s SMB firewall (acquired in 2022) to serve smaller sites and retail chains.

Go-to-market leverage. Arista primarily sells to Global 2000 cloud, financial services, and web-scale operators—audiences that increasingly request managed SD-WAN solutions to connect distributed workloads. Bundling VeloCloud with spine-leaf refresh cycles or campus upgrades could accelerate cross-sell velocity.

Path to full-stack SASE. The strategic decision is whether to remain an SD-WAN specialist or pursue the larger SASE total addressable market (TAM). Staying narrowly focused minimizes incremental R&D and integration risk but would leave Arista exposed as single-vendor SASE preferences harden. Conversely, expanding into Security Service Edge (SSE) would require investment—either organically or through the acquisition of a cloud-delivered network security pure play—but positions Arista to participate in a segment projected to exceed $10 billion by 2025.

Execution risks.

- Marketing/enablement gap: The transaction excludes most of VeloCloud’s marketing, field enablement, and demand-generation personnel, so Arista must build these functions nearly from scratch, risking slower pipeline growth and weaker partner momentum in the first 12–18 months.

- Integration complexity: Absorbing roughly 500 staff, migrating them to Arista’s lean HR and IT systems, and aligning development road maps across EOS, CloudVision, and VeloCloud’s orchestrator will be resource-intensive.

- Channel dislocation: Broadcom’s partner reset created churn. Arista must quickly rebuild trust with top VARs and MSPs before rivals solidify their footholds.

- Strategic focus tension: Arista’s DNA—and current market leadership—lies in data-center switching, particularly in the fast-paced AI data center networking race. Enterprise WAN and SASE target very different buying personas. As Arista pivots into these adjacent markets, it must avoid diluting resources or missing its core AI opportunity—a balancing act that will test execution discipline.

Upside bias.

- Accelerated enterprise relevance: SD-WAN grants Arista a credible branch-to-cloud narrative, broadening its addressable opportunity beyond data-center switching.

- Recurring revenue lift: VeloCloud’s SD-WAN revenue diversifies Arista’s P&L with software subscriptions and managed service attach.

- Platform optionality: Possession of a mature edge stack enables Arista to choose the pace of SSE expansion through selective tuck-in deals or partnerships, while still harvesting SD-WAN growth today.

Bottom line. VeloCloud’s core technology remains well-regarded, and demand for high-performance SD-WAN remains intact. However, the platform languished under Broadcom’s cost-driven stewardship. Broadcom’s loss of VeloCloud—its only native SD-WAN pillar—means its Symantec/Carbon Black security unit can no longer claim single-vendor SASE. Still, because integration between the two portfolios was minimal, the security division can pivot to partnerships with other networking leaders without significant disruption.

The bigger story, however, is Arista’s gain: a culturally aligned, engineering-driven home that can reignite VeloCloud innovation, restore channel confidence, and extend Arista’s influence from the data-center spine to the branch edge. If Arista executes on integration and closes its marketing and enablement gap, the acquisition could transform a challenged asset into the catalyst for Arista’s next phase of growth and position the company for a broader SASE play.

For granular market-share data—including VeloCloud’s latest position—see Dell’Oro Group’s SASE & SD-WAN Quarterly Report, which tracks vendor performance each quarter.