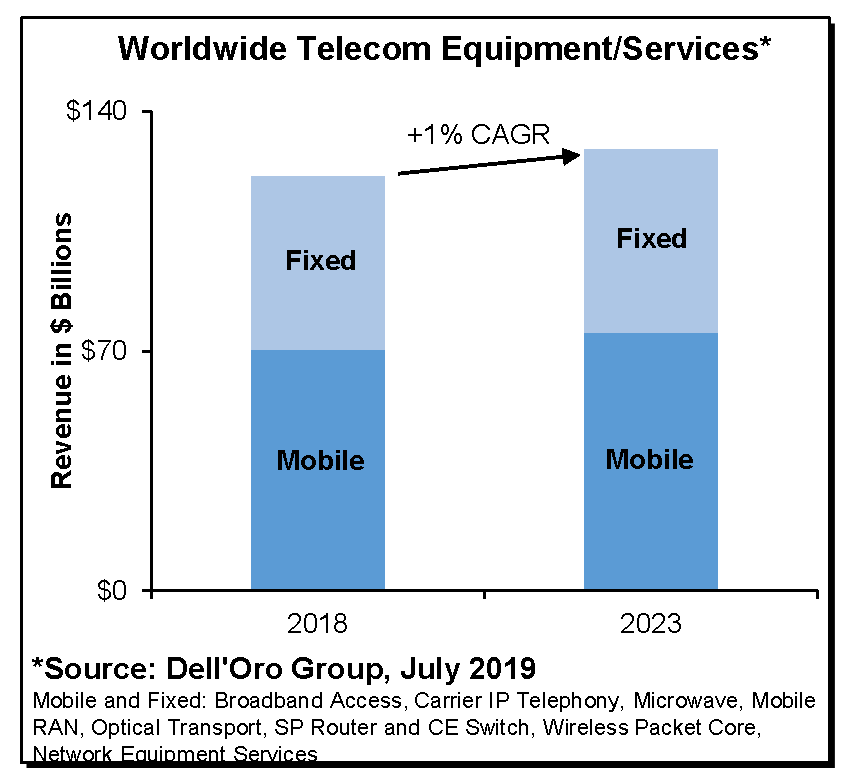

The overall telecom equipment and services market is projected to grow at a 1% CAGR

We just wrapped up the July 2019 5-year Forecasts for all the Telecommunications Infrastructure and Services programs covered at the Dell’Oro Group.

In this forecast, the overall telecom equipment and services market is projected to grow at a 1% CAGR, approaching $129 B by 2023, up from $121 B in 2018. Helping to drive this growth is fairly synchronized growth projections within the application mix, with mobile and fixed revenue projected to both grow at a 1% CAGR over the forecast period.

Additional key takeaways from the reporting period include:

- In order to cope with mobile data traffic that continues to grow at an unabated pace and flattish revenue trends, operators are balancing their investments carefully between the supply side related challenges and the opportunities from a demand perspective. The need to reduce TCO has been a catalyst for the overall 4G to 5G migration acceleration, benefitting not only RAN equipment but also the demand for core, transport, and services.

- Total Transport Market – including Microwave and Optical – is projected to grow at a 3% CAGR.

- The demand for Mobile Backhaul is projected to grow at a 3% CAGR while the overall RAN market is projected to grow at a 2% CAGR, over the forecast period.

- Overall 5G infrastructure projections – including 5G RAN and 5G Core – were revised upward, reflecting a more optimistic view about the 5G Core market.

- The adoption of 400 GE will help to advance the SP Router market and offset flat growth expectations for Broadband Access.

- Following five years of contractions, Network Equipment Services revenue growth is expected to improve, buoyed by improving market sentiment for telecom equipment. Total Network Equipment Services revenue – including Managed Service, Network Rollout Service, and Consulting Service – is projected to grow at a low-single digit growth rate over the forecast period.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Carrier IP Telephony, Microwave Transmission & Mobile Backhaul, Mobile Radio Access Network (RAN), Optical Transport, Service Provider (SP) Router & Carrier Ethernet Switch, Telecom Capex, Wide Area IoT, and Wireless Packet Core.

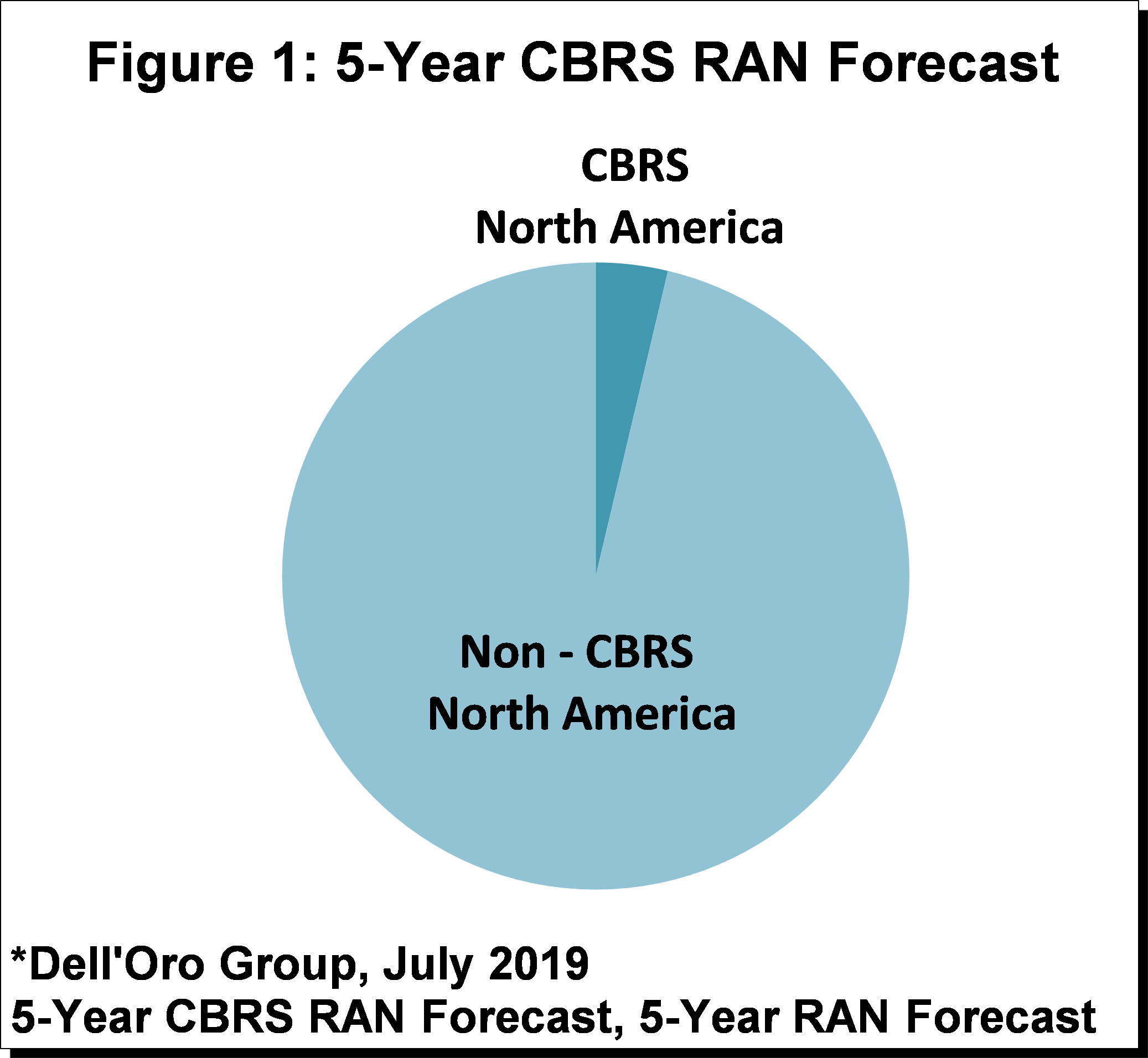

impact the long-term demand for LTE and 5G NR CBRS solutions – the overall CBRS RAN market outlook is relatively unchanged since the January 2019 update. The overall CBRS market is expected to grow at a rapid pace between 2019 and 2023 with cumulative RAN investments projected to comprise a tangible share of the overall North America RAN market (Figure 1).

impact the long-term demand for LTE and 5G NR CBRS solutions – the overall CBRS RAN market outlook is relatively unchanged since the January 2019 update. The overall CBRS market is expected to grow at a rapid pace between 2019 and 2023 with cumulative RAN investments projected to comprise a tangible share of the overall North America RAN market (Figure 1).