We recently published an update to our Service Provider (SP) Router and Carrier Ethernet Switch (CES) five-year market forecast report. Compared to our prior forecast in January, we made some significant adjustments to incorporate the impact of the COVID-19 pandemic. On the other hand, our view of emerging technology trends remains largely unchanged, and that demand will remain healthy over the coming years. Our forecast isn’t as rosy as our January outlook, but we still expect The SP Router and CES market to grow annually from 2021 and to top $15 billion by 2024.

We recently published an update to our Service Provider (SP) Router and Carrier Ethernet Switch (CES) five-year market forecast report. Compared to our prior forecast in January, we made some significant adjustments to incorporate the impact of the COVID-19 pandemic. On the other hand, our view of emerging technology trends remains largely unchanged, and that demand will remain healthy over the coming years. Our forecast isn’t as rosy as our January outlook, but we still expect The SP Router and CES market to grow annually from 2021 and to top $15 billion by 2024.

The COVID-19 pandemic led to a major reset of our forecast assumptions and market growth profile for the next five years. For the short term through 2020, market growth will be suppressed due to supply and human resource constraints, as well as weakened macroeconomic conditions. Over the longer term, from 2021 through 2024, we expect the technology and use case drivers of our prior forecasts to remain largely intact and drive annual growth.

The good news is that the importance of technologies such as 400 Gbps, 5G, and Cloud networking remains unchanged or perhaps even more so in the face of tighter capital spending and infrastructure investments. These prioritized spending will lead to a faster decline in spending for less critical infrastructure and legacy technologies.

On the 400 Gbps technology front, the emergence of new products will be a big growth driver over the next five years. Network operators see 400G as a logical step to increasing network capacity at lower costs for hardware and operations. The ecosystem of 400G technologies, from silicon to optics is ramping and throughout 2020, a broad range of routers supporting 400G will become commercially available. Starting in 2021, large-scale deployments will contribute meaningful market. By 2024, we expect 400G to generate almost $3 billion in manufacturers’ revenue and to be widely deployed in all of the largest core networks in the world.

One phenomenon of the pandemic has been the acceleration of 5G radio deployments in 2020 as service providers see the opportunity to build differentiated networks and associated services. Along with the 5G radio deployments, many network operators are upgrading IP transport capacity in backhaul networks. Over the next five years, we expect to see multiple waves of backhaul network investments as operators deploy 5G at varying times and rates around the world. Initially, networks will be upgraded to support the faster data rates of 5G services. Over time, we anticipate a larger focus on implementing extensive and very granular network management, control, and automation capabilities that enable the vast array of services that service providers envision.

We hear so much about the adoption of Cloud services, but what is often overlooked is the massive IP networks used to interconnect the thousands of Cloud data centers and points of presence, to private networks, and the public Internet. Sales of Service Provider Core and Edge routers to Cloud operators are expected to grow at a higher rate compared to sales to Telecommunication Service Providers. The largest Cloud operators will be the early adopters of 400G as they upgrade from 100G in their backbone networks to accommodate the traffic growth to and from, and across their data centers.

In summary, we maintain a positive growth outlook for the SP Router and CES market over the next five years. Demand is coming from the tremendous growth of new and innovative services from Telecom and Cloud SPs that in turn drive the need to expand IP network capacity and functionality. The potential supply of many new products and technologies that meet the new network requirements is emerging from the entire technology ecosystem. We look forward to watching the industry’s progress!

If you need to access the full report to obtain revenue, units, pricing, relevant segmentation including regions and vertical markets, etc., please contact us at dgsales@delloro.com

About the Report:

The Dell’Oro Group Router & Carrier Ethernet Switch Five Year Forecast Report offers complete, in-depth coverage of the Service Provider Core and Edge Router, Carrier Ethernet Switch, and Enterprise Router markets for future current and historical time periods. The report includes qualitative analysis and detailed statistics for manufacture revenue by regions, customer types, and use cases, average selling prices, and unit and port shipments.

Analysis of market performance during the prior two recessions was a fundamental part of our forecast process, as we assessed the impact of the COVID-19 pandemic. However, it is very important to recognize how this pandemic-induced recession may differ from the prior two recessions, not only at a macro level but also from a technology perspective. COVID-19 will bring many changes to our lives and will impact the adoption of technology in different ways. Some of these changes may be short-term, but we believe a number of them will remain with us for the long term. In the report, we detail our view on the potential impact of the COVID-19 pandemic on the market, in terms of both upside and downside. We also explain how and why this recession may differ from the prior two recessions. Our view is the result of numerous interviews over the last three to four months with end-users, system integrators, VARs, and manufacturers. Below are some highlights:

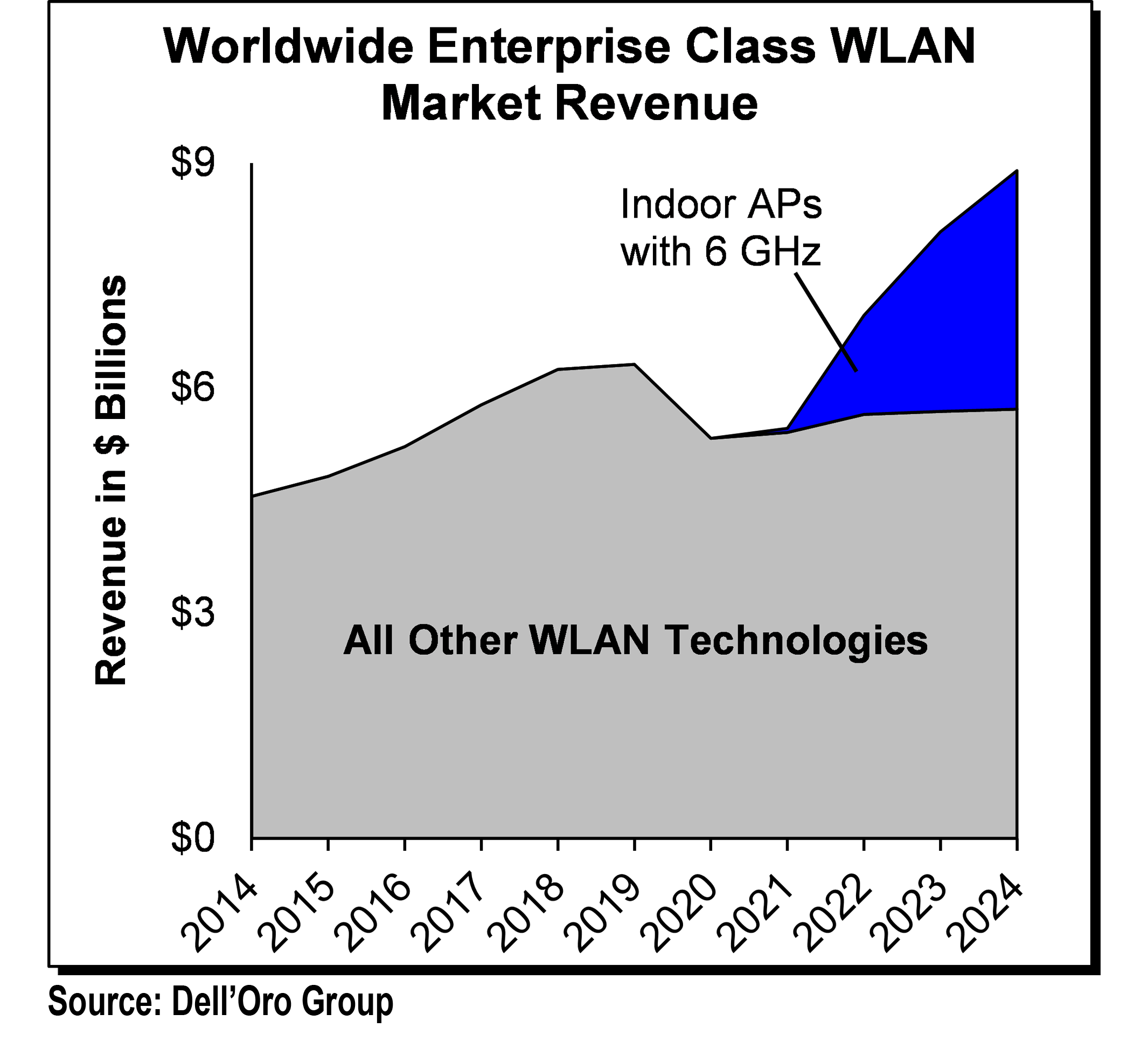

Analysis of market performance during the prior two recessions was a fundamental part of our forecast process, as we assessed the impact of the COVID-19 pandemic. However, it is very important to recognize how this pandemic-induced recession may differ from the prior two recessions, not only at a macro level but also from a technology perspective. COVID-19 will bring many changes to our lives and will impact the adoption of technology in different ways. Some of these changes may be short-term, but we believe a number of them will remain with us for the long term. In the report, we detail our view on the potential impact of the COVID-19 pandemic on the market, in terms of both upside and downside. We also explain how and why this recession may differ from the prior two recessions. Our view is the result of numerous interviews over the last three to four months with end-users, system integrators, VARs, and manufacturers. Below are some highlights: COVID-19 Near-Term Impact on WLAN Market

COVID-19 Near-Term Impact on WLAN Market