We just published the 4Q19 update to the Microwave Transmission & Mobile Backhaul quarter report. Here are a few key findings for the quarter.

- Microwave Transmission market declined in 2019 following a slight rebound the prior year. The decline in 2019 was due to a massive slowdown in India. We estimate sales to Indian operators declined over 50 percent in the year.

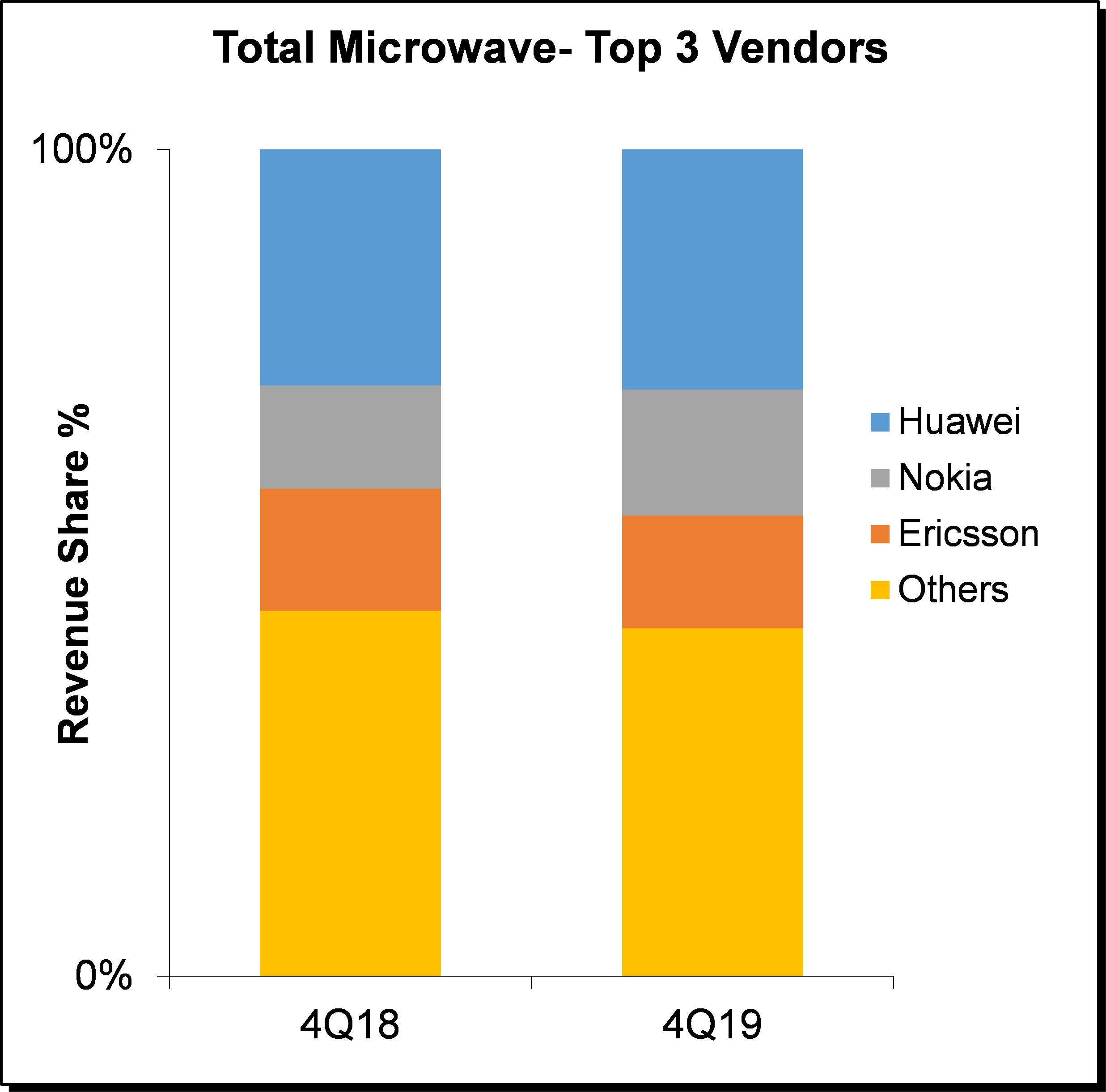

- Huawei continued to hold the largest share of the Microwave Transmission market, garnering 29 percent share in 4Q19.

- Vendor share was more fluid than usual in the quarter. Typically the top three vendors in this market consists of Ericsson, Huawei, and NEC. In 4Q19, Nokia overtook Ericsson for the first time and captured the second highest share.

- E/V Band shipments outperformed in the quarter, helping to bring full year growth rates back up above 20 percent.

- Among the microwave technology segments, we believe E/V Band systems have the greatest growth potential driven by its ultra-high capacity (10 Gbps), small footprint, and low spectrum license fees in certain countries. In addition to these advantages, demand for E-band systems in particular is projected to grow because of the availability of multi-band solutions that combine the benefits of both standard microwave frequencies with that of E-band.

The Dell’Oro Group Microwave Transmission & Mobile Backhaul Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, ports/radio transceivers shipped, and average selling prices by capacities (low, high and E/V Band). The report tracks point-to-point TDM, Packet and Hybrid Microwave as well as full indoor and full outdoor unit configurations. To purchase this report, please contact us at dgsales@delloro.com