We’ve just wrapped up the 4Q20 reporting period for Dell’Oro Group’s Enterprise Network Equipment programs, which include Campus Switches, Enterprise Data Center Switches, SD-WAN & Enterprise Routers, Network Security, and Wireless LAN. Enterprises include businesses of all sizes as well as government, education, and research entities. The equipment tracked in these programs can be used for wired or wireless data communication in private and secure networks.

2020 Market Performance

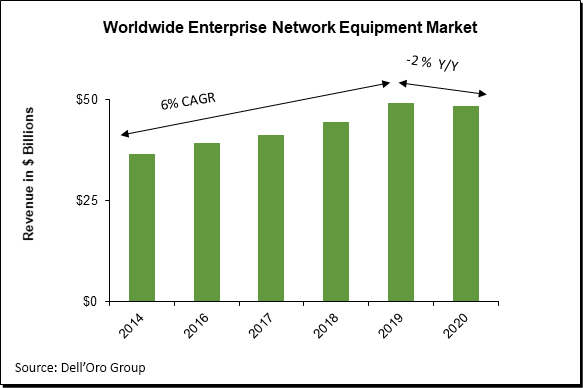

Our reports suggest that the overall Enterprise Network Equipment market declined 2% year over year (Y/Y) for full-year 2020 to $48.5 B as a result of the COVID-19 pandemic. This is a significant departure from the 6% CAGR achieved from 2014 to 2019.

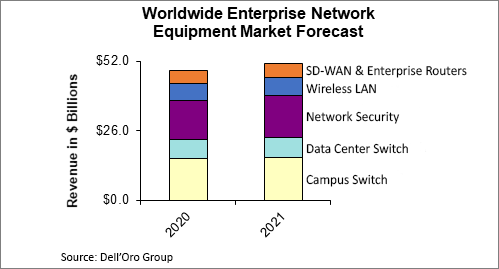

The decline was driven mostly by campus and data center switches. In the meantime, enterprise spending was up on both routers and security and it was flat on Wireless LAN. What’s interesting is that growth in routers and security was actually driven by software and subscription-based products (SD-WAN and virtual and SaaS security). Even within Wireless LAN, we saw growth in controllers and licenses. In the meantime, spending declined on hardware products (access routers, physical firewall, Wireless LAN access points, and Ethernet switches).

The softness in the total Enterprise Network Equipment market was more pronounced in the first half of the year. However, starting in 3Q20, spending on network equipment began to recover, as enterprises showed confidence investing for the future. Government stimulus around the world was also a major factor. Additionally, what caught our attention is the spread across various technologies of this increase in spending. We calculated that enterprises increased their spending on network equipment by about $400 M in 2H20 (compared to 2H19), about 70% of which was allocated to Wireless LAN.

2020 Vendor Landscape

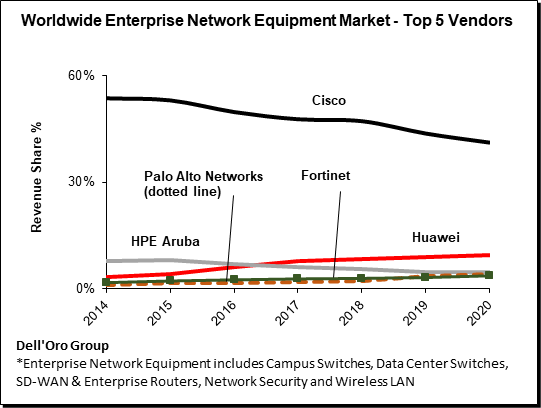

From a vendor perspective, Huawei and Cisco composed about 50% of the Enterprise Network Equipment market in 2020; they were the only two vendors with more than 10% revenue share in the Enterprise Network Equipment market.

Cisco remained the market leader in all segments. However, the company saw revenue-share loss in 2020 due to high exposure to hardware-based products and low exposure to China, which outgrew the market during the pandemic.

In the meantime, Fortinet climbed to fifth place, displacing H3C. Fortinet has high exposure to the security market, while H3C has high exposure to the switching market. Since security performed better than switching in 2020, it helped Fortinet gain share and improve its ranking in 2020.

| Top 9 Vendors | 2019 | 2020 |

| CISCO | 44% | 41% |

| HUAWEI | 9% | 10% |

| HPE ARUBA | 5% | 5% |

| PALO ALTO NETWORKS | 4% | 4% |

| FORTINET | 3% | 4% |

| H3C | 3% | 4% |

| JUNIPER | 2% | 2% |

| CHECK POINT | 2% | 2% |

| SYMANTEC / BLUE COAT | 2% | 2% |

2021 Market Outlook

Dell’Oro analysts remain optimistic about the 2021 outlook and forecast 5% growth for the total Enterprise Network Equipment Market. This optimism is prompted by improving macro-economic conditions and business confidence as well as the ongoing government stimulus. Additionally, our interviews with end-users, system integrators, and value-added resellers (VARs) revealed that if a portion of the workforce returns to work by the end of 2021, spending on network infrastructure in preparation for such a development should start a few months in advance, perhaps as early as 2Q21 or 3Q21.

Dell’Oro Group Enterprise Network Equipment research programs consist of the following: Campus switches, Enterprise Data Center Switches, SD-WAN & Enterprise Routers, Network Security and Wireless LAN.

Related blogs for 5-year Forecast Jan 2021:

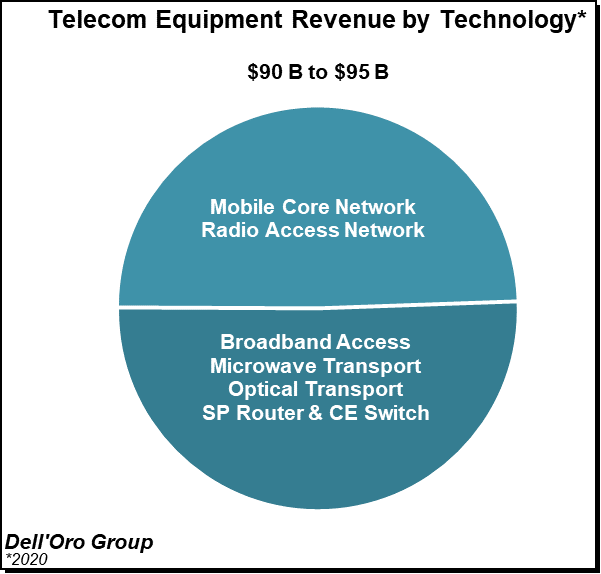

We just wrapped up the 4Q20 reporting period for all the Telecommunications Infrastructure programs covered at Dell’Oro Group. Preliminary estimates suggest the overall telecom equipment market – Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Carrier Ethernet Switch (CES) – advanced 7% year-over-year (Y/Y) for the full year 2020, growing at the fastest pace since 2011.

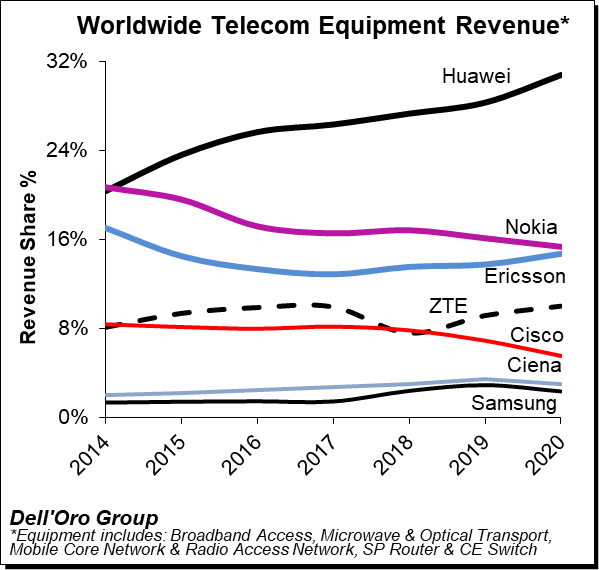

The analysis contained in these reports suggests revenue rankings remained stable between 2019 and 2020, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers, accounting for 80% to 85% of the total market. At the same time, revenue shares continued to be impacted by the state of the 5G rollouts in highly concentrated markets. While both Ericsson and Nokia improved their RAN positions outside of China, initial estimates suggest Huawei’s global telecom equipment market share, including China, improved by two to three percentage points for the full year 2020.

We estimate the following revenue shares for the top seven suppliers:

| Top 7 Suppliers | Year 2019 | Year 2020 |

| Huawei | 28% | 31% |

| Nokia | 16% | 15% |

| Ericsson | 14% | 15% |

| ZTE | 9% | 10% |

| Cisco | 7% | 6% |

| Ciena | 3% | 3% |

| Samsung | 3% | 2% |

Additional key takeaways from the 4Q20 reporting period include:

- Preliminary estimates suggest that the positive momentum that has characterized the overall telecom market since 1Q20 extended into the fourth quarter, underpinned by strong growth in multiple wireless segments, including RAN and Mobile Core Networks, and modest growth in Broadband Access and CES.

- Helping to drive this output acceleration for the full year 2020 is faster growth in Mobile Core Networks and RAN, both of which increased above expectations.

- Covid-19 related supply chain disruptions that impacted some of the telco segments in the early part of the year had for the most part been alleviated towards the end of the year.

- Not surprisingly, network traffic surges resulting from shifting usage patterns impacted the telecom equipment market differently, resulting in strong demand for capacity upgrades with some technologies/regions while the pandemic did not lead to significant incremental capacity in other cases.

- With investments in China outpacing the overall market, we estimate Huawei and ZTE collectively gained around 3 to 4 percentage points of revenue share between 2019 and 2020, together comprising more than 40% of the global telecom equipment market.

- Even with the higher baseline, the Dell’Oro analyst team remains optimistic about 2021 and projects the overall telecom equipment market to advance 3% to 5%.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Mobile Radio Access Network, Optical Transport, and Service Provider (SP) Router & Carrier Ethernet Switch.