The infrastructure of the cloud—data centers and the computer and networking systems resources housed within—is expanding rapidly as the demand for cloud services spreads globally. The traffic between data centers, as well as traffic into and out of the cloud, is expected to grow strongly, placing pressure on the data center interconnect (DCI) networks used to connect the data centers.

According to the Dell’Oro Group CBRS RAN 5-year January Forecast Report, short term delays will not impact the long-term demand for LTE and 5G NR CBRS solutions – the overall CBRS RAN market is expected to grow at a rapid pace between 2019 and 2023 with cumulative investments surpassing $1 B over the next five years.

overall CBRS RAN market is expected to grow at a rapid pace between 2019 and 2023 with cumulative investments surpassing $1 B over the next five years.

“We continue to believe the CBRS band with its unique spectrum sharing characteristics include many of the right ingredients to change the status quo about how networks are built,” said Stefan Pongratz, senior director at Dell’Oro Group. “And recent announcement by the CBRS Alliance to support OnGo over 5G underpins projections that 5G NR deployments in the CBRS band are set to accelerate in the outer part of the forecast period,” continued Pongratz.

Followings are additional highlights from the CBRS 5-Year Forecast January Report (2019 to 2023):

- CBRS capex is not projected to have a significant impact on the WLAN capex.

- CBRS investments are projected to account for more than a fifth of the U.S small cell market by the outer part of the forecast period.

- FWA is projected to drive the lion share of the CBRS capex over the near-term.

Dell’Oro Group’s Advanced Research: Citizen Broadband Radio Service (CBRS) 5-year Forecast Report offers an overview of the CBRS RAN potential with a 5-year forecast (2019 to 2023) for indoor and outdoor LTE and 5G NR CBRS deployments along with a discussion on the participating suppliers.

For more information about the report, please contact dgsales@delloro.com.

This blog post is a summary of RAN-related key takeaways from MWC 2019 Barcelona. For access to the full version, please contact daisy@delloro.com

RAN Optimism

The MWC event supported the premise we have communicated for some time that there are convincing reasons to be optimistic about the RAN market. One of the show’s key findings was a strong consensus that 2019 will be another solid year for the RAN market driven by growth in China, Korea, and the U.S.

While we have already projected that 5G NR would accelerate rapidly in 2019, key findings at the show increase our confidence level that 5G NR shipments and revenues will be material in 2019. We discuss the mobile infrastructure market’s 2018 performance in this press release.

Massive MIMO

Another key takeaway from MWC2019 was the strong focus on Massive MIMO. This increased confidence in the upwardly adjusted Massive MIMO projections we outlined in conjunction with recently published Mobile RAN reports. Given that operators have multiple tools in their toolkit to manage capacity (Figure 1), why are we so optimistic about the Massive MIMO opportunity in the sub 6 GHz spectrum? Learn more about Massive MIMO at Barcelona in this article.

Millimeter Wave

The Millimeter Wave (mmW) narrative has morphed somewhat over the past couple of years with the industry sentiment fluctuating about the role mmW will play for mobile applications. Even though the opportunity cost for operators with significant mid-band assets will be more favorable for

some time leveraging the macro grid and Massive MIMO, our view has always been that mmW will be an important technology over the long-term (there is no fourth alternative in Figure 1).

The most important takeaways from the event include: 1) mmW is now real, phones are coming to the market, and mmW shipments will be material in 2019, 2) The perception about Qualcomm’s mmW simulation is changing, 3) Findings validate our short-term and long-term forecast.

A summary of the latest Mobile RAN five-year forecast may be found here.

Open and Virtual RAN

In general good momentum during the show behind the shift towards opening up the RAN and moving away from proprietary hardware with Rakuten communicating its C-RAN (Cloud Radio Access Network) progress in Japan, Ericsson recently joining the ORAN Alliance, and Telefonica sharing its roadmap and ecosystem partners for Open Access – which did not include the larger macro RAN vendors for the SW stack or the radios.

While there is no doubt that virtual RAN sceptics will be monitoring Rakuten’s performance when the company goes to live with its 5500 sites this fall, it remains to be seen how well true C-RAN systems will handle—for example, a site with 64T64R 100 MHz BW Massive MIMO systems, along with legacy 2G/4G systems.

To some degree, the event reminded both virtual and proprietary HW RAN proponents that both sides have something to bring to the table. Open RAN and Virtual RAN are making significant headway and there is excitement about this progress. However, the event did little to convince us of our long-standing thesis—that the shift toward RAN virtualization will eventually occur—but it will take time. Moreover, initially, it will be confined to non-traditional builds, e.g., new use cases, indoor deployments, greenfield deployments, and rural settings. Finally, after such deployments, it will need to be revised.

CBRS

The key takeaway from a CBRS perspective is the reduced risk that regulatory delays could eventually impact the ecosystem. With Pixel 3 and Galaxy S10 now supporting the CBRS band, the ecosystem will undoubtedly get a boost. In addition to Qualcomm’s Snapdragon X20/24, Sierra Wireless and Sequans Cassiopeia now also have production-grade modules.

Our CBRS forecast report, which suggests that will grow at a rapid pace between 2018 and 2022 with total RAN investments approaching $1 Billion and CBRS RAN shipments to eclipse half a million units. Learn more from my blog on the CBRS RAN market.

For access to the full version, please contact daisy@delloro.com

After spending a few days at OFC 2019, I sat down and read through the notes I took during each meeting at the conference and concluded that I have fewer pages of notes for this OFC than in the past two OFCs attended. Kidding aside…This lack of notes was in no way an indication of the meeting quality. They were great meetings with a lot of information exchange. It was, however, an indication that nothing was “really” new at this conference from the past two conferences. In fact, at times, I felt a sense of Déjà vu.

At the conference 600 Gbps and 800 Gbps coherent optical components, DSPs, and systems were re-affirmed with samples, demos, and timelines. As I understand it, the timeline for system availabilities are as follows:

- 600 Gbps capable coherent line cards

- Cisco’s NCS 1004, Infinera’s Groove G30 using Acacia’s DSP will be available by the end of March 2019

- Fujitsu’s 1Finity T600 using NEL’s DSP was available one week before OFC

- Huawei’s OSN with an in-house DSP will be available by end of March 2019

- Nokia’s 1830 PSI-M with an in-house DSP will be available in 3Q 2019

- 800 Gbps capable coherent line cards

- Ciena is targeting the end of 2019 (I’m guessing last month of 2019)

- Huawei by end of 2020 (I’m guessing last month of 2020)

- Infinera is targeting 2H20 (I’m guessing the first month of 4Q 2020)

Nearly everyone talked more about 400 Gbps ZR in a QSFP-DD or OSFP form factor this year. This was the same as last year. However, now both Ciena and Infinera have announced plans for developing and manufacturing 400G ZR. So, there are definitely more companies interested in making and selling 400G ZR. We should see 400G ZR products and demo in OFC 2020.

The most interesting item I saw at OFC this year was probably a new product that Fujitsu is developing that they call Trans Lambda. It sounded like the company needed a couple more years to develop the product, but the concept was quite unique. The premise is that as the optical world hits Shannon’s limit, the use of L-band will increase. So, Fujitsu is working on a box that can shift C-band signals to L-band without an optical-electrical-optical conversion. I’m looking forward to hearing how this technology develops and fits into the optical market in the future.

2019 is the year of 5G. All of the pieces of the ecosystem are falling into place: the announcement of 5G smartphones is coming soon and numerous service providers are committing to 5G deployments this year. Following are my observations about the core from walking the show floor.

QUALCOMM

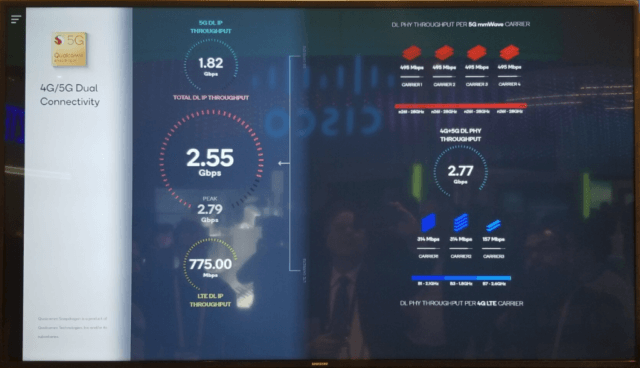

Qualcomm’s ceremony, which I unfortunately missed, brought together the industry leaders who made 5G happen in 2019, a year earlier than originally planned, with the 5G Non-Standalone (NSA) architecture. Qualcomm’s stand featured a live Dual Connectivity 5G NSA network demonstration of the combined bandwidth of three 20 MHz LTE carriers and four 100 MHz 5G carriers utilizing the 4G Evolved Packet Core (EPC).

For background information on the journey to 5G, see my previous blog, “The Twisted Road To 5G.”

Rakuten

Rakuten

“Cloud-Native” architecture at the core made the news at MWC.

The news was buzzing about Rakuten’s new mobile network being billed as “the world’s first end-to-end fully virtualized, cloud-native mobile network.” We got a chance to spend time with Tareq Amin, CTO, of Rakuten Mobile Network, Inc. and saw first-hand the network elements. The company is a new service provider in Japan with a license in the 1700 MHz band and 20 MHz of spectrum in the uplink and downlink (20×20). This provides a theoretical bandwidth of 400 Mbps with 256 QAM modulation and 4×4 MIMO. The network will launch as a 4G LTE network in October 2019 and will be 5G ready.

The following vendor news for the Rakuten network, focused on the core, was announced at the conference:

- The vendor for the EPC with Control and User Plane Separation is from Cisco.

- The IMS Core, Subscriber Data Management, and Common Data Layer will be provided by Nokia with 25 cloud-based VNFs; Mavenir will supply the RCS solution.

- Data servers will be provided by Quanta Cloud Technology powered by Intel with the next-generation Intel® FPGA Programmable Acceleration Card N3000.

Rakuten has been open about its network deployment plans, encouraging the industry to learn from its pioneering efforts to realize an end-to-end fully virtualized cloud-native network. The company’s goals and plans are discussed here by CEO, Mickey Mikitani and here by CTO, Tareq Amin.

TELEFÓNICA

Telefónica’s Juan Carlos García, SVP of Technology and Architecture, outlined the company’s digital transformation plans, called the Telefónica Open Digital Architecture (TODA), for its fixed, mobile, and edge networks around the globe. TODA is an open architecture with disaggregated hardware and software that is fully virtualized for the radio access, the core, and the optical transport layer with software-defined networking (SDN). By 2022, Telefónica expects to start realizing the potential of TODA, completing the total transformation by 2025.

Casa Systems

At Casa Systems’ stand, Casa partnered with BT, demonstrating how its cloud-native 5G Packet Core with network slicing supports the convergence of fixed and mobile networks. Telefónica listed Casa Systems as a packet core partner in its TODA project. Casa Systems stated it is in trials with many Tier 1 service providers in North America and Europe.

Cisco, Ericsson, Huawei, Nokia, and ZTE

The top-five wireless core infrastructure vendors did not disappoint, each putting on a spectacular show with massive stands demonstrating its end-to-end technology prowess empowering 5G use cases, all enabled with their respective cloud-native cores. Their stands were packed with customers and potential customers leading to thousands of meetings. Each vendor had its share of press releases with 5G deals around the globe that are too numerous to name here. Links to the happenings at MWC19 from each of the top-five vendors may be found at Cisco, Ericsson, Huawei, Nokia, and ZTE.

Summary

These are just a few examples from a small sample of participants at MWC19 Barcelona. What has not been detailed here are all of the use cases on display by numerous vendors and the 25+ service providers who were exhibitors. Every 5G uses case that has been envisioned was demonstrated.

With so many 5G smartphone announcements, service providers’ 5G network launch announcements, and 5G infrastructure vendors already delivering their launch plans, the 5G era is upon us. We have embarked on the connected society. Everything that I saw confirms our positive outlooks for the Wireless Packet Core and IMS Core markets. See you at MWC19 Los Angeles in the fall. (Also, see our blog, “Wireless Packet Core Market CAGR is projected to be 3 Percent.”)