[wp_tech_share]

On December 6th, Adtran announced that it had acquired broadband and virtual customer premises equipment (CPE) supplier SmartRG for an undisclosed sum. The move provides Adtran with an infusion of tier 2 and 3 customers in the Americas, along with a line of broadband CPE hardware running the gamut from ADSL2+ to GPON to DOCSIS.

More importantly, SmartRG gives Adtran a comprehensive and well-regarded SDN and NFV platform for the delivery of vCPE functions that can be integrated into Adtran’s Mosaic SD-Access platform. With SmartRG’s SmartOS, Adtran can now extend its microservices architecture from the access network all the way into the home, something that rival Calix has been touting via its Gigaspire series of CPE and EXOS SDN architecture.

For Adtran, the acquisition was a necessary move to keep pace with its chief broadband access rival in North America.

The addition of SmartRG is also reflective of the need tier 2 and tier 3 operators have for remote and software-defined provisioning, monitoring, and troubleshooting of broadband CPE and home networking devices in an age of growing interest in IoT. These smaller, often rural operators, absolutely require solutions that will both reduce their overall operating costs while also positioning them to increase top-line broadband revenue through the addition of new services, including managed WiFi and home automation services.

If you take a look at SmartRG’s customer base and where the company has excelled to date, it is among tier 3 RLECs, co-ops, and ISPs who service areas where the average truck roll could be 2x-3x the cost of a truck roll for an operator in a more urban area. These are the operators who provide an immediate business case for remote provisioning of residential CPE. For them, there is simply no room to send a truck whenever a client has connectivity issues. If 80% of those issues can be diagnosed from the main office, then that dramatically improves the margin profile for these operators’ broadband services.

Remote provisioning and troubleshooting is where SmartRG cut its teeth.

SmartRG was spun out of ClearAccess, a provider of TR-069 software, when the company was acquired by Cisco in 2012. At the time, Cisco was one of the leading suppliers of broadband CPE, particularly to cable operators. Cisco had acquired Scientific-Atlanta back in 2005 and Linksys in 2003. Cable operators around the world were in the process of moving to a TR-069-based architecture for managing their increasingly complex DOCSIS gateways and EMTAs. TR-069 would allow MSOs to offer self-installation and remote provisioning of CPE for new and existing subscribers, thereby eliminating the need to roll a truck for each new customer.

Meanwhile, SmartRG had combined its existing hardware design along with the knowledge of how to deliver TR-069-based architectures to address the needs of smaller ISPs in the North American market, where it found considerable traction.

Flash forward to today, where the tenets and efficiency goals of TR-069 have been encapsulated and reborn as a small part of the overarching NFV and vCPE concepts. When combined with its Mosaic-based SD-Access solution, Adtran can now provide its customers with visibility from the access network all the way into the home, regardless the physical WAN interface. If a customer is experiencing connectivity issues, the service provider can diagnose whether the underlying problem is a fiber cut, interference, or routing table issue in the access network, or whether it is due to channel interference, the addition of a new peripheral, or a DHCP issue in the home or small office. Again, diagnosing and troubleshooting these issues without needing to roll a truck is a critically important money-saving feature all broadband providers, both small and large, are demanding for their networks.

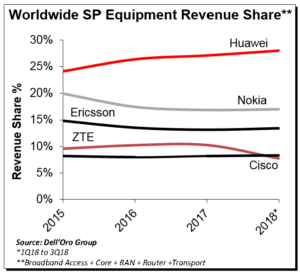

We just wrapped up the 3Q 2018 reporting period for all the Telecommunications Infrastructure programs.

We just wrapped up the 3Q 2018 reporting period for all the Telecommunications Infrastructure programs.