Driven largely by the renewed focus on fixed broadband networks and services, industry standards bodies and their members are increasingly defining fixed network evolutions with cadences similar to those found in the world of mobile networks. Designed initially to enhance the benefits that 5G is bringing to mobile networks worldwide, these overarching frameworks of technology requirements, use cases, and implementation guidelines are intended to give service providers a blueprint for network evolutions that both complement mobile network evolutions while also enabling new capabilities for fixed broadband networks.

ETSI is the primary organization defining these frameworks through its Fifth Generation Fixed Network (F5G) working group. Prior to its establishment in 2020, there really was no coordinated effort among various standards organizations to define standards and goals for fixed networks. In the mobile world, the ITU, 3GPP, and GSMA have historically cooperated and delivered the standards for each new technology evolution. But on the fixed networks side, separate standards from the ITU, IEEE, ETSI, Broadband Forum (BBF), and the Optical Internetworking Forum (OIF) have resulted in a disjointed evolutionary path.

From ETSI’s perspective, harmonizing standards and evolutionary requirements across fixed networks is the best way to ensure networks that both complement and enhance mobile network evolutions. The utility of these frameworks in mobile networks is clear. But in fixed networks, the relevance is less clear, especially since fixed networks encompass everything from core transport networks to in-home connectivity. Coordination in mobile networks is essential while in fixed networks it isn’t necessarily a requirement. This is due to the simple fact that in mobile networks, spectrum availability defines the technology. In fixed networks, technology determines spectrum availability- and there are many ways to deliver that spectrum in the form of optical wavelengths, RF spectrum, etc.

Nevertheless, there is certainly value in laying out an umbrella framework of technical requirements, applications, and use cases that will underpin fixed network upgrades that complement mobile network evolutionary steps. And certainly, there is value in applying the framework’s principles to the emerging F5G networks of today to the anticipated F5G Advanced networks of tomorrow.

Defining F5G

Back in 2019, 10 companies jointly launched the F5G working group, which was approved by ETSI at the end of the year. To help define the Fifth Generation Fixed Network, it was important to clarify the previous four generations and their underlying technologies—similar to how Wi-Fi generations were recently re-named.

| First Front Fixed Network Generations | ||

| Generation | Broadband Technology | Speed |

| F1G | PSTN/ISDN | 64 Kbps |

| F2G | ADSL | 10 Mbps |

| F3G | VDSL | 30-200 Mbps |

| F4G | GPON/EPON | 100-500 Mbps |

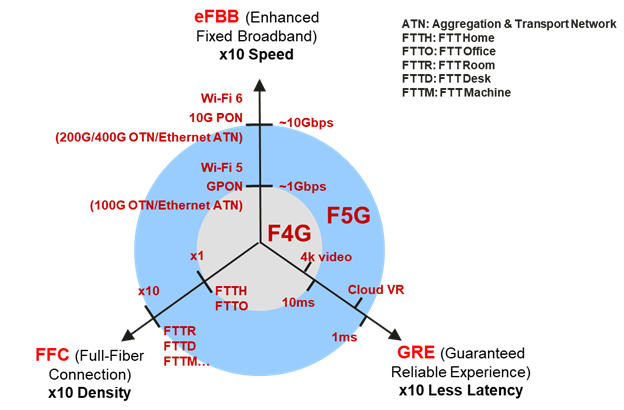

The group also set out to define the characteristics of the Fifth Generation, which is the network most operators are currently building today. The three primary technical pillars of F5G were:

- Full-Fiber connections (FFC) to every residence, business, room, and desktop, along with an expansion of fiber-based connections and density by 10x.

- Enhanced Fixed Broadband (eFBB) to deliver symmetric, gigabit speeds to residential locations and 10 Gbps speeds to businesses.

- Guaranteed Reliable Experience (GRE), defined by delivering minimal packet loss, a 10x reduction in latency, microsecond delays, and 99.999% reliability across the network and to every endpoint.

The underlying technologies of F5G are:

- 10G PON

- Wi-Fi 6

- 200G/400G Optical Transport Networks

The coordinated evolution of in-home and in-building networks, the fixed access network, and transport networks is intended to provide enough bandwidth and Quality of Service to better accommodate today’s use cases, including online gaming, education, E-health, and the continued reliance on cloud applications in enterprise environments. Additionally, the goal is to be able to support forthcoming, high-bandwidth applications, including cloud-based VR and AR, as well as uncompressed 4k and 8k video. Finally, delivering a sustainable network built on passive fiber connections and active electronics that consume less energy and reduce network operators’ carbon footprints is a key tenet of the F5G framework.

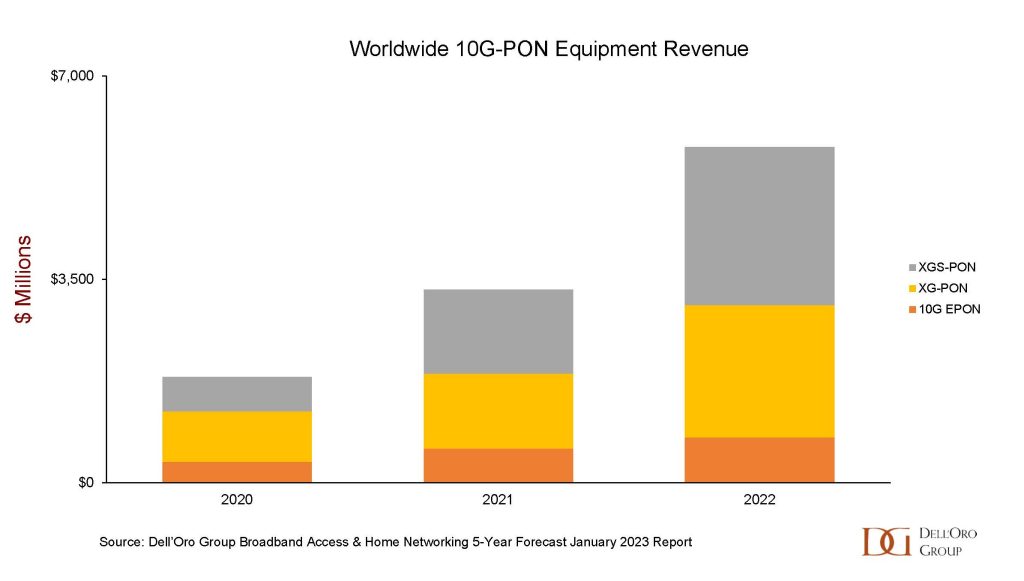

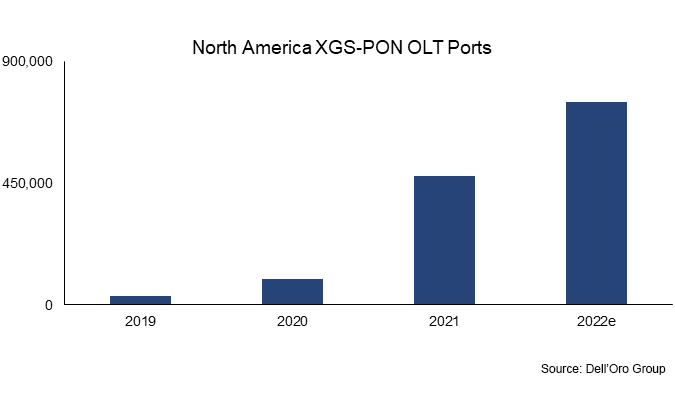

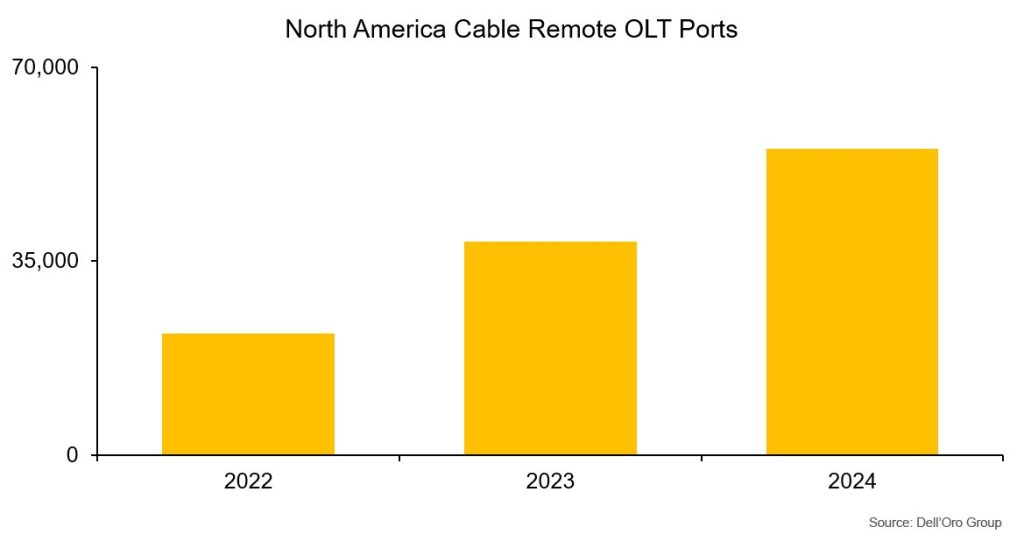

Operators globally are certainly expanding their gigabit-capable fiber networks, with combined XG-PON and XGS-PON OLT port shipments jumping from 2.2 M in 2020 to 8.7 M in 2022. In part due to the supply chain issues that have plagued consumer electronics over the last two years, total residential subscribers connected to these speeds remain well behind the available infrastructure. Additionally, the current high interest rate environment has dampened consumers’ appetites for higher-cost, premium broadband connections in many Western markets. Nevertheless, operators continue to invest in 10G infrastructure as they continue to pass more homes and businesses.

Certainly, bandwidth consumption patterns aren’t going to change and will remain on their steady upward trajectory based on an annual CAGR of 35-40%.

Enter F5G Advanced

Because of this consistent growth in bandwidth consumption and because F5G was never envisioned as being the ideal end state of fixed networks, members of the F5G Working Group have proposed F5G Advanced as the next evolutionary step, ultimately leading to an F6G framework, following their colleagues on the mobile side who have proposed 5G Advanced to help 5G evolve to deliver a more robust set of capabilities. At its heart, F5G Advanced aims to improve upon the goals established within the F5G framework, with more widespread FFC, including fiber connections to the room and to a wider array of endpoints, faster eFBB through the deployment of 50G PON, and faster GRE through more widespread availability od deterministic bandwidth and latency.

In addition to those enhancements, F5G Advanced focuses on improved energy efficiency with a heavy focus on optical access networks and ONUs, in particular, which consume by far the most energy in aggregate.

Tightly coupled with reducing energy consumption is adding significantly more network intelligence through AI and machine learning. AI is envisioned as both a means to improve the operation of the network as well as a service that can be provided to customers. For service providers, the use of AI and machine learning has very practical use cases, including allowing them to:

- Support automatic network planning and capacity upgrades by modeling how the addition of services and capacity will impact current and future network requirements as well as the need to add switching and routing capacity to support application delivery

- Implement network changes automatically, reducing the need for manual intervention and thereby reducing the possibility of errors.

- Constantly provide detailed network monitoring at all layers and provide proactive fault location, detection, and resolution while limiting manual intervention.

- Simplify the service and application provisioning process by providing a common interface that then translates requests into desired network changes.

Finally, F5G Advanced seeks to make fixed networks more aware so that faults can be anticipated, isolated, and resolved, whether they originate in the home, the access network, or the optical transport network. Also, awareness means allocating bandwidth and setting latency based on applications being used, not just statically delivered to users. This is the concept of experience-oriented SLAs as opposed to the traditional method of service guarantees through bandwidth alone.

Key Technologies

F5G Advanced builds on the underlying technologies of F5G and includes platforms that deliver additional capacity from the transport network all the way to the home and business, are more energy efficient, are autonomous, programmable, and intent-based, are more secure, and can support end-to-end network slicing and deterministic latency.

The key networking technologies of F5G Advanced include:

- 50G PON

- Wi-Fi 7

- 800G Optical Transport Networks

The use of 50G PON, which introduces Digital Signal Processors (DSPs), is key to the overall architecture because it is viewed as a convergence technology for residential, business, and wholesale fiber networks onto a single ODN. Mobile midhaul and fronthaul applications, expanding IoT devices and services, wholesale fiber access to microcells, aggregation of Wi-Fi7 traffic in a business campus environment—all of these can, in theory, be delivered using 50G PON. Other applications and use cases are certain to emerge as operators continue to reap the benefits of converting their disparate networks onto a shared ODN, with throughput and services delivered via 50G PON.

F5G-Advanced’s Impact on the Market

It’s difficult to assess what—if any—impact F5G Advanced will have on global equipment markets. Service provider networks differ significantly, as do their competitive landscapes, which often dictate the adoption of broadband access and in-home Wi-Fi technologies. Though operators are certainly moving in the direction of all of these technologies—and have signaled their planned adoption and deployment of these technologies within the next few years, they are likely to do so at different intervals that are distinct and based on individual market dynamics.

Two technology components of F5G Advanced that will certainly see global adoption by operators are Wi-Fi 7 and 50G PON. Already, a growing list of operators has submitted RFPs for new residential and business CPE with Wi-Fi 7 support. The combination of an increase to 320 MHz of spectrum, 4096 QAM, and multi-link operation (MLO) is exactly what operators have been looking for in their customer endpoints.

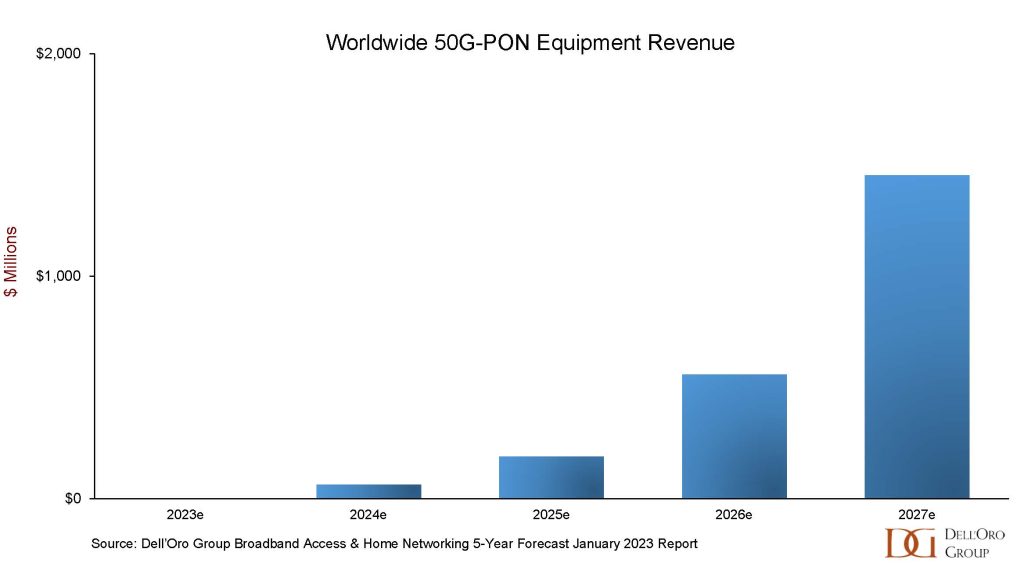

Though early, Dell’Oro Group believes total 50G-PON equipment revenue will increase from less than $3M in 2023 to $1.5B in 2027. Much more significant growth is expected from 2027 on, as operators begin to evolve their 10Gbps PON networks to next-generation technologies.

Beyond being able to anticipate future bandwidth growth coming from consumer applications such as VR, AR, online gaming, videoconferencing, and 8k video, 50G PON positions operators to address business services. Specifically, 50G PON allows a provider to offer four 10G Ethernet connections, split among multiple businesses. Additionally, 50G PON is ideal for POL (Passive Optical LAN) deployments, where fiber can be run to the desktop and deliver connectivity with less power, rack space, and less cooling than traditional point-to-point Ethernet architectures.

Similarly, 50G PON has applications in the backhaul of public Wi-Fi hotspots as well as private wireless LANs, both of which will see significant bandwidth growth with the availability and deployment of Wi-Fi 6E and Wi-Fi 7. Wi-Fi 6E allows individual subscribers to burst to 9.6Gbps while Wi-Fi 7 quadruples that throughput to nearly 40Gbps. Additionally, the Wi-Fi 7 standard defines extremely low levels of latency and jitter, which the evolving 50G PON standard is also incorporating.