[wp_tech_share]

The global upswing that began in the second half of 2018 has become deeper and stronger. Even with the higher-than-usual degree of uncertainty around the economy, we forecast that the RAN market will grow at a healthy pace over the next three years, before growth tapers off in the outer part of the forecast period, resulting in a mid-single digit CAGR between 2018 and 2022. Cumulative investments over the 2019 to 2024 period are expected to eclipse $200 B.

The global upswing that began in the second half of 2018 has become deeper and stronger. Even with the higher-than-usual degree of uncertainty around the economy, we forecast that the RAN market will grow at a healthy pace over the next three years, before growth tapers off in the outer part of the forecast period, resulting in a mid-single digit CAGR between 2018 and 2022. Cumulative investments over the 2019 to 2024 period are expected to eclipse $200 B.

The main growth drivers have not changed. They include:

(1) A rapid shift toward 5G NR for mobile broadband (MBB) applications, resulting in a condensed deployment phase;

(2) New capex to address IoT, Fixed Wireless Access (FWA), In-building, and Public Safety opportunities for both private and public deployments;

(3) The shift from passive to advanced antenna systems, which will shift capex from the antenna to the RAN market.

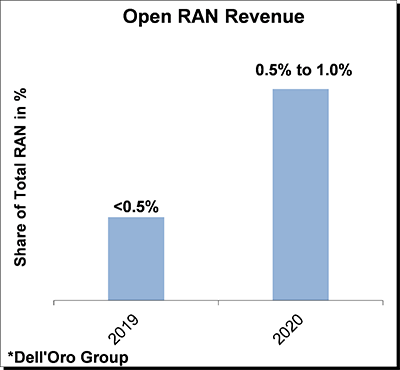

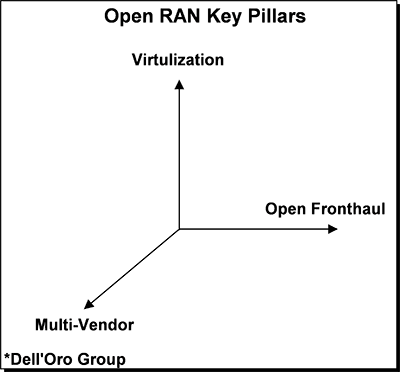

The expected impact of these growth drivers has changed. Cumulative revenue projections for the 2019 to 2024 period have been adjusted upward, reflecting more upbeat expectations in China and North America. This in combination with a more favorable outlook for FWA is expected to outweigh downward risks associated with COVID-19 and a pickup in Open RAN—we have adjusted the Open RAN projections upward, with Open RAN now approaching a double-digit share of the overall RAN capex by the outer part of the forecast period. Within the technology mix, cumulative 5G NR RAN revenues for the 2019 to 2024 period have been revised upward while the equivalent LTE capex has been adjusted downward.

Our forecast that 5G NR will be deployed at a faster pace than LTE and surpass LTE in 2021 hinges on a set of key assumptions, including:

(1) The 5G NR mid-band business case for MBB applications remains compelling;

(2) 5G mid-band spectrum will be available sooner than LTE spectrum was made available in the 3G to 4G transition;

(3) New dynamic spectrum sharing technologies will simplify and accelerate the migration from LTE to 5G NR;

(4) Initially 5G will be just another G, but long-term it will be more than another G, even if it takes time to reach the full potential of 5G;

(5) Complete 5G systems to address new use cases will be deployed gradually, at a slower pace than Sub 6 GHz MBB 5G NR.

Regional projections have been adjusted to reflect some COVID-19 related near-term slowdown in late majority MBB regions, including Europe, Latin America, parts of Asia Pacific (APAC), and parts of Middle East & Africa (MEA). While the CAGR is fairly flat in most regions, the capex envelope within the forecast period is expected to vary across the regions.

Risks are broadly balanced. The geopolitical uncertainty could trigger more government stimulus than we have currently considered to support network swaps and other forms of tax policies to improve the staying power of non-Chinese vendors.

Taking into consideration that significant changes in GDP resulted in material RAN changes with a roughly one-year lag in the 2001 and 2008 recessions, and that we are modeling 2021 to be a growth year, the baseline projections rest on the assumption that there will be some downward push over the short-term in the less advanced MBB markets. At the same time, we anticipate the upside driven by the 5G rollouts in the advanced markets will ultimately outweigh the downward adjustments, implying that the extent of the projected growth will appear disconnected from the underlying economy.

Other takeaways from the July 5-Year RAN Forecast include:

- The Millimeter Wave outlook has been revised upward driven by improved momentum in the Asia Pacific region.

- The pickup in mid-band deployments has propelled the demand for Massive MIMO. In this forecast, 5G NR Massive MIMO is projected to comprise more than half of the cumulative 5G NR capex.

- The underlying assumptions driving the regional projections remain fairly unchanged, with the APAC region being the main near-term growth vehicle.

- With more clarity about the 5G rollout plans in the North America region, we have adjusted the near-term outlook upward and now forecast the North American RAN market to continue advancing over the near-term.

- Global macro base station (BTS) shipments are projected to remain elevated between 2020 and 2022, underpinning projections that 5G activity is set for an upturn. This positive momentum will eventually slow, resulting in some softness in the outer part of the forecast period.

- The high level small cell vision has not changed. We expect unlicensed WiFi systems to coexist with cellular technologies. For upper mid-band deployments, operators will need to accelerate indoor deployments rapidly while the sub 6 GHz micro adoption phase will be more gradual.

- Since the last forecast, we have adjusted the outdoor small cell outlook upward, driven primarily by a more favorable Millimeter Wave forecast.

- Fixed Wireless Access (FWA) Radio Access Network (RAN) investments, including mobile network and dedicated fixed networks, are projected to comprise a growing share of the overall RAN capex envelope over the next five years, reflecting the size of the potential upside, various technology advancements, and improving market sentiment for both basic and high performance connectivity

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the Mobile RAN industry by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue, transceivers or RF carrier shipments, unit shipments for 5GNR, 5G NR Sub 6 GHz, 5G NR mmW, LTE, LTE FDD, LTE TDD, WCDMA, and GSM pico, micro, and macro transceiver base stations. The report also include splits for macro and non-residential small cells and Massive MIMO. Click here to learn more about the report or contact us (dgsales@delloro.com) for the full report.

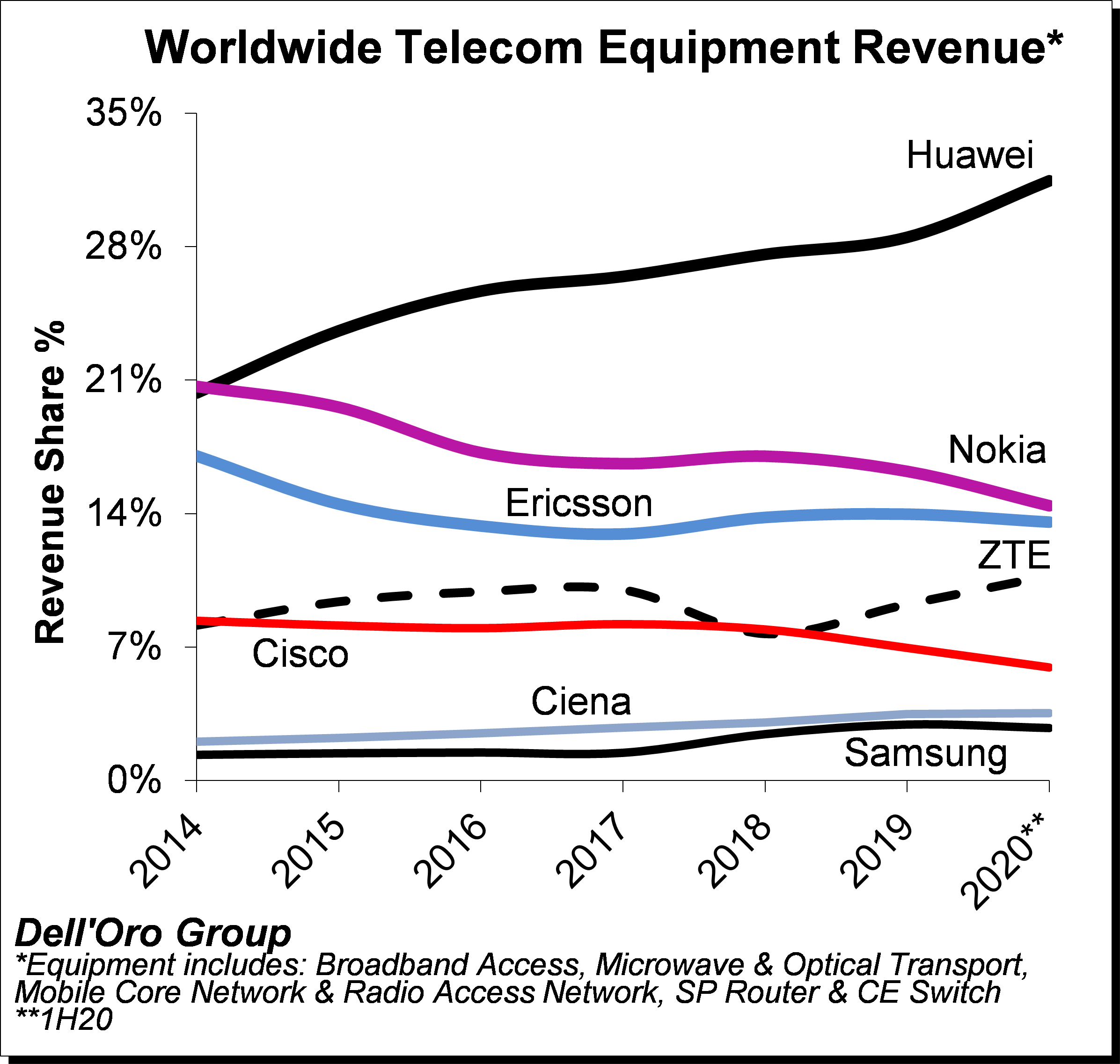

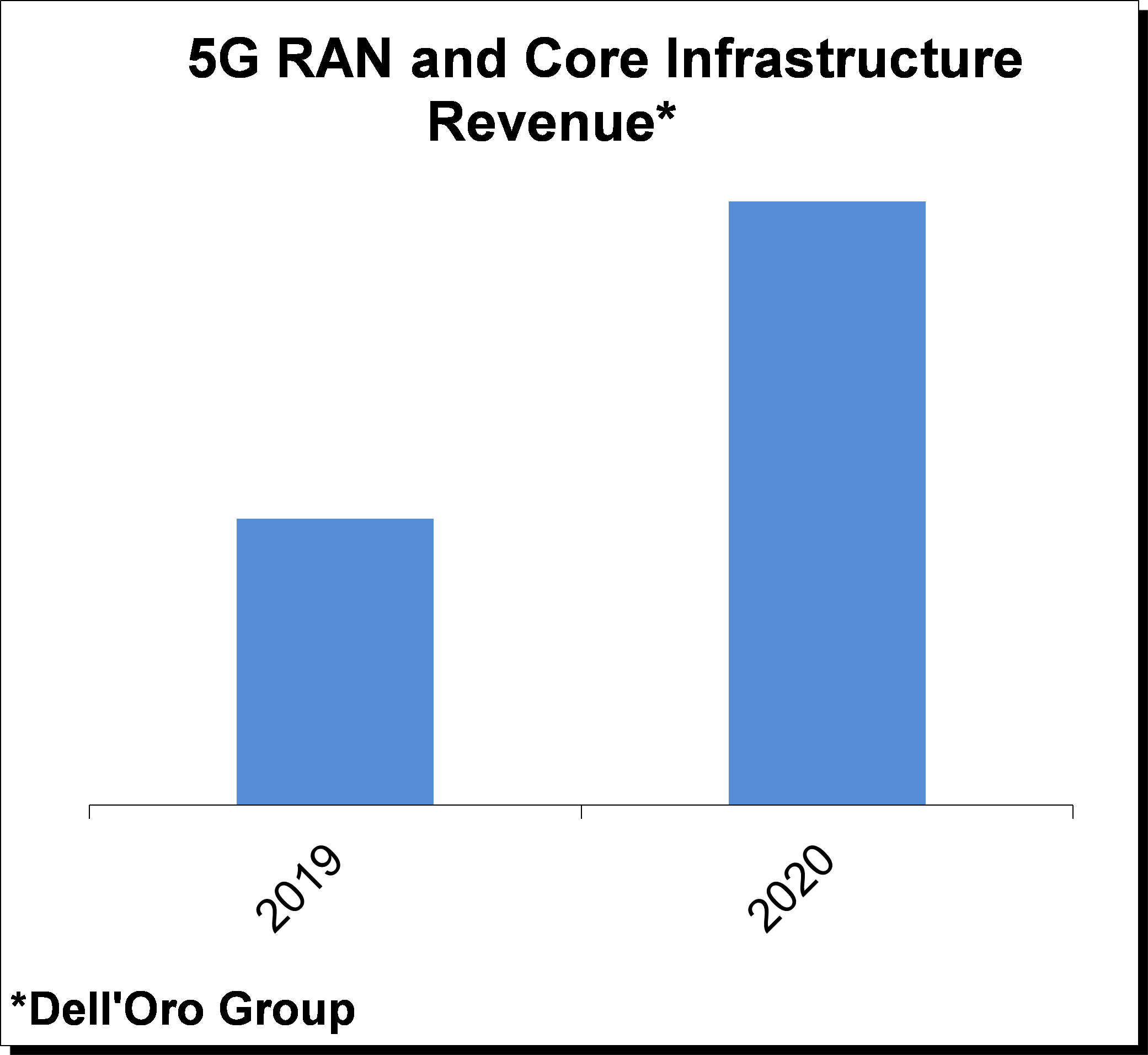

Preliminary readings suggest revenue rankings remained stable between 2019 and 1H20, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers. At the same time, revenue shares changed slightly as the Chinese suppliers benefited from large scale 5G rollouts in China.

Preliminary readings suggest revenue rankings remained stable between 2019 and 1H20, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers. At the same time, revenue shares changed slightly as the Chinese suppliers benefited from large scale 5G rollouts in China.

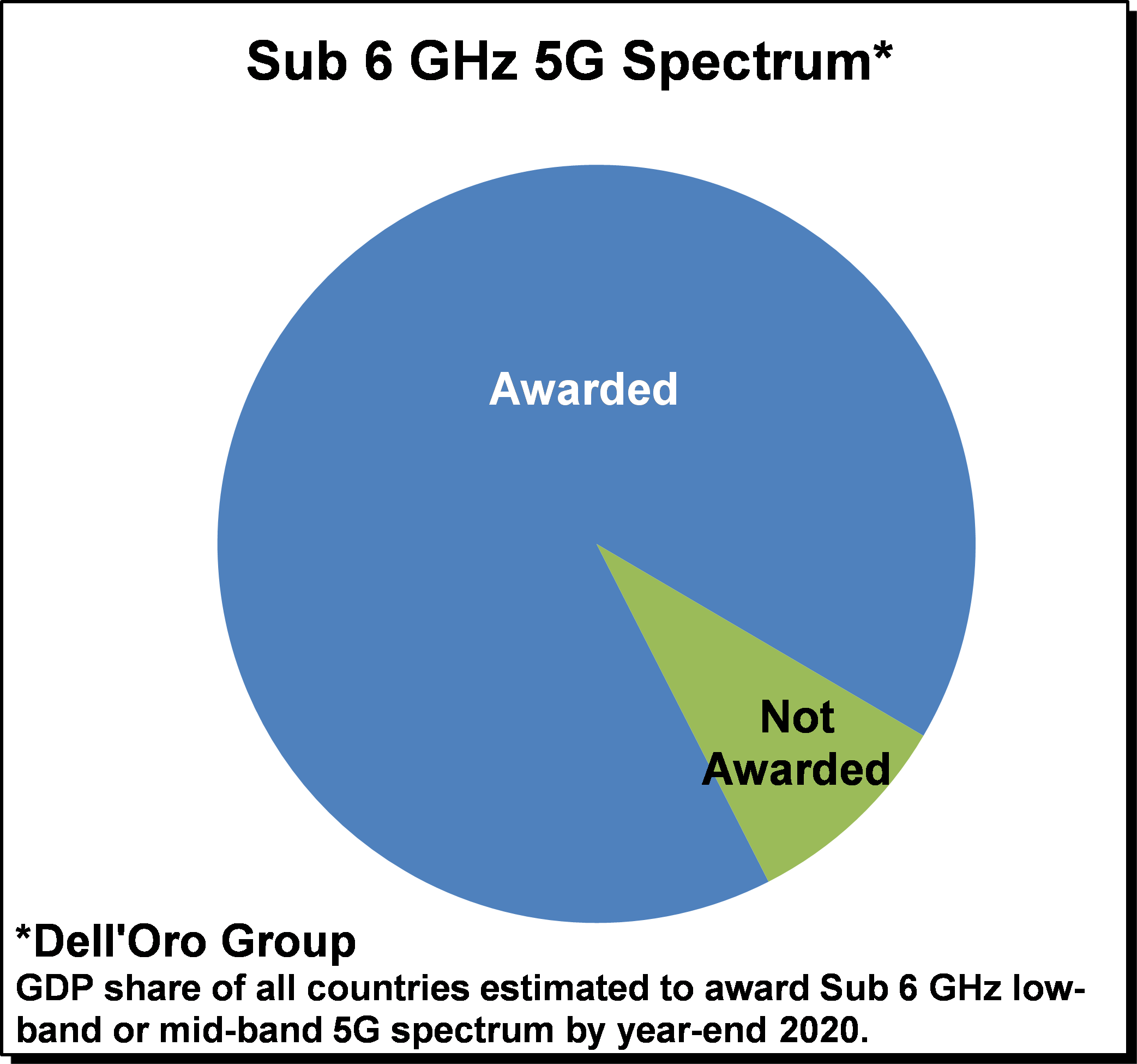

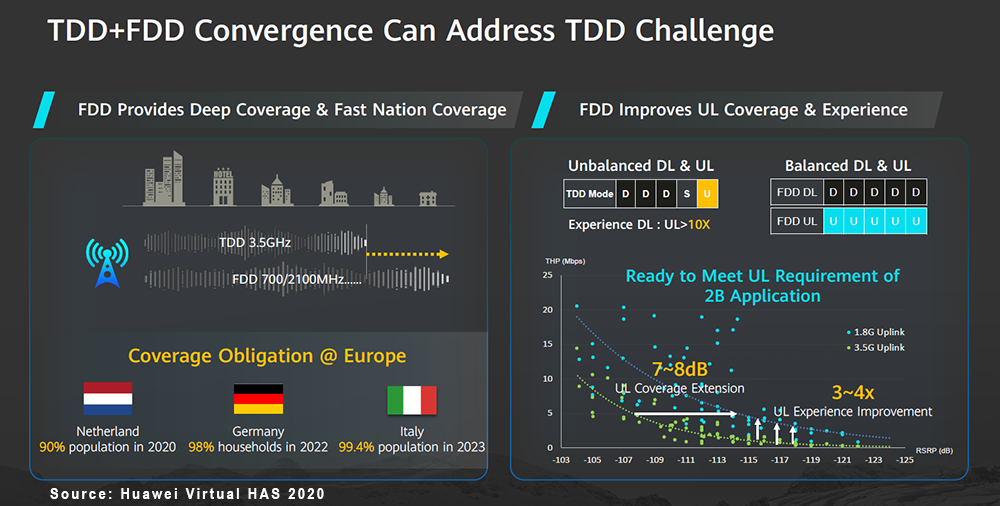

With 5G deployments now accelerating at a torrid pace and 5G NR investments projected to comprise 30% to 50% of global RAN investments in 2020 (Dell’Oro Group), operators are reassessing how to optimize their spectrum resources to capitalize on the potential business and technology benefits with 5G NR. Many countries are realizing the strategic importance of timely 5G deployments spurring governments and regulators to actively release/award 5G spectrum. Even with some minor spectrum auction delays as a result of Covid-19, countries that have auctioned or plans to award sub 6 GHz spectrum by year-end 2020 together comprise nearly 90% of worldwide GDP. At the same time, the amount of spectrum and the type of spectrum that is available varies widely across the globe, prompting operators to effectively capitalize on their respective spectrum assets to build 5G networks with optimal experience.

With 5G deployments now accelerating at a torrid pace and 5G NR investments projected to comprise 30% to 50% of global RAN investments in 2020 (Dell’Oro Group), operators are reassessing how to optimize their spectrum resources to capitalize on the potential business and technology benefits with 5G NR. Many countries are realizing the strategic importance of timely 5G deployments spurring governments and regulators to actively release/award 5G spectrum. Even with some minor spectrum auction delays as a result of Covid-19, countries that have auctioned or plans to award sub 6 GHz spectrum by year-end 2020 together comprise nearly 90% of worldwide GDP. At the same time, the amount of spectrum and the type of spectrum that is available varies widely across the globe, prompting operators to effectively capitalize on their respective spectrum assets to build 5G networks with optimal experience. One of the more compelling features with 5G in addition to the increased spectrum bandwidth that comes with the upper mid-band and the mmW spectrum is the fact that 5G NR offers spectral efficiency improvements on a like for like basis relative to LTE, implying that operators and eventually enterprises can take advantage of these efficiency benefits regardless of their current spectrum portfolio. And in contrast to previous mobile technology transitions, new technologies such as dynamic spectrum sharing, dual connectivity and carrier aggregation across multiple technologies will provide the necessary tools to simplify and accelerate the migration from LTE to 5G NR. This improved flexibility taken together with the efficiency and performance upside with 5G NR plays an important role in the improved market sentiment that has characterized the RAN market in this initial 5G mobile broadband (MBB) deployment phase. While having the right mix of spectrum remains extremely important, the relatively seamless transition enables operators to put parts of the spectrum to use today. It does not matter if the spectrum is optimized for coverage or better suited for capacity or if an operator has a non-ideal portfolio mix of low-band, mid-band, or high-band spectrum. With 5G, operators now have the tools to capitalize on the benefits with the respective bands and put together a roadmap that migrates the portfolio in various phases from legacy 2G-4G to 5G NR.

One of the more compelling features with 5G in addition to the increased spectrum bandwidth that comes with the upper mid-band and the mmW spectrum is the fact that 5G NR offers spectral efficiency improvements on a like for like basis relative to LTE, implying that operators and eventually enterprises can take advantage of these efficiency benefits regardless of their current spectrum portfolio. And in contrast to previous mobile technology transitions, new technologies such as dynamic spectrum sharing, dual connectivity and carrier aggregation across multiple technologies will provide the necessary tools to simplify and accelerate the migration from LTE to 5G NR. This improved flexibility taken together with the efficiency and performance upside with 5G NR plays an important role in the improved market sentiment that has characterized the RAN market in this initial 5G mobile broadband (MBB) deployment phase. While having the right mix of spectrum remains extremely important, the relatively seamless transition enables operators to put parts of the spectrum to use today. It does not matter if the spectrum is optimized for coverage or better suited for capacity or if an operator has a non-ideal portfolio mix of low-band, mid-band, or high-band spectrum. With 5G, operators now have the tools to capitalize on the benefits with the respective bands and put together a roadmap that migrates the portfolio in various phases from legacy 2G-4G to 5G NR.

Given that there is a strong correlation between network services requirements and mobile broadband investments for the more simplified site deployments, this on-going shift towards multi technology sites including both legacy technologies and more complicated 5G solutions that could involve dynamic spectrum sharing and beamforming addressing a wider scope of use cases spanning across potentially multiple industries in combination with the increased site complexity and the need to focus on energy optimization will accelerate the shift towards more intelligent planning/design, operations and predictive analysis.

Given that there is a strong correlation between network services requirements and mobile broadband investments for the more simplified site deployments, this on-going shift towards multi technology sites including both legacy technologies and more complicated 5G solutions that could involve dynamic spectrum sharing and beamforming addressing a wider scope of use cases spanning across potentially multiple industries in combination with the increased site complexity and the need to focus on energy optimization will accelerate the shift towards more intelligent planning/design, operations and predictive analysis.