The blog is about my insight on the global small cells market, challenges and the changing ecosystem I shared with SCWS 2018.

Q: How has the global small cells market changed in the last 6-12 months and what are your predictions for the next 6 months?

While the overall mobile infrastructure market recorded a third consecutive year of declining revenues in 2017, the global upswing in small cell activity is strengthening and continues to be one of the bright spots. Preliminary data suggest that small cell unit shipments advanced 70% to 80% in 2017 – now accounting for 5% to 10% of the total radio access network (RAN) market.

More importantly, the 10x to 15x growth over the past four years is slightly greater than we originally anticipated, and we have revised our near-term projections upward. The results during 1Q18 were encouraging both from an indoor and outdoor perspective and support our previously communicated thesis that small cells will play an increasingly important role in the ongoing shift from coverage to capacity.

Q: What factors are driving this?

The majority of the small cell deployments to date have actually been to address coverage holes. This is one of the reasons it has been so difficult to predict the development of small cells simply because it has not been possible to model the uptake based on data traffic trends. But over the past 6 to 9 months, the ratio between coverage and capacity deployments started changing and operators are increasingly turning to small cells to address capacity shortages, reflecting to some degree the robust adoption of larger data buckets and increased utilization on the macros.

In addition, the demand is spreading and it is no longer only China and the APAC region driving the market. Positive developments in both Europe and the U.S. are also contributing to the improved outlook.

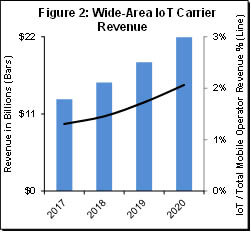

While consumer enabled voice and data traffic for mobile applications continue to characterize the lion share of the small-cell capex, investments in new verticals including IoT, public safety, and FWA are expected to grow both over the near-term and long-term.

Q: What are the main challenges preventing wide-spread roll out of small cells and connectivity solutions?

The three primary small cell challenges include 1) the business case cannot always be justified, 2) deploying small cells is different than deploying macro cells. It will take time for all the responsible parties and ecosystems to adapt to address a vastly different deployment model, and 3) the ownership model has to change to cross the chasm in the enterprise and stimulate private deployments. Regulators need to think differently about how they allocate and auction spectrum.

Q: How has the provider and supplier ecosystem changed in the last 6-12 months?

The original small cell vision had two key objectives. First, small cell deployments would scale materially. Second, the proliferation of small cells would lower the barrier-to-entry for new entrants.

It is fair to conclude today that the industry has so far only met the first of the two objectives. Small cell deployments are growing rapidly, but the small cell vendor landscape and share positions clearly show that new entrants have failed to shake up the RAN landscape – per our 1Q18 RAN report, the top 5 macro RAN vendors account for around 90% of the non-residential small cell market.

The primary change over the past 6-12 months is that new entrants are slowly coming to life again. But what is interesting is that it is not LTE-A or 5G fueling the renewed interest in small cells, instead it is the CBRS spectrum. One of the more compelling propositions relating to the CBRS band is that if implemented correctly, CBRS can lower the barrier-to-entry and provide opportunities for a wide range of participants to operate a public or private cellular network.

Dell’Oro Group has identified more than 23 vendors that have announced or plan to introduce CBRS small cell products, and the list is growing as we speak…

Q: Why are events like SCWS World so important to the industry?

SCWS is a great event to keep current on all the latest trends, meet all the key players, and discuss the most pressing issues the industry is facing over the next couple of years.

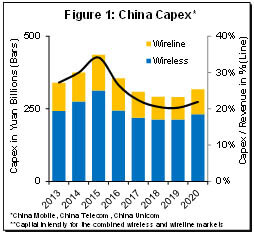

ave adjusted our overall three-year capex expectations upward to reflect a more optimistic investment view than we had originally envisioned in both the US and Chinese markets (Figure 1). Worldwide capex growth is now expected to increase at a compound annual growth rate (CAGR) of one percent in constant currency terms between 2017 and 2020.

ave adjusted our overall three-year capex expectations upward to reflect a more optimistic investment view than we had originally envisioned in both the US and Chinese markets (Figure 1). Worldwide capex growth is now expected to increase at a compound annual growth rate (CAGR) of one percent in constant currency terms between 2017 and 2020. flat between 2017 and 2020. The forecast assumes that operators will struggle to identify new revenue streams, so as to offset slower smartphone revenue growth.

flat between 2017 and 2020. The forecast assumes that operators will struggle to identify new revenue streams, so as to offset slower smartphone revenue growth.