According to many operators around the world with cable, DSL, and fibre broadband networks, upstream peak traffic growth throughout 2020 increased more than 50 percent, while downstream peak traffic growth increased 30 percent… Although the world is gradually returning to normal, with teleworkers moving slowly back into their offices, there is simply no turning back now for broadband subscribers who either upgraded or switched to an FTTH service.

The global demand for broadband service has resulted in an acceleration of interest among fixed and mobile operators alike to either expand their existing LTE or point-to-multipoint fixed wireless offerings or roll out early 5G services to a growing base of current and potential subscribers. In both mature and emerging markets, there has been a tremendous increase in the number of RFPs for equipment and software to support large-scale 5G fixed wireless service deployments. Clearly, service providers are looking to strike while the iron is hot, securing subscribers who need broadband now, while also taking advantage of growing government subsidization of broadband service rollouts.

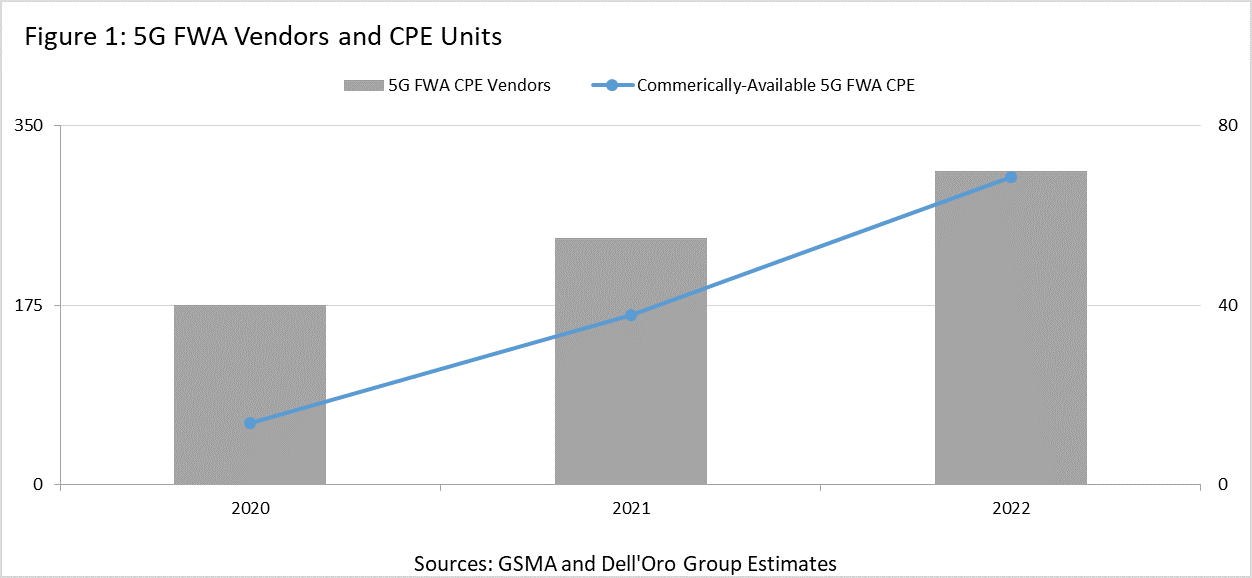

The vendor ecosystem supporting 5G fixed wireless has naturally increased, particularly in the area of dedicated CPE. According to the GSA (Global mobile Suppliers Association), there are currently over 130 FWA CPE devices (both indoor and outdoor) that have been announced by a growing list of vendors, which now numbers above 50. Over 50 of these dedicated CPE are now commercially available, which is up from 15 commercially-available units just one year ago. By the end of 2021, we expect that the number of commercially-available devices will exceed 100 and will double in 2022. The number of vendors producing or planning to produce 5G FWA CPE already exceeds the number of suppliers of 4G FWA CPE.

The increase in available units, which corresponds with the perceived addressable market of 5G network deployments and subscriber uptake, combined with the rapid uptake of 5G-capable smartphones will help to push the cost of both indoor and outdoor 5G FWA units down to levels that satisfy the business case requirements of operators globally. In particular, operators in emerging markets where ARPU levels are typically low, cost-reduced CPE are an absolutely critical requirement to ensuring a faster ROI.

The larger the addressable market, the more willing component suppliers will be to forward-price to capture a larger share of that growing market. The resulting price reductions in components begets wider availability of finished CPE. It becomes an iterative cycle that benefits the entire supply chain and the network operators as end purchasers.

Quick Ramp of 5G FWA Devices Expected

At the end of 2020, we estimate that there are nearly 60M fixed wireless subscribers globally. A large percentage of these subscribers use 4G LTE networks, though there are also subscribers using 3G networks, proprietary point-to-multipoint services, as well as some using early 5G technologies, including sub-6Ghz and millimeter wave. We estimate that the 5G subscribers are around 1 million currently. However, we expect that those subscriber numbers are set to double in 2021, as operators such as T-Mobile (USA), AT&T, Verizon, Bell Canada, Saudi Telecom, Rain (South Africa), Swisscom, Deutsche Telekom, Optus, and others introduce or expand 5G FWA services this year.

With those operator commitments already in place, we estimate that the total number of 5G FWA devices shipping to operators this year will easily exceed 3 million units and could push 4 million units. The vast majority of these units will be to support sub-6Ghz service offerings, though we also expect to see millimeter wave units, as some operators use a combination of those technologies to provide both extensive coverage and fiber-like speeds in areas where the competition from fixed broadband providers is more intense. Overall, however, we expect volumes first from sub-6GHz units this year and into next year, followed by increasing volumes of millimeter wave units beginning in the latter part of 2022 and into 2023.

We also anticipate that the vast majority of 5G FWA deployments will rely on indoor gateways that combine a 5G modem with a WiFi 6 access point for signal distribution within the home. Many of these gateways will also be mesh-capable and will be paired with satellite units to blanket homes with WiFi coverage and to eliminate dead spots within the home.

There will be situations where outdoor units will be required, particularly in the case of millimeter wave deployments which require line of sight because of the high-frequency ranges being used. But even in the case of sub-6Ghz 5G FWA deployments, outdoor units will be required when homes or apartments have very thick-paned windows or are located in LEED (Leadership in Energy and Environmental Design) buildings.

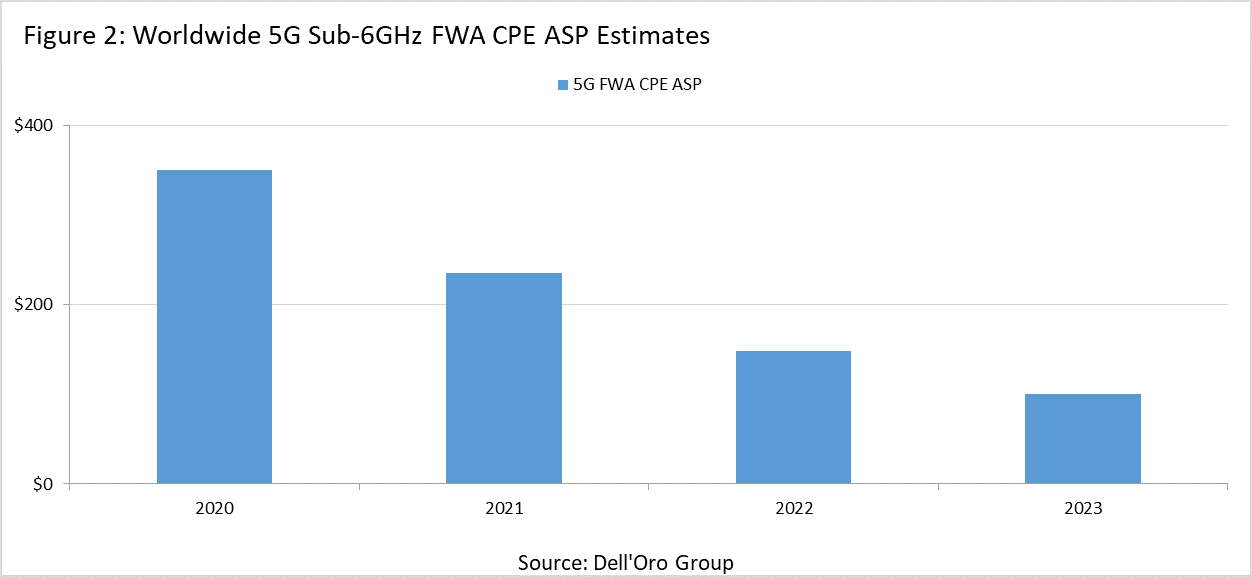

With this growing clarity around deployment models and device types, we expect that the costs of 5G FWA CPE will decline throughout this year and next, providing a catalyst for much larger, global deployments of the service through 2022 and beyond. We believe that the average cost for an indoor 5G FWA CPE supporting sub-6GHz frequency bands will decline from around $350 in 2020 to around $100 by the end of 2023 (Figure 2).

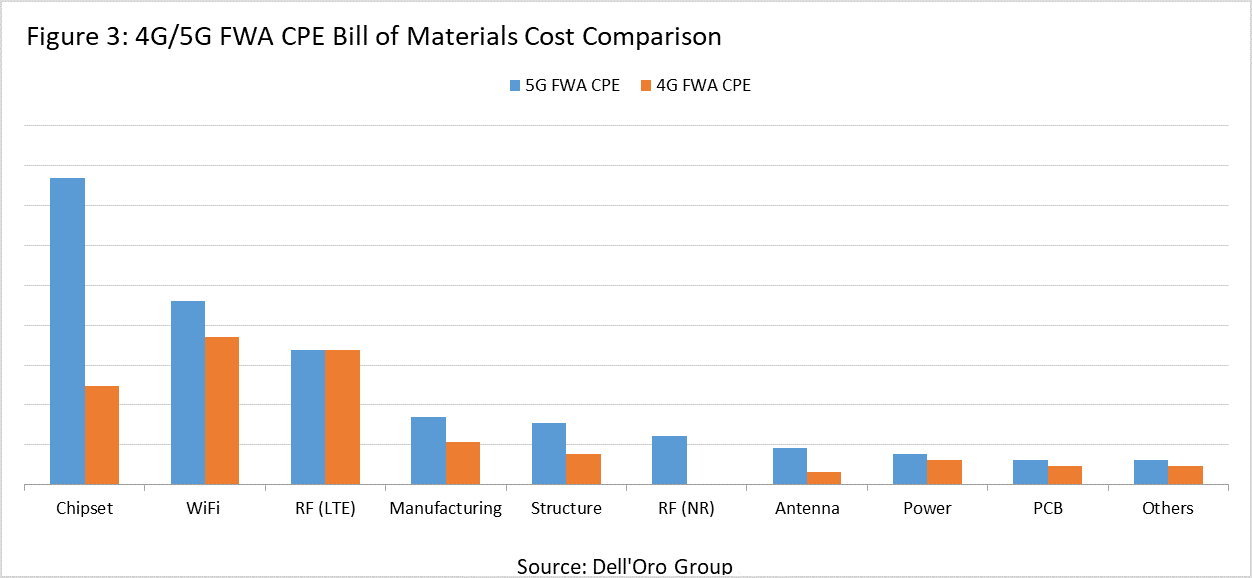

5G chipsets will see the biggest price declines, helped in large part by increasing volumes of 5G smartphones, but also by a growing ecosystem of 5G modems, gateways, tablets, cars, and other products reliant on 5G networks for WAN connectivity. Currently, 5G SoCs are roughly 4x the cost of 4G SoCs. But we have seen this played out before in the early stages of 4G network and device rollouts when the cost of chips dropped quickly as device volumes increased.

Similarly, the cost of WiFi 6 chips remains about 15-20% higher than WiFi 5 units. While WiFi 6 will be the primary technology for mature, highly competitive markets, WiFi 5 will remain an important option for very price-sensitive markets, particularly those in developing countries and in rural markets where competition comes from lower-cost services. But as enterprise and higher-end residential gateways are built with WiFi 6 technology, the cost of those chips will decline significantly over the next couple of years.

Beyond these two major components, manufacturing costs will also decline as equipment and contract manufacturers increase volumes based on initial board and hardware designs. FWA gateway designs, like higher-end residential WiFi access point designs, are well-understood at this point. However, with any new product spin, there is a learning curve for the manufacturers. Though the cost of producing the first few thousand units is high, the costs quickly decrease as the manufacturing process becomes clearly defined and as new iterations of the devices incorporate lower-cost components.

There are two critical components for the steady reduction in cost for 5G FWA CPE: Increased orders and volumes from service providers, along with the cooperation among providers of 4G CPE devices and 5G units to understand how to bring down the costs as quickly as possible. This cooperation will be necessary to stimulate interest among service providers, who can then drive the volumes necessary to improve the overall economics of delivering 5G fixed wireless services.

5G FWA Will Build on 4G Deployments

Though the deployment of FWA services using 4G LTE networks has been moderately successful around the world, 5G will dramatically boost the addressable market of subscribers, as well as the service’s ability to reasonably compete with most fixed broadband technologies. 5G can comfortably deliver downstream speeds that compare favorably with VDSL and DOCSIS 3.0 services while easily beating previous generations of both fixed technologies. More importantly, C-band and millimeter wave technologies promise to be comparable with DOCSIS 3.1 and fiber services, thereby expanding the addressable market of subscribers even further.

Mobile operators around the world who have previously been unable to compete with fixed broadband providers, as well as fixed broadband providers looking to expand the reach of their services more quickly, are all enthusiastic about the opportunity in front of them with FWA. Their growing commitment to the service, as well as a rapidly expanding vendor ecosystem for customer devices, will help to quickly reduce the cost of those devices, thereby ensuring a faster ROI for service providers and a willingness to expand their reach even further.

Dell’Oro Group published an update to the Broadband Access and Home Networking 5-Year Forecast report in July 2021

Continued Subscriber Growth and Bandwidth Consumption Remain Key Catalysts

Global spending on broadband access equipment and CPE is expected to have a 3% CAGR from 2020-2025, which is a solid increase from a 0% CAGR in our January 2021 5-Year forecast edition. The combination of continued residential subscriber growth and increased capacity utilization rates noted by global broadband providers will more than offset the negative impacts of component shortages and labor limitations.

Broadband subscriber additions continue to grow at a furious pace around the world, as the Delta variant continues to limit the return of employees to their offices and has extended hybrid learning environments for students. Even if subscriber growth does slow later this year, broadband penetration rates and the total addressable market for broadband service providers have expanded significantly over the last year. Subscriber growth has also resulted in improved revenue and gross margins for service providers. As a result, providers are pulling forward some of their upgrade projects, including those involving the transition from copper to fiber.

The spending slump we had expected to see in 2021 after the increased investment levels of 2020 is not going to materialize. In fact, spending will continue to grow this year as operators deal with continued subscribers additions, as well as competitors increasing their investments in fiber, HFC, and fixed wireless networks.

PON Equipment Spending Expected to Remain Solid

Our five-year CAGR for PON equipment has been increased yet again to 5% from 3%. China, which has historically accounted for anywhere from 65-80% of total PON spending, has peaked in terms of total ONT units consumed on an annual basis. The Chinese FTTH market has matured, with broadband penetration in the country reportedly nearing 80%. Though subscriber growth is slowing, there is still a tremendous installed base of subscribers that will continue to require new ONTs.

Although China’s ONT volumes are coming down from the peak years of 2017 and 2018, additional growth is expected from the rest of the world—particularly North America and Western Europe. In North America, the FCC’s $20B RDOF (Rural Digital Opportunity Fund) program will help transition a significant number of rural areas to fiber over the next 5-7 years. In Western Europe, major operators including Orange, DT, BT OpenReach, and Proximus are all expanding their fiber rollouts and even moving quickly to XGS-PON for symmetric 10 G services.

Finally, in Asia, India, Indonesia, and Malaysia, along with a 10 G upgrade cycle in Japan and South Korea should also help sustain the market.

Cable Infrastructure Spending Set for Growth

The glut of DOCSIS channel capacity that helped push down cable equipment revenue in 2018 and 2019 was actually beneficial to operators in 2020 as they were able to address significant increases in both upstream and downstream traffic during the pandemic with minimal increases in spending. In most cases, cable operators used the software tools available as part of DOCSIS 3.1 to ensure adequate bandwidth for all subscribers. In other cases, operators purchased additional DOCSIS licenses as part of accelerated node split programs to address systems with the greatest need.

Regardless, after two years of under-investing in infrastructure, the overall cable infrastructure market will see a steady increase in revenue throughout our forecast period, as mid- and high-split projects in North America and Western Europe, designed to increase upstream capacity, are accelerated. Investments in outside plant equipment, particularly new amplifiers and taps, will also continue as operators begin the multi-year process of preparing their networks for DOCSIS 4.0 and its ability to enable extended-spectrum DOCSIS (ESD), low-latency DOCSIS, and full-duplex DOCSIS (FDD).

About the ReportThe Dell’Oro Group Broadband Access and Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for Cable, DSL, and PON equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, and PON), along with SOHO WLAN Equipment, including Mesh Routers. For more information about the report, please contact dgsales@delloro.com. |

|

Back in September 2020, CableLabs released the specifications for Flexible MAC Architecture (FMA). FMA defines the disaggregation of the CCAP into separate management, control, and data planes. Essentially, it is the next step in the evolution that was started years ago with M-CMTS architectures, followed by the move to DAA and Remote PHY, specifically. FMA expands the disaggregation of a traditional integrated CCAP platform into a combination of DAA, SDN, and NFV.

More importantly, it gives cable operators the flexibility they desperately need as they navigate how to prioritize current capacity upgrades through traditional node splits, mid-and high-splits, upcoming outside plant upgrades to 1.2Ghz and 1.8GHz, as well as determining whether their future access network relies on DOCSIS 4.0, fiber-to-the-home, or a combination of the two. FMA gives cable operators the flexibility to deliver Low Latency DOCSIS (LLD) as well as Mobile xHaul over DOCSIS, as well as far more flexibility in how they architect their CIN (Converged Interconnect Networks) with external switching elements that give them the ability to scale their interconnect networks more easily than ever before.

Finally, FMA opens the door to the true virtualization of cable access networks, supporting any number of use cases and any number of physical layer connections through the same disaggregated network functions, which can be placed in any physical location—node, hub site, headend, super headend, or data center. When cable operators faced a significant ramp in upstream bandwidth consumption in the early weeks of the COVID-19 pandemic, some had a difficult time being able to support that growth without the traditional tools of node splitting and increasing DOCSIS channels through the addition of CCAP line cards or new CCAP chassis in instances where current CCAP platforms are already maxed out. With FMA, operators have the ability to scale far more quickly, adding CPU cycles quickly to match the increase in service groups and bandwidth.

Vendor Interoperability a Key Tenet

The disaggregation of the traditional CCAP into multiple, discrete network functions allows for cable operators to mix and match those functions supplied by different vendors—similar to Open RAN architectures for mobile networks. For example, one vendor can provide the MAC manager function, another can provide the PacketCable aggregator, while multiple vendors can supply RPDs, RMDs, and OLTs. Again, the idea is to provide an evolution of the current generation of virtual CCAP platforms, completely disaggregated to match the operator’s use cases, business case, and overall architectural goals.

Vendors who have been providing virtual CCAP solutions to the market would appear to have a leg up on their competition, having gone through the paces of real-world deployments with all their challenges and variables. The disaggregated CCAP envisioned by the FMA specification clearly requires more than just taking existing CCAP software and porting it onto individual servers. It requires further disaggregation into discrete functions, such as a MAC manager, DOCSIS controller, video core, and out-of-band (OOB) controller. That effort takes time and a thorough understanding of docker containers, Kubernetes, and other microservice technologies and standards.

The focus on disaggregation also opens the door to new vendors and new approaches to architecting cable access and back-end management networks, just as remote PHY and remote MACPHY architectures did. For example, the video-core function could be handled by traditional CCAP vendors, or it could become a spin-off product for those suppliers focused on middleware, conditional access (CA), or video processing platforms. Video processing itself has become a largely software-based market. Whether a cable operator continues to deliver QAM-based broadcast video or shifts their focus to IP-based multicast video, the need for a flexible video core as part of FMA is critical.

Of course, the biggest question when it comes to disaggregated, virtualized implementations of core network functions is just how much vendor diversity operators are comfortable with. As data center technologies and principles have permeated telco networks, there has been a lot of open discussion about how vendor diversity benefits operators in areas such as supply-chain redundancy, release cycle acceleration, and, of course, lower prices due to more competitive bidding. But the reality has been a bit more conservative, with operators selecting specific areas of their network (metro edge) or platforms (BNG) to open up, rather than more wholesale changes. That is completely understandable, given the decades-long reliance on specific vendor and technology partnerships operators have had.

Cable operators tend to take conservative approaches to technology upgrades in an effort to avoid massive capex outlays that might disrupt the present mode of operation. And this approach, for the most part, has been incredibly successful—especially when it comes to broadband. But with their primary competitors finally making a wholesale shift away from copper and towards fiber, there is justifiable concern that the conservative approach might leave them at a competitive disadvantage that moderate upgrades to HFC just can’t overcome.

Thus, the timing of the FMA specification and its focus on disaggregation of core access network platforms into discrete VNFs along with the emphasis on supporting multiple physical layer technologies (HFC, PON, wireless, etc.) couldn’t be better.

Hyperscaler Partnerships

Beyond an increase in the vendor ecosystem, the other possible by-product of FMA is a move by hyperscalers to partner with cable operators by either hosting elements of their FMA architectures in the public cloud or offering a completely hosted solution for operators who might be looking to outsource that portion of their network.

Hyperscalers are extremely adept and efficient at providing low-cost workloads and CPU cycles. They have proven their ability to do so with hosted video processing functions for OTT providers and broadcasters. So, why not attempt to do so with broadband services on platforms that are disaggregated and virtualized?

Of course, there is no evidence that any cable operator is actively seeking this type of solution or partnership. And it remains to be seen whether any operator would even consider outsourcing any portion of what has become their most important and profitable service.

Yet, cable operators also have a significant investment cycle ahead of them—whether it’s DOCSIS 4.0 or FTTH. Additionally, many of the larger operators continue down the path of consolidating their headends to reduce their real estate footprint and costs, as well as their operational costs. Offloading workloads to a hyperscaler partner could help them expedite additional headend consolidation efforts and further reduce operational costs.

Whether cable operators pursue these partnerships or not and whether they pursue true, multi-service access networks, the technology underlying these possibilities is FMA. As the FMA standard evolves and as vendors and operators begin to introduce products into their networks, it will be interesting to watch the new use cases—and possible partnerships—that develop.

Back in April, I wrote about the widening gap between the demand for new FTTH network buildouts and connections and the ability of equipment vendors to supply those network buildouts as well as the ability for network operators to find the necessary labor to complete those buildouts.

This discrepancy between supply and demand is in danger of increasing further based on pending and proposed funding and subsidization initiatives, which could total up to $16B in 2022, then gradually declining to $12B in 2025 as programs are phased out.

Adding more fuel to the fire has been the announcements in recent weeks by operators making strategic decisions to prioritize the expansion of their FTTH network buildouts to pass more homes in a shorter amount of time. In just the last three weeks, here is a quick summary of public announcements made by operators all planning to expand the reach of their fiber broadband services:

- AT&T announced that it was planning to more than double its fiber footprint to 30 million customer locations by the end of 2025 after it spun off its WarnerMedia unit in a combination with Discovery.

- Alaska’s GCI Communications announced that it will deliver 2Gig speeds to 77% of Alaskans in 2022 and that it will also provide 10Gig speeds in the next five years.

- TDS Telecom detailed plans to add more than 300k fiber locations by 2024, with 150k of those coming in 2021 alone

- Windstream revealed its plan to hire 1,000 new workers beginning in the fourth quarter of 2021 to support its five-year, $2B fiber expansion project, which would expand gigabit fiber services to 2 million locations by 2025.

These announcements follow others made in 2020, including Consolidated Communications detailing its plan to add 1.6 million new fiber passings in five years, with 300k of those being added in 2021.

Of course, these public announcements are a mere sampling of the substantial investments being made in FTTH network expansions throughout the United States both in 2021 and throughout the next five years. RDOF (Rural Digital Opportunity Fund), CARES (Coronavirus Aid Relief and Economic Security Act) and ARPA (American Rescue Plan Act) funds will go to further subsidize additional fiber projects in rural and underserved areas, as state legislatures prioritize the expansion of fiber broadband in the wake of the COVID-19 pandemic which highlighted the absolute for connectivity throughout their communities.

The concern for operators now suddenly ready to ditch their aging copper infrastructure and finally compete with cable operators who now hold a near-monopoly on fixed broadband subscribers is that supply chain and labor shortages will extend their fiber buildouts well beyond their announced target dates. Already, we are hearing anecdotally about the difficulty in hiring skilled workers in the fields of professional services and installation, as well as growing lead times for fiber, conduit, and ONTs. Also, equipment vendor backlogs are increasing at a rapid clip, as the gap between customer orders and finished goods they can ship for revenue widens.

The net result is that many of these fiber projects will take considerably longer to complete than the five-year deadlines the operators have set for themselves. Given some of the latest signals on inflation in the US, that might not be such a bad thing. Infrastructure projects such as these tend to ensure a sustained source of job creation over the course of multiple years, as opposed to a direct stimulus investment.

Even if project completion dates are pushed out due to supply chain and labor shortages, one possible outcome of this extensive and sustained fiber push is a similar switch to more fiber deployments by US cable operators. Though the larger operators have already signaled their intention to continue using HFC DOCSIS as their primary residential technology, with DOCSIS 4.0 as the next step that will get them to near-symmetric, multi-gigabit speeds, other smaller operators are moving more towards fiber. These operators talk about the fact that moving to a passive architecture in the outside plant and away from powered amplifiers helps them from an opex perspective.

DOCSIS 4.0 already represents a fork in the road, with operators having a choice between Extended Spectrum DOCSIS and Full-Duplex DOCSIS. But, if the competition from fiber providers ramps up faster than the availability of DOCSIS 4.0 equipment, there could be another fork in the road for multi-system operators (MSOs): A future based on DOCSIS or one on fiber. We have heard anecdotally that, where fiber providers have entered a broadband market previously dominated by a cable operator and have successfully stolen away a high percentage of broadband customers, the MSO has been forced to quickly do a node split to boost speeds. That will work in some systems and with certain subscriber bases, but it will fall short, especially when service is marketed as “True Fiber” and the other as just “Fiber-Like.”