[wp_tech_share]

The combination of Industry 4.0/Smart Factories and 5G represents a promising growth opportunity and value creator for suppliers and operators looking beyond the tepid growth typically associated with the consumer 5G MBB market. Fueled by the vision that 5G has a growing role to play in the Factory of the Future, 5G manufacturing expectations are rising. And even though manufacturing comprises a significant share of the current ~10 K 5G B2B projects globally, commercial 5G RAN investments targeting the manufacturing vertical are still tracking behind schedule. In this blog, we will review the cellular manufacturing opportunity, the benefits with private 5G, and potential 5G use cases. We will also review progress with some of the early 5G manufacturing adopters.

The Manufacturing Opportunity

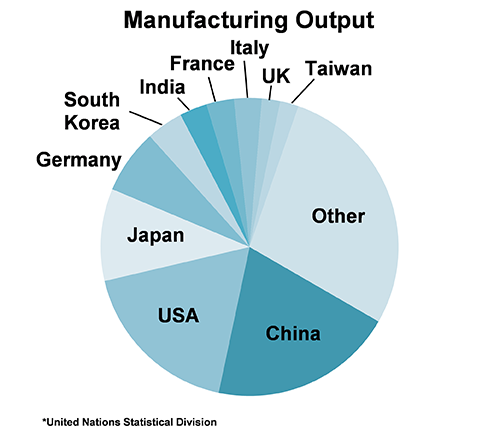

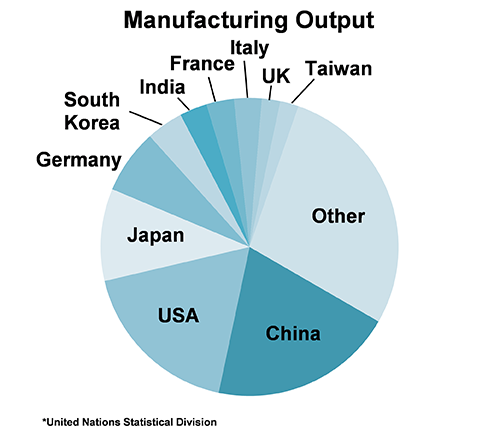

One of the more compelling aspects of the manufacturing vertical is that this market is quite large. According to the World Bank, manufacturing accounted for 16% of global GDP in 2020. A fairly concentrated industry, from a regional perspective, China, the US, and Japan generate nearly half of global manufacturing output.

In addition, the manufacturing sector is transforming rapidly, as new technologies are introduced to manage changing consumer demands and external risks, including supply chain disruptions and skillset shortages.

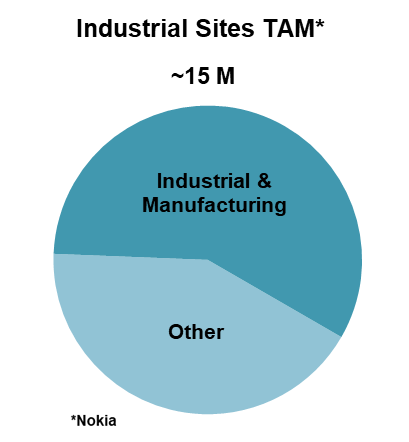

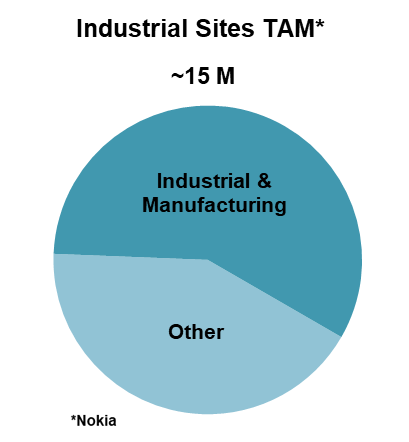

While premium cellular connectivity will not make sense in all manufacturing locations, Nokia estimates approximately 10 M industrial & manufacturing sites globally that could potentially benefit from using mobile technologies.

Huawei is even more optimistic. This vendor has endorsed a report estimating that 5G could unlock $740 B of value in manufacturing by 2030, adding nearly one percent to global GDP.

Ericsson is also excited about the potential productivity and efficiency gains with 5G. The company’s “5G for business” report predicts that manufacturing will make up a fourth of the incremental $700 B opportunity for communications service providers (CSPs) by 2030.

According to ZTE’s most recent analyst update, the vendor sees the enterprise opportunity as an important growth vehicle that can offset the more tepid growth typically associated with the CSPs.

Not surprisingly, operators are also enthusiastic about the upside with the manufacturing vertical. China Unicom is expecting that manufacturing will comprise around 28% of the economic value of the 5G verticals by 2035, underpinned by healthy growth in a wide range of manufacturing verticals.

More importantly, 86% of manufacturing executives say they believe that smart initiatives, such as improved connectivity using private mobile technologies, will play an important role over the next five years (Deloitte).

Why Use 5G in Manufacturing?

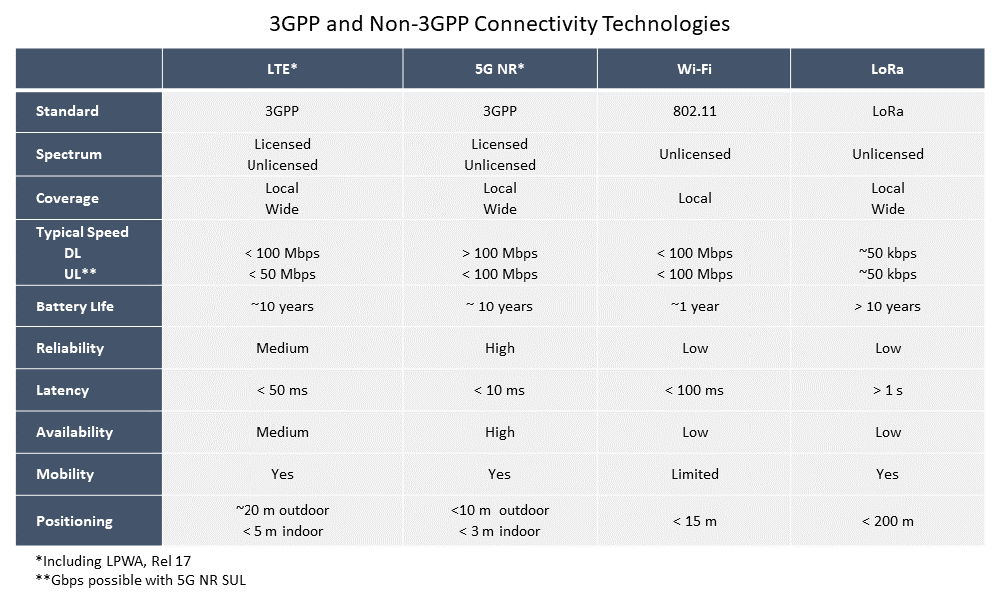

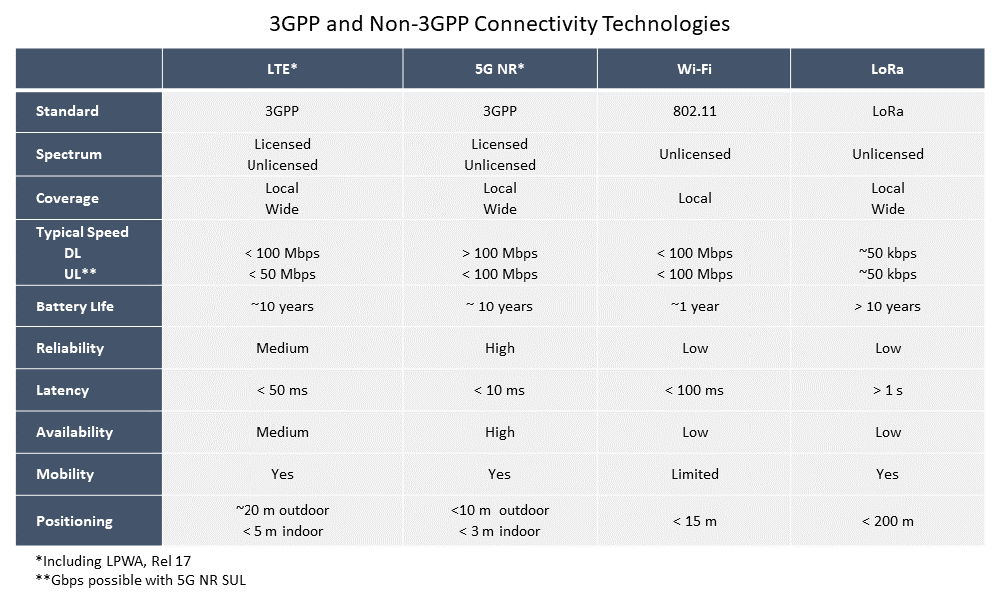

Given that WLAN is the de-facto IoT technology and that the manufacturing vertical has comprised around 10– 15% of the enterprise Wi-Fi market over the past five years (Dell’Oro Group, WLAN), why use 5G instead of Wi-Fi? After all, Wi-Fi is well equipped to address a wide range of non-industrial use cases. Enterprises are familiar with the technology, the PHY is almost the same, and it can typically be deployed in less time than cellular-based systems. WiFi6, which uses the 802.11 ax standard, offers multiple enhancements relative to its predecessor, including improved performance in high-density scenarios.

Still, even as the gap between Wi-Fi6 and 5G NR is shrinking on paper and Wi-Fi is projected to play a dominant role in manufacturing going forward, early cellular adopters see LTE—and especially 5G—as an important complement in industrial settings with demanding consistency, reliability, positioning, mobility, security, and UL performance requirements.

It is important to note, however, that both the unlicensed and licensed spectrum have a role to play. And while the physical layers for both 5G and Wi-Fi don’t differ much, the scheduler process in the MAC layers does differ. Findings from two 5G smart factories, one in China and another in Europe, suggest that Wi-Fi will do just fine with 10-20 IoT devices and minimal handover requirements. If the site needs to support more than 20–30 devices transferring large amounts of data, though, wide-bandwidth (WB) 5G NR is preferable to Wi-Fi.

Perhaps more importantly, 5G is typically not operating in the shared spectrum. It was interference and signal degradation with the Wi-Fi network that triggered Whirlpool to explore licensed 5G, instead of WiFi, to support its driverless vehicles inside its Ohio factory.

The roles of Wi-Fi and cellular will likely evolve over time. As manufacturers move beyond this initial connectivity phase with PCB inspections, automated material handling, autonomous-guided vehicle (AGV) dispatching, and 5G robot controls, the 5G business case will likely improve further as manufacturers rely more on AR and time-critical communications play a greater role.

Manufacturing Use Cases

5G manufacturing is still in its early days—and the majority of enterprises are still in the exploratory phase, learning how consistent 5G can provide incremental value over existing connectivity technologies. Below we will list some of the use cases we believe could benefit from 5G, both short-term and long-term.

-

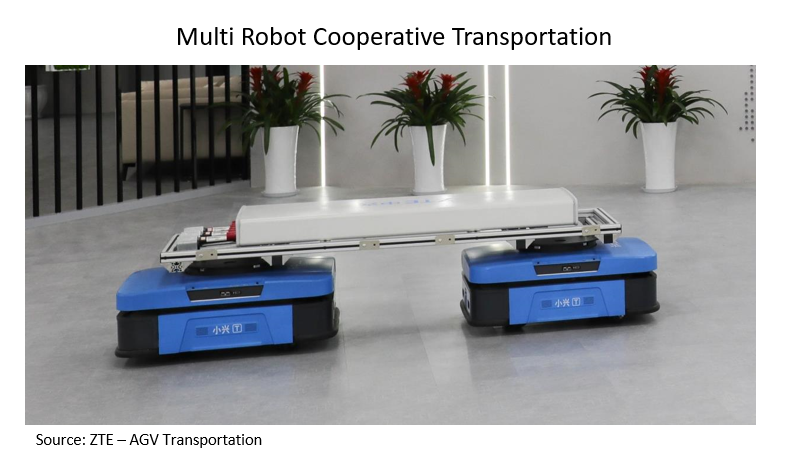

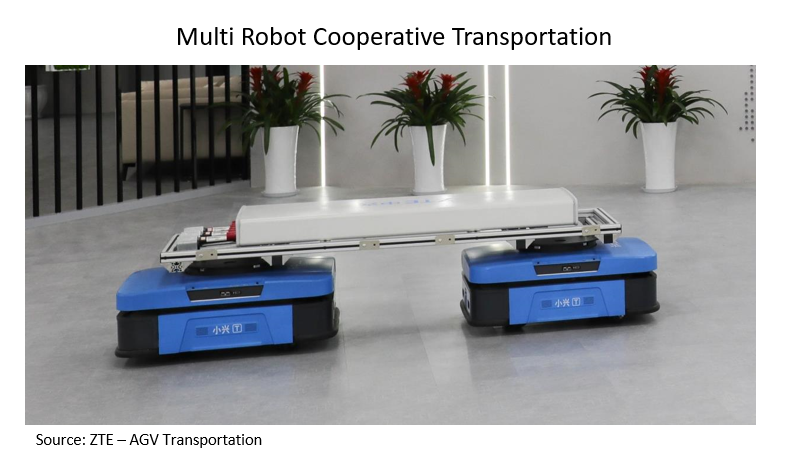

- Automated Guided Vehicles (AGVs) & Autonomous Mobile Robots (AMRs)

Based on preliminary feedback from multiple manufacturing plants, 5G-connected AGVs will likely be one of the leading smart manufacturing use cases initially. The concept of using AGVs— also known as portable robots, self-guided vehicles, or autonomous vehicles—to transport and distribute material across the factory floor, enable just-in-time (JIT) delivery of raw material, and improve efficiency across many different industrial settings is not new. The AGV market is well established, worth > $2 B, according to external sources.

Up until now, the AGVs have relied predominantly on Wi-Fi as the connectivity technology. While Wi-Fi works very well in many industrial settings, it is not always ideal for AGVs, especially if they are moving across large areas and are being used to capture information.

According to Hitachi, the optimization gained by investing in these assets can quickly be eroded if there are Wi-Fi shadows around the facilities.

Both LTE and 5G can provide the consistency, reliability, coverage, capacity, and mobility required for AGVs to navigate the transition from defined path transportation to autonomous flexible routing and, eventually, centrally guided routing.

Ericsson envisions that 5G can also help to reduce cost, by moving the compute from the AGV to a local edge location.

Most importantly, this is more than a PowerPoint vision at this point, as 5G-connected AGVs are already helping manufacturing plants free up forklift operators and improve efficiency. ZTE’s 5G BTS smart factory in Binjiang Park (part of the Green Expo Park, located in the southern city of Nanjing) utilizes more than 40 5G cloud-based AGVs to deliver materials, including chipsets and PCBs, across the plant for various production steps. Similarly, Ericsson is using 5G-connected AGVs at its smart factories in Tallinn and Texas. And Nokia is relying on 4.9 G-connected AGVs at its facility in Oulu, Finland.

With the AGV market expected to grow nearly eight-fold by 2030 (Ericsson), the 4G/5G AGV opportunity is real, though it is worth pointing out that when we reviewed America for Motion’s cellular AGV readiness, we learned that only the Easybot offered Wi-Fi/4G. All other remaining vehicles—including the fork, clamp, unit load, lift table, tugger, turret truck, and specialty AGV—only support Wi-Fi.

Digital Twin technology creates a digital replica of a physical object or system. By combining the physical form/digital representation and the dynamics coordinated in real-time based on sensing and monitoring of actual performance, digital twins can help to continuously test, assure, optimize, monitor, and automate prototypes, commercial products, networks, and processes.

Creating virtual models out of physical objects and processes is not a new concept. And while existing connectivity technologies will go a long way, the improved availability, capacity, coverage, latency, mobility, and reliability with 5G can play an important role in capturing data from a large number of sensors across the factory in near-real-time.

According to a recent Verizon survey, digital twin implementations will become a priority over the next year in the manufacturing sector.

ZTE’s 5G digital twin assembly line, at the smart manufacturing base in Binjiang Park, leverages sensor data and physical models to make forecasts for the entire lifecycle, ultimately improving efficiency

Recent supply shortages are also spurring the need for supply chain digital twins to help manufacturers forecast bottlenecks and respond to disruptions and fluctuations throughout the supply chain.

Inspections are critical steps in the manufacturing process, to ensure the expected quality and reliability but they also come at a cost. Manufacturers are constantly trying to find the right balance between cost and quality. Even with technology advancements, manual visual inspections (MVIs) still comprise a significant share of the overall inspection process.

LTE/5G connected cameras with machine learning and MEC computing can be used to reduce reliance on manual inspections and improve overall quality. While this process can also be implemented with Ethernet, wireless systems are generally more flexible.

The combination of 5G high-definition cameras and machine learning has helped ZTE reduce its reliance on manual labor for PCB inspections at its Binjiang Park smart factory, improving PCB quality by about 97%.

-

- Augmented Reality (AR)/Virtual Reality (VR)

AR and VR have tremendous potential for improving productivity and efficiency across multiple manufacturing segments and production steps. These technologies can help workers display overlays and enable them to tap into remote skillsets. The ability to use voice commands with wearables and locate drawings and part numbers without having to pause and use a computer can be a game-changer. Boeing, for example, was able to cut its wire harness assembly production time by 25% and lower error rates to nearly zero.

With skillset shortages accounting for nearly 60% of unfilled manufacturing positions (Ericsson), the remote opportunity is significant. Ericsson estimates that AR has helped to cut travel costs by 50% and reduce downtime at its 5G Factory in Texas.

5G Manufacturing Market Status

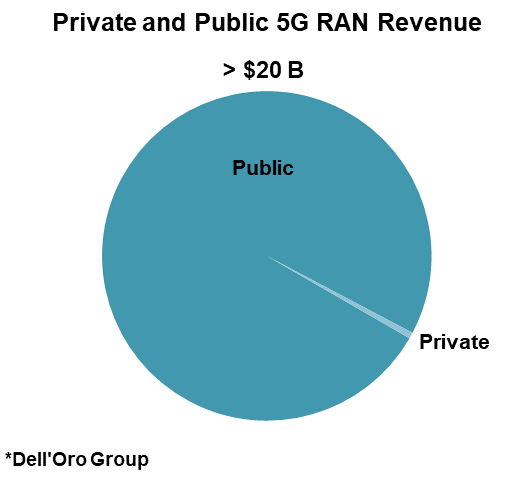

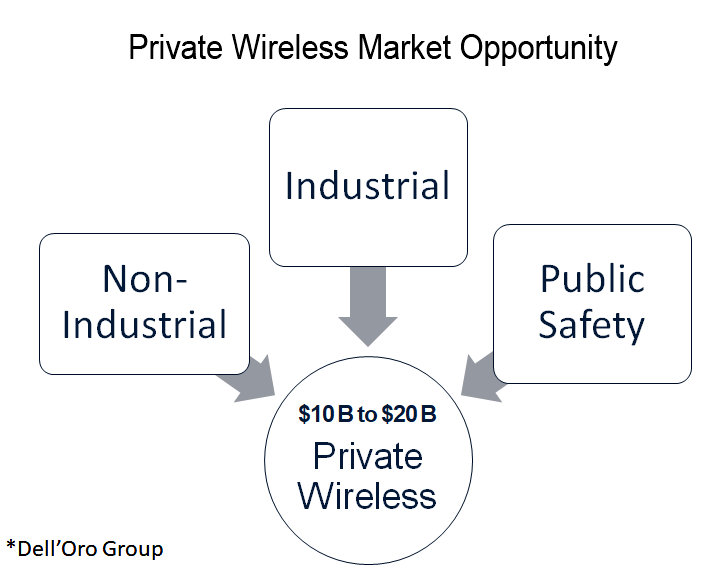

Preliminary estimates suggest that the 5G NR manufacturing vertical still accounts for about 0% of the overall 5G RAN market. However, activity is increasing as more enterprises are exploring how 5G can help them modernize the factory, reduce costs, shorten production cycles, improve asset utilization, and boost safety. The manufacturing vertical currently accounts for a double-digit share of Huawei’s, Nokia’s, and Ericsson’s ongoing private wireless projects. Ericsson recently reported, in fact, that the manufacturing segment is showing the strongest momentum within all its private wireless engagements.

In addition, RAN suppliers are also putting the technology to use internally. Ericsson and Nokia, both of which are powering some of their own factories with 5G, have also been selected by the World Economic Forum as an Advanced 4th Industrial Revolution (4IR) Lighthouse. In Korea and the US, Samsung has already delivered a full end-to-end 5G network to its own factories.

Similarly, ZTE’s manufacturing base in Binjiang Park utilizes 5G connectivity to improve efficiency and costs with 5G-connected AGVs, cameras, digital twins, machine vision, and industrial robots. Full automation of all operations has saved millions of USD in manpower per year, implying that the initial investments can be recouped in just a few years.

In summary, 5G manufacturing is still in its early days. At the same time, more suppliers and enterprises are increasingly exploring how 5G can be used to deliver value beyond existing connectivity technologies across multiple manufacturing segments. The uptick in demand—in combination with progress on the supply side—with more end-to-end services and solutions becoming increasingly available, forms the basis for an upbeat long-term outlook for the future of 5G manufacturing.

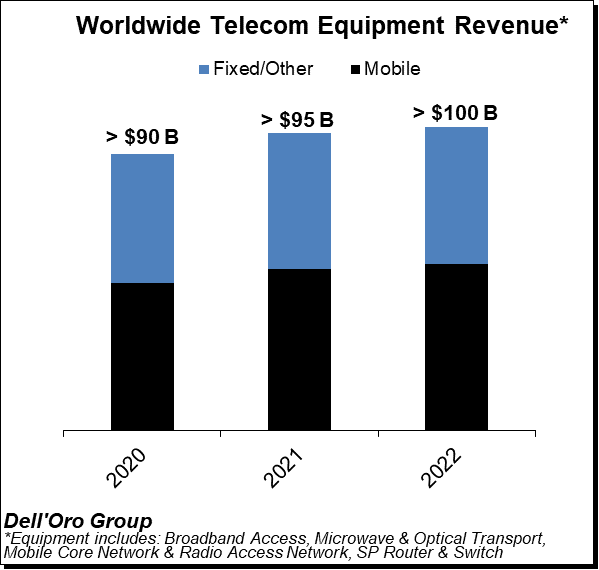

Positive market sentiment in the third quarter was driven by strong growth in RAN and Broadband Access, which was more than enough to offset weaker trends in Optical Transport.

Positive market sentiment in the third quarter was driven by strong growth in RAN and Broadband Access, which was more than enough to offset weaker trends in Optical Transport.