What the Numbers Say

The announcement that HPE plans to acquire Juniper Networks for almost $14 B surprised the industry. HPE has declared it wants to be a networking company. In the enterprise market, this means one thing – challenging Cisco – and according to HPE CEO Antonio Neri, he does business like he plays soccer. If he can’t be first, he’ll start a fight.

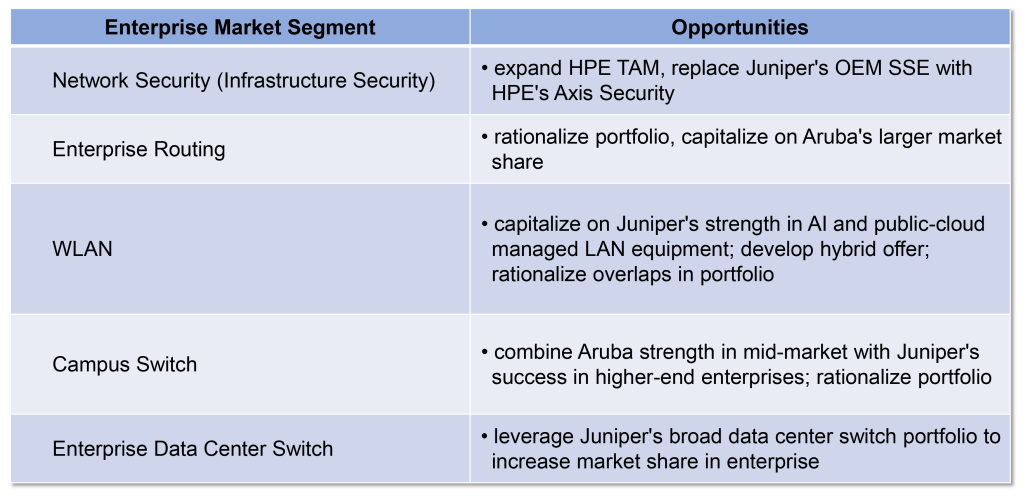

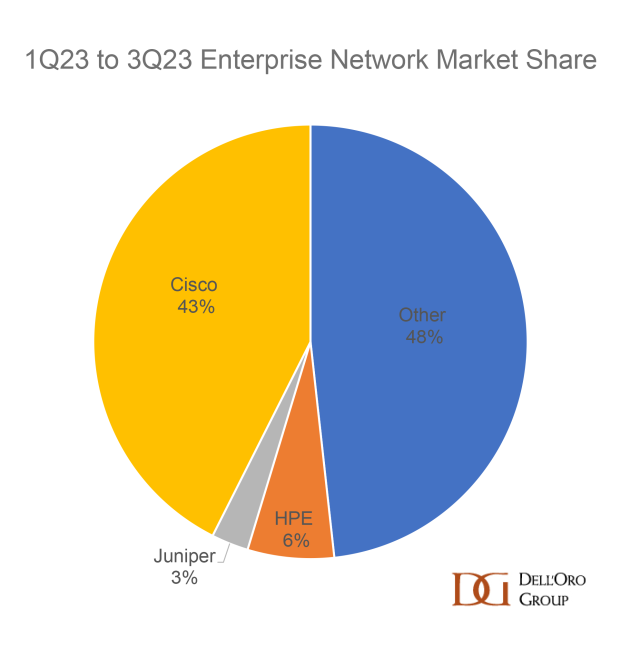

An analysis of the total enterprise market, defined as a sum of the Infrastructure Security, Enterprise Routing, WLAN, Campus Switch, and Enterprise Data Center Switch sales, reveals that a simple combination of Juniper’s and HPE’s Enterprise market share will not make much headway in taking on the market behemoth.

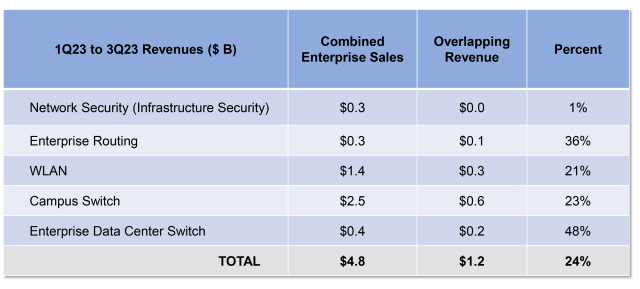

In addition, it is legitimate to question whether the acquisition would result in a straightforward addition of HPE’s and Juniper’s enterprise revenues. Given the overlap in product portfolios, the results of a combined entity will more likely be a complex algebraic formulation of the separate pieces. Whether the result is accretive depends on the strategy that the company leaders will take in each of the enterprise market segments, considering the strength of the two companies’ portfolios and market presence.

Market Share Ranking – Additive Scenario

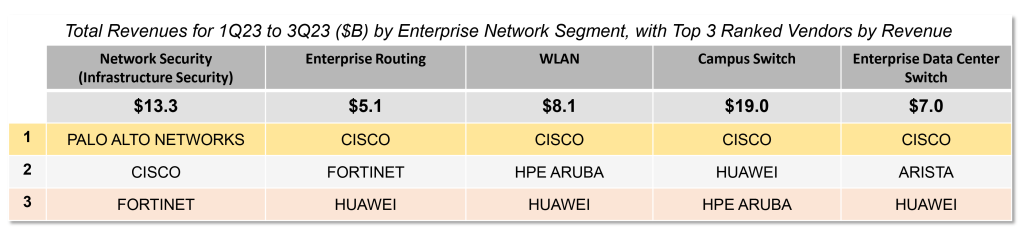

Breaking down the total market into its five distinct pieces demonstrates Cisco’s dominance. Huawei makes multiple appearances on the leaderboard, but in North America is virtually absent.

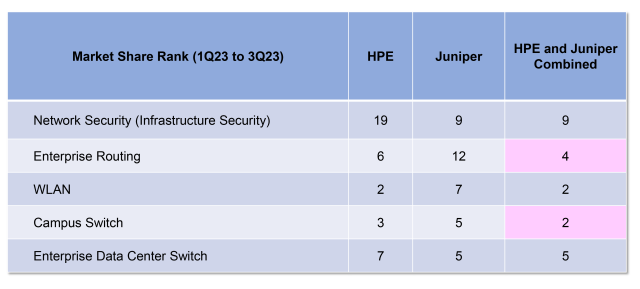

HPE is a significant player in the Wireless LAN (WLAN) and Campus Switch markets, whereas Juniper is not prominent in any of the five markets. However, just looking at the top three in each market does not reveal that Juniper outperforms HPE in revenue share of both the Network Security (Infrastructure Security) and Enterprise Data Center Switch markets. In these areas, Juniper can offer HPE an expanded customer base and a more diverse range of products. At the end of this blog, we highlight recently published blogs that delve into the effects of the merger within the realms of the WLAN, Data Center Switch and Network Security markets.

Considering Juniper’s Enterprise Routing and Campus Switch revenues in the first three quarters of 2023, the combination with HPE’s results would have propelled the joint company to a higher share rank in both markets. In Campus Switch, a segment in which both companies have a strong showing, the combined revenues would have narrowly edged out Huawei for second place.

In the other enterprise markets, the substantial revenue advantage held by the top vendors means that the merging of Juniper and HPE wouldn’t have affected the combined company’s overall revenue ranking over the first three quarters of 2023.

Product Overlaps – Worst Case

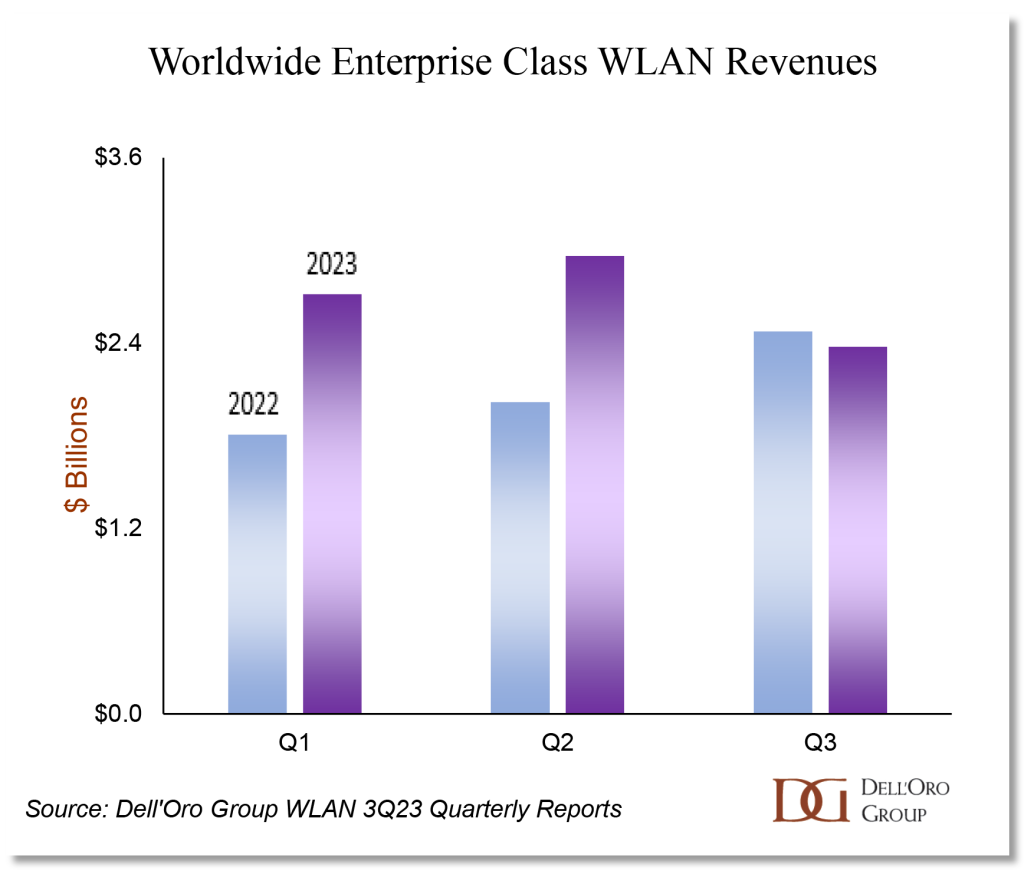

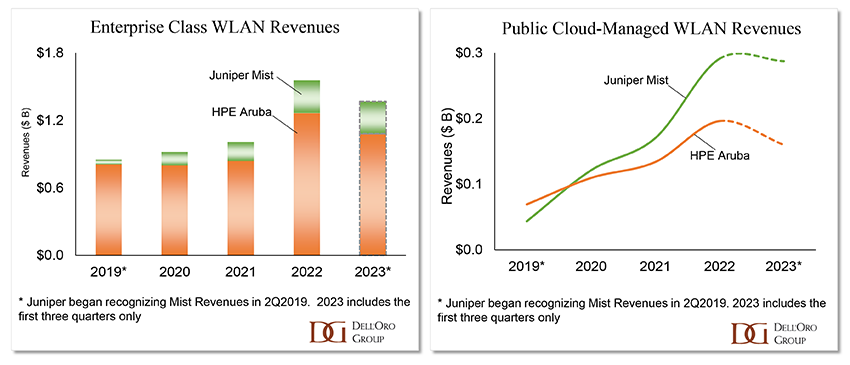

The most significant overlaps in enterprise portfolios between HPE and Juniper are in the WLAN, Campus Switch, and SD-WAN domains.

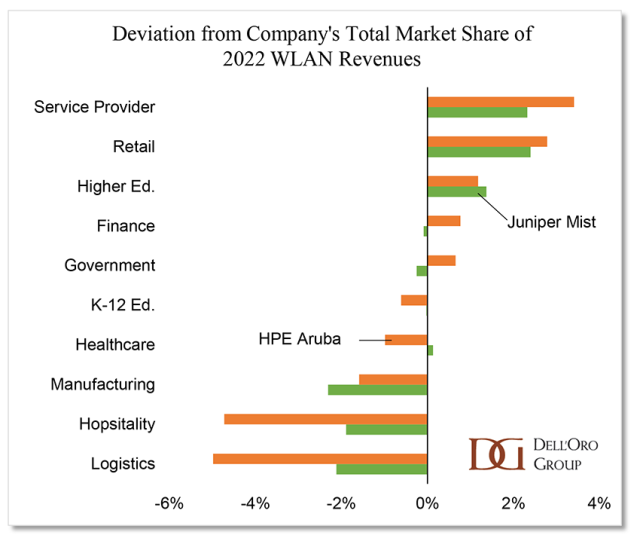

Where there is a clear overlap in product portfolio, gains may still be possible if the companies serve different market segments or geographies. HPE’s core strength is in the mid-market, whereas Juniper has made inroads with higher-end enterprises. Juniper’s Mist solution is managed from a vendor cloud, while HPE’s strength is with on-premises managed equipment.

However, both companies obtain significant revenue from the Higher Education and Retail verticals, increasing the risk of cannibalization. On a regional basis, Juniper is heavily weighted towards North America and would benefit enormously from expanding its reach to the rest of the world.

Our analysis of the two companies reveals that the maximum overlap in revenues in the first three quarters of 2023 was 24% of their combined revenues. The cost-cutting targets announced by Neri could compensate for the associated reduction in net income if this range of overlapping revenues were to evaporate once the acquisition occurs.

Opportunities for future growth

The data shows that, in the total enterprise market, this acquisition is less about HPE purchasing market share and more about investing in future technological capabilities. The main question is whether the combined company will be able to capitalize on respective portfolio strengths and market segment differences to go beyond what each company could achieve individually.

HPE stands to gain AI assets and strong branding by purchasing Mist. In domains where Juniper’s technology is considered superior, it will benefit from HPE’s scale in go-to-market organizations, especially outside North America. However, once the acquisition is complete, judicious choices must be made, portfolio by portfolio, to ensure that one plus one does not equal less than two.

Despite the minimal impact the acquisition will have on short-term market share, buying into AI-driven technology is a smart move for HPE. Juniper’s Mist brand for enterprises has been gaining steam and has been lauded publicly by CIOs evangelizing about the dramatic simplifications Mist’s AIOps has brought to their network operations. In North America, larger companies are coming around to adopting public cloud-based management of their networking equipment, opening the door to Mist.

Meanwhile, most incumbent vendors are turning their development efforts and marketing messages to AI. In addition, a new startup in the networking market, Nile, has been spawned by ex-Cisco executives and is positioning fully automated, AI-based networking technology. Any vendor not using AI in their offers will be left behind. This highlights a key risk HPE must now navigate. The acquisition announcement heavily emphasizing ‘Artificial Intelligence’ implies that the primary risk to customer confidence lies with the Aruba portfolio, which lacks AI flair.

Until the acquisition is complete, the two companies will continue to compete head-to-head. Because of the overlap of Juniper and HPE’s enterprise portfolios, customers can be forgiven for being concerned about the longevity of either company’s technology. Competitors such as Cisco, CommScope Ruckus, Huawei, Extreme, Fortinet, Palo Alto, and Nile will try to capitalize on customer confusion while HPE awaits regulatory approvals.

To read more on the HPE’s acquisition of Juniper, consult the following Dell’Oro blogs:

- HPE to acquire Juniper – WLAN market impacts (Siân Morgan)

- HPE Contributes better ‘Networking for AI’, Juniper Contributes better ‘AI for Networking’ (Sameh Boujelbene)

- HPE Acquires Juniper: What does this mean for its Network Security and SASE/SD-WAN aspirations? (Mauricio Sanchez)

*data presented in this blog has been extracted from the following Dell’Oro Group reports: Ethernet Switch – Campus 3Q23 Quarterly, Ethernet Switch – Data Center 3Q23 Quarterly, Network Security 3Q23 Quarterly, SASE & SD-WAN 3Q23 Quarterly, Wireless LAN 3Q23 Quarterly.