Part 2 of a 3-Part CNaaS Blog Series: Focusing on Enterprise Needs, the Three CNaaS Variants Become More Than Solutions Looking for a Problem

Campus NaaS is poorly defined in the industry, leading to market confusion. In this series of blogs, Siân Morgan explores the differences and similarities of the offers on the market and proposes a set of definitions to help enterprises and vendors speak the same language.

The first danger sign came when Henry Ford named the Edsel, Ford Motor Company’s ambitious new car concept, after his son. The idea for a premium mid-market car was laden with high expectations, and after ten years and $250 million spent planning, the Edsel was launched with fanfare in September 1957. Three months later, sales plummeted. Ford had projected it would sell 200,000 Edsel cars a year. Instead, 118,287 were sold over the three years the Edsel was in production. Ford had misunderstood what customers wanted.

In the first blog of this series, we defined the technological characteristics of CNaaS, but bearing in mind the Edsel backfire, it is important to address the way CNaaS fulfills real customer needs.

All of these offers are focused on two common customer requirements:

-

- The increasing complexity of Local Area Networks, coupled with a lack of skilled IT resources.

This requirement has been amplified by the recent wave of AI innovation. Most enterprises are focused on developing an AI roadmap, and many would prefer to reallocate resources from maintaining the LAN to higher-value projects.

-

- Enterprises’ desire to reduce capital expenditures while prioritizing IT investments.

Typical CNaaS offers include hardware financing that allows LAN hardware, software and services to be bundled into one recurring fee. Some enterprises may find the opex price structure alluring because it helps with cost allocation, better matches the company’s revenue streams, or fits better with funding cycles. However, companies that are measured or restricted by financial covenants based on their EBITDA, or entities that are prevented from committing to multi-year contracts, will prefer to purchase their LAN equipment outright. To cater to these enterprises, some CNaaS vendors have structured their pricing to appear as capital leases on enterprises’ books. Other CNaaS vendors have the option of a capex acquisition model.

The three CNaaS variants address enterprises IT requirements in different ways

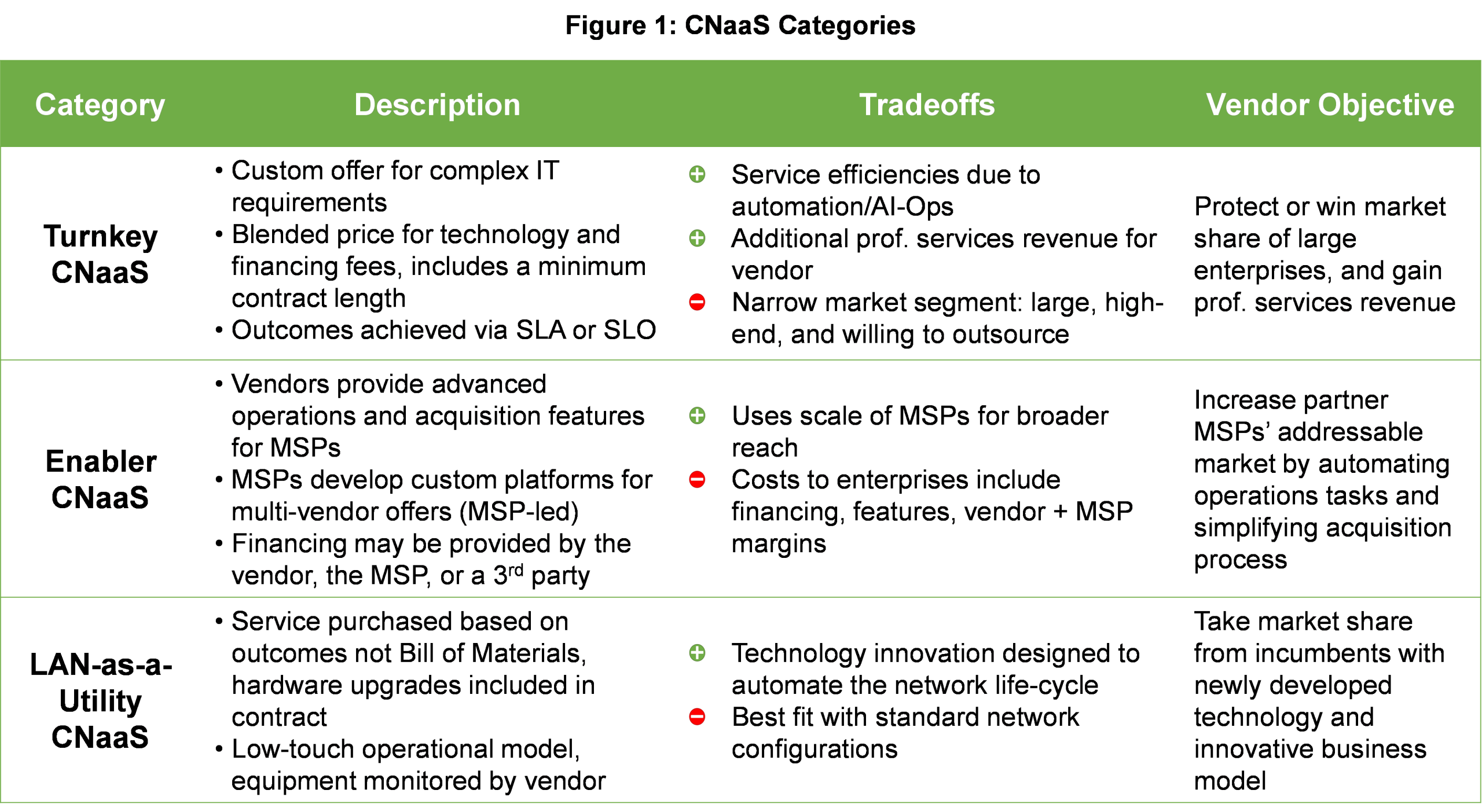

To match the multitude of CNaaS options, vendors have approached the service from different angles. Among the offers available, it is possible to classify them into three categories, based on the vendors’ business objectives outlined in Figure 1.

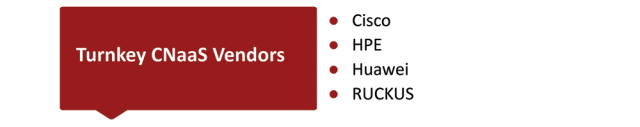

Turnkey CNaaS—Led by Large Vendors

-

- Who offers it: Large, incumbent vendors with broad portfolios are well-placed to offer this type of “high-touch” offer, targeting large enterprises directly and without the support of an MSP.

-

- How it works: These offers can be financed by the vendors such that service price is aligned with an enterprise’s business model. For instance, a vendor could blend and distribute the service price to fluctuate in step with the enterprise’s cyclical revenue. The price could also be structured to match the geographic distribution of an enterprise’s revenue centers.

-

- Market example: HPE brought the Turnkey CNaaS variant to the market’s attention when it announced its deal with Home Depot in 2021.

-

- Market impact: This type of offer has a more traditional delivery model than the other two CNaaS categories. Turnkey CNaaS was responsible for virtually all of CNaaS revenue in 2020 and was the largest category of CNaaS revenue in 2024.

Enabler CNaaS—Scaling Through MSPs

-

- Who offers it: Enabler CNaaS is typically offered by incumbent LAN equipment vendors that maintain deep channel relationships with MSPs. Unlike Turnkey CNaaS, the vendor keeps the vendor–MSP partnership intact. Exceptionally, Shasta Cloud is a startup in this category. Shasta leverages TIP’s OpenLAN initiative and requires a service provider or partner to label and deliver the offer to customers.

-

- How it works: The innovation lies in the business model. Vendors develop tools to simplify acquisition and may finance the hardware. This helps the MSPs to bundle professional services with vendor hardware and software, creating a more attractive package for enterprises. Even without explicit support from vendors, MSPs can build their own version of CNaaS, which we label “MSP-Led”. This approach often involves in-house development from an MSP.

-

- Market examples: This category of CNaaS is made up mainly of incumbent LAN equipment vendors leveraging existing MSP relationships.

-

- Market impact: We expect Enabler CNaaS to comprise most of CNaaS revenue from 2026 to 2029. MSPs are established globally and have the capability of scaling up the sales of these solutions to mid-to-large enterprises quickly, once they commit to selling opex-structured offers.

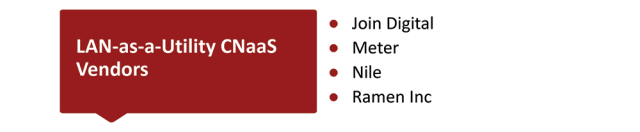

LAN-as-a-Utility— A New Model for Campus Networks

-

- Who offers it: Whereas the innovation of Turnkey and Enabler CNaaS offers is centered on the business model and acquisition process, LAN-as-a-Utility vendors have developed entirely new hardware and software designed to automate network delivery and operations.

-

- How it works: Initially, most LAN-as-a-Utility offers were acquired by enterprises directly from vendors, and purchased based on a standard, outcome-oriented price per area or number of connected devices. Because LAN-as-a-Utility offers are designed to automate the day-to-day monitoring of enterprise network equipment, they risk reducing business opportunities for MSPs. However, MSPs are also valuable routes to market for LAN-as-a-Utility vendors. For this reason, there has been a gradual shift in the relationship between the LAN-as-a-Utility vendors and channel partners, with the vendors allowing the partners to take on more of the initial design and site surveys, as well as ongoing network monitoring.

As the LAN-as-a-Utility vendors have become more established, their approach to pricing has also evolved. As the vendors encountered a diverse set of enterprises with different needs, they began presenting a more nuanced pricing approach, with custom pricing depending on location, space and enterprise requirements.

-

- Market examples: Each of the four most active vendors in this category includes different components in their offers; however, all are involved in developing in-house software and in monitoring the networks on an ongoing basis.

-

- Market impact: LAN-as-a-Utility vendors are challenging the established IT equipment industry. These offers resonate best with small-to-mid sized enterprises that have very small, or non-existent, IT teams. By outsourcing the network and its monitoring with the protection of an outcome-oriented SLA (Service Level Agreement), these enterprises can obtain a high-quality network without the associated labor costs and without large outlays of capital. LAN-as-a-Utility CNaaS vendors now report that a significant number of their deals are arriving via channel partners. However, it will take time for these newcomers to build a channel presence as large as the incumbent vendors. Although this variant of CNaaS has the smallest share of revenue out of the three variants, it also has the most impressive growth rate.

Turnkey, Enabler and LAN-as-a-Utility CNaaS are all different offers, leading to a variety of customer experiences. However, they are all delivered with public cloud-managed equipment, and with automation as a central feature. The CNaaS construct represents three different ways to address enterprises’ need for IT simplification.

Which of the three is likely to be more successful? How big is the overall market? These questions will be addressed in the final blog of this three-part series.