A Problem to Solve

For the past couple of decades, the rising demand for optical network capacity has been counter-balanced by the declining price of a Gbps. It was one reason service providers could keep up with customer demand for bandwidth without exponentially growing their Capex spend. However, while bandwidth demand rose, the cost to lower the price-per-Gbps increased. Stated another way, optical companies had to perpetually invest more resources in research and development (R&D) to solve one key problem for their service provider customers: keeping the cost of bandwidth from growing exponentially.

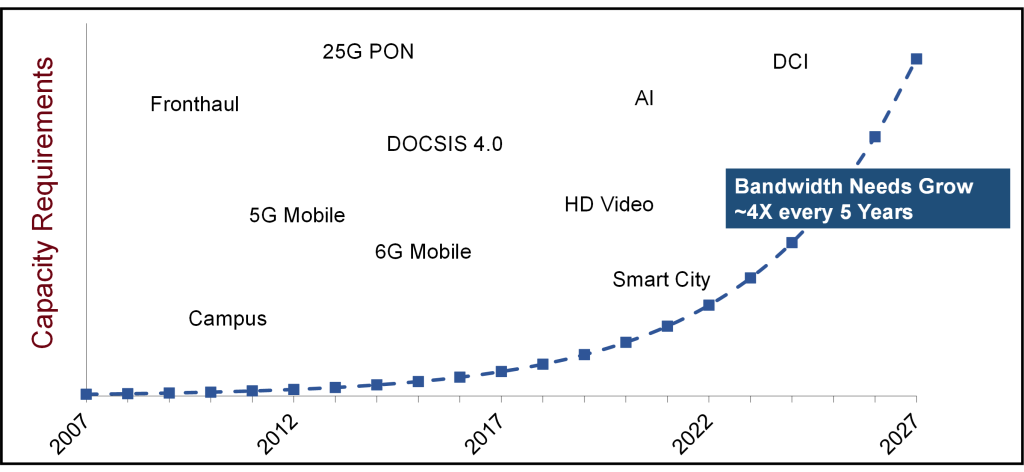

Demand for Bandwidth Grows 30% Annually

The demand for capacity in long distance networks has been growing at an average annual rate of 30% for the past decade and is expected to do the same for the next decade. This means that for every five-year period, the amount of installed network capacity on a Gbps basis needs to grow by roughly 4X. This increase in bandwidth is driven by an increase in applications that consume more capacity.

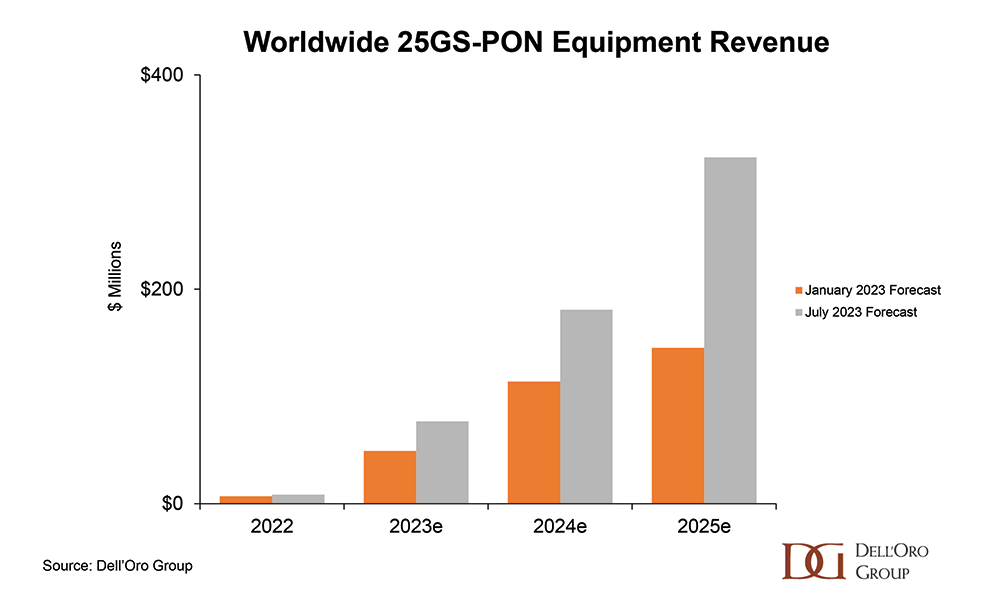

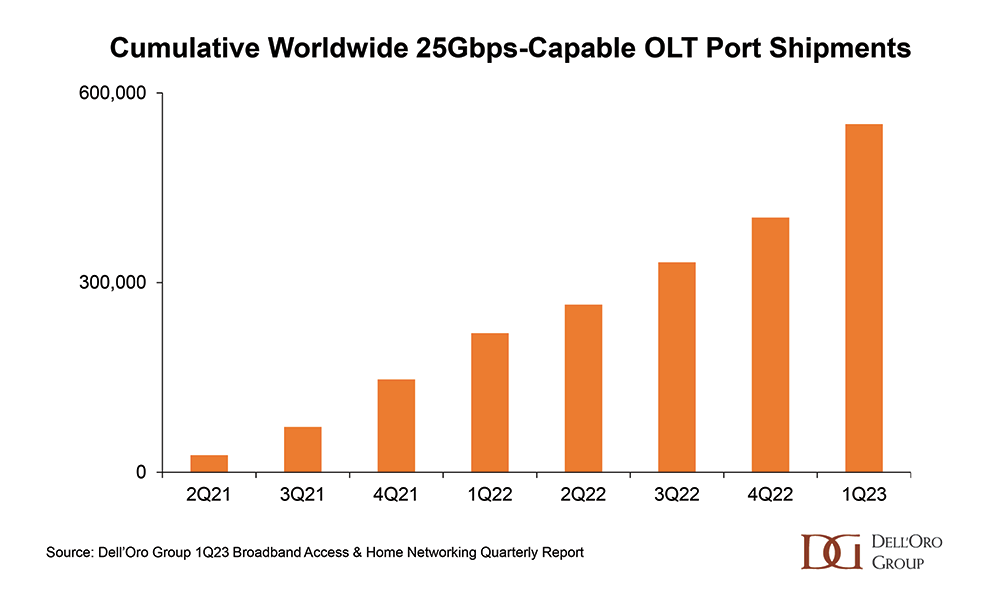

- Access technology: The technology in the access layer increased the speed that end users were able to access the internet from Kbps to Gbps. The latest access technologies include 25G PON and 5G; the future includes 50G PON and 6G.

- Densification: More places are being connected with fiber. Over time, fiber connections have moved from central offices to city blocks and now to homes. Smart cities are emerging that integrate communication technology with the infrastructure, further pushing up the number of connected devices, including those for safety and security.

- Video: High definition (HD) video has moved beyond the television to handheld devices, surveillance cameras, and even doorbells.

- Artificial Intelligence (AI): This is just the start of AI and machine learning (ML). We think ChatGPT was the first of many new applications leveraging AI and ML that will appear in the market. In fact, it is a possibility that AI/ML applications will drive annual bandwidth growth beyond 30% in the future.

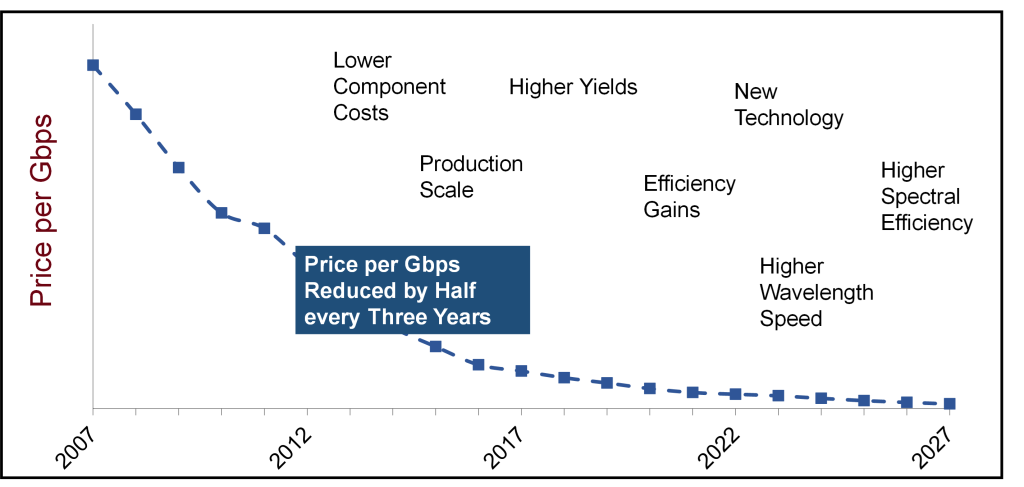

Price of a Gbps Declined 20% Annually

Although bandwidth requirements grew exponentially, service provider Capex grew linearly. This is because the price of DWDM equipment on a Gbps basis declined at 20% annually or by half every three years.

The 20% annual price decline is broadly achieved through the combination of two cost drivers:

- Efficiency gains: We believe efficiency gains contribute approximately one-third of the annual price reduction. A few ways to improve efficiencies include improving manufacturing processes, achieving better product yield, and obtaining manufacturing scale.

- Innovation: New technologies introduced into the market contribute the remainder of the 20% price reduction. These new technical innovations include coherent DSP and photonics to produce higher wavelength speeds that have better spectral efficiency (SE).

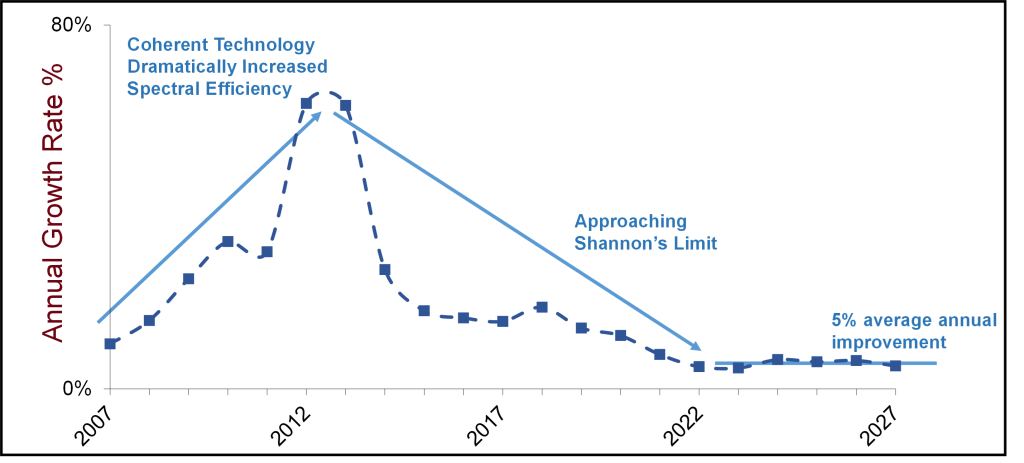

Spectral Efficiency Improvements Slowing

One of the main methods to lower the price-per-Gbps is to increase the SE of a wavelength. When sending more bits in the same amount of spectrum, the service provider amortizes the high cost of the optical line system (comprised of DWDM chassis, amps, ROADMs, and fiber) over more bandwidth. Thereby, lowering the price-per-bit of the network.

But, as we approach Shannon’s Limit, SE improvements are slowing and a problem is emerging.

- Beginning in 2008, SE improvements accelerated higher due to the introduction of coherent technology. When a service provider moved from using a 10 Gbps wavelength to a coherent 100 Gbps wavelength, the SE increased 10X.

- Although SE improved with the availability of new wavelength speeds, it was not at the same scale because the SE improvement of each generation is less than that of the previous generation as we advance towards Shannon’s Limit.

- We believe the SE improvements in the next five years will only be 5%.

The Problem Statement

Increasing SE was the biggest lever to reducing the price-per-Gbps. However, due to Shannon’s Limit, future SE gains are harder to realize. Therefore, new technical innovations must be created. Otherwise, one day, service provider Capex will need to grow exponentially to keep up with user demand for bandwidth.