FTTH Deployments Could be Slowed By Supply Chain Issues

“If you build it, they will come” has been the guiding mantra for network operators for decades now, especially when it comes to their broadband access networks, which have seen accelerated subscriber growth over the last year and consistently contribute margins ranging from 55-70%.

As I recently pointed out in another blog, the global trend for building out new broadband networks is to do so with fiber, as the importance of premium residential broadband connections was made abundantly clear during the lockdowns of the COVID-19 pandemic.

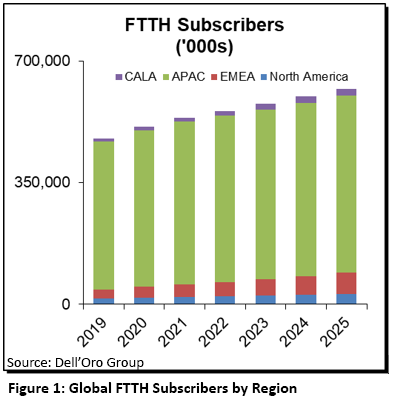

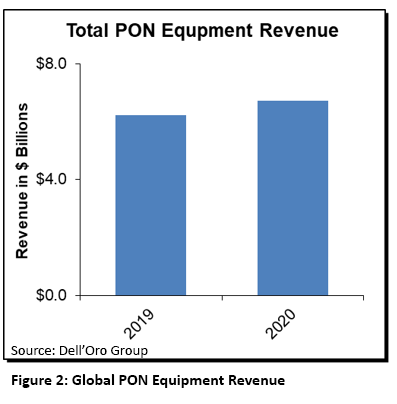

The emphasis on fiber broadband shows no signs of slowing

Building networks and doing so with fiber has made the path clearer for operators and regulators alike. Twin national goals of bridging the digital divide and getting all citizens connected along with the desire to provide gigabit speeds to everyone have merged and are driving a renewed cycle of subsidization and investment in broadband access networks and equipment, especially in the US.

In the US, the aggregate amount of loans, grants, and other subsidies that has already been approved to connect rural, unserved and underserved communities will nearly double current subsidy levels to over $8B per year. These funds include the $9.23B approved through phase 1 of the RDOF (Rural Digital Opportunity Fund) auction, $125M through the $2.2T CARES (Coronavirus Aid Relief and Economic Security Act) legislation passed in March, 2020, a potential $7.5B through the CAA (Consolidated Appropriations Act) passed in December 2020, as well as additional funds eligible for broadband projects through the ARPA (American Rescue Plan Act) passed in March 2021.

Government subsidies to expand fiber connectivity, particularly in the US, will reach historical heights soon

These funds don’t even include proposed legislation which includes $15B in the American Broadband Buildout Act, $94B in the AAIA (Accessible, Affordable Internet for All Act), $109B in the LIFT (Leading Infrastructure for Tomorrow’s America Act), and $100B in the American Jobs Plan.

Combined, the amount of money available via legislation that has already been passed along with proposed legislation could push total subsidies available for broadband network buildouts to over $16B in 2022, declining gradually to $12B in 2025 as programs are phased out. That represents a 4x increase in the amount of money intended to bridge the digital divide and connect millions of American homes with reliable broadband Internet.

Of course, these projects aren’t going to be completed overnight. In fact, recent history with the American Recovery and Reinvestment Act of 2009, which earmarked $7.2B for broadband expansion and improvement, as well as the Connect America Fund (CAF and CAF II), shows that these projects, from approval to funding to deployment can take years. Many of the programs (RDOF is one) allocate money over the course of 10 years.

We can debate the vehicles for funding the rollout and expansion of broadband networks, but we can’t debate the merits. There is no question that there is a significant percentage of the US household population that remains unserved (roughly 22-25M homes) along with a millions more homes that are classified as underserved. Combined, those households could range from 35M-40M. If we assume that operators add roughly 2.7-3.2M new broadband subscribers annually, then the 10-year timeline to connect everyone and provide respectable broadband speeds and service seems particularly aggressive.

Though there is clear demand, shortages in components and labor will delay the full achievement of connectivity goals

Despite all the funding options and demand from network operators, equipment suppliers, and subscribers alike, the bigger problem in the short-term isn’t one of demand, but of supply. Instead of “if you build it, they will come” supply chain and labor market constraints might prevent operators from building it in the first place.

Shortages in semiconductors and other vital components, including capacitors and flash memory, have been well-documented, impacting not only networking equipment, but also consumer electronics, automobiles, and other industrial equipment. Meanwhile, demand for fiber cables, conduit, and other ODN infrastructure has pushed lead times for these components to anywhere from 12-18 months. Lead times for OLTs and other active equipment used in FTTH deployments have remained fairly stable despite the disruptions, but have been sneaking up recently as demand has increased, particularly from larger operators who have major strategic initiatives in place to accelerate their home passings.

Delays will open the doors for wider usage of alternative technologies, including fixed wireless and satellite

Delays and higher costs to ship finished goods from overseas could also slow FTTH network rollouts, though the bigger challenge there will be managing the higher costs to ship goods.

Finally, the biggest impediment to getting fiber networks rolled out within a realistic time frame is likely to be a lack of trained workers in the fields of professional services and installation. Nearly all job functions are likely to be short-handed, given the potential demand coming from subsidized projects: Network engineers, surveyors, fiber technicians, all the way to individuals handling permitting and right of way applications both for operators and individual municipalities. Many of these functions require specialized training through community colleges and trade schools. In other words, the workers can’t be added fast enough to be able to match the demand expected from ongoing and potential fiber projects.

The net result is that fiber broadband deployments in rural and underserved communities are likely going to take considerably longer to complete, potentially pushing the goal of connectivity out past 10 years. Potential—and arguably necessary—changes to how the FCC and individual states map and classify broadband services will also slow down the process by likely increasing the total number of homes classified as unserved or underserved. For example, individual states have completed their own mapping exercises and found unserved and underserved totals being 2x-3x what the FCC has reported via its own maps.

These exercises lead us to our conclusion that total unserved and underserved homes in the US are likely closer to 40M. Even this number could be conservative. But until the FCC or states conduct a revised process of mapping, the totals will likely be less than that 40M estimate.

In upcoming blogs, I will explore in more detail the implications not only for fiber broadband deployments and equipment providers, but also for fixed wireless providers and emerging satellite broadband players, such as Starlink. With so much money on the table, along with a commitment across the board to finally bridge the digital divide, driven largely by the recent pandemic, I expect there to be an ongoing push-and-pull between legislators, network operators, and the industry lobbying groups representing them (e.g. WISPA, Fiber Broadband Association) to either expedite rollouts in the name of achieving goals faster or slowing rollouts to make sure they are done right the first time. There has already been considerable debate regarding the inclusion of fixed wireless solutions and whether they will truly be able to provide the gigabit speeds and services legislators are requesting or whether those speeds take a backseat to the primary goal of getting everyone connected.