Open RAN investments surged in the first quarter of 2021. Preliminary estimates suggest total Open RAN revenues – including O-RAN and OpenRAN compatible macro and small cells radios plus baseband hardware and software – increased around five-fold year-over-year. The uptake is uneven. In this blog, we will discuss four Open RAN related key takeaways with the 1Q21 quarter including 1) The Asia Pacific (APAC) region is driving the market, 2) Macro is dominating but small cell adoption is improving, 3) The Open RAN Massive MIMO landscape is evolving, and 4) Short-term outlook remains favorable.

The operators in the APAC region are largely behind the surge, underpinned by a fairly synchronized migration from proprietary RAN towards Open RAN in Japan. In addition to Rakuten, which now has some 50 K radios up and running, other Japanese operators are increasingly optimistic about O-RAN and the role open interfaces will play with more advanced radio deployments.

Not surprisingly, macro deployments are dominating the Open RAN revenue mix both globally and in APAC, reflecting the state of the overall RAN market and the current focus by operators deploying Open RAN. This is also consistent with our own projections and the recently released Open RAN Technical Priorities Summary by the larger European telcos, suggesting Macro RAN is the primary target for the operators.

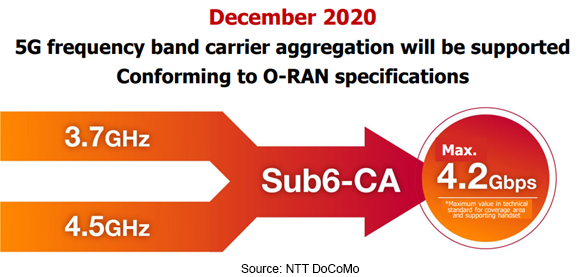

At the same time, Open RAN small cell activity is on the rise. Helping to drive this acceleration is faster growth with millimeter wave (mmWave) deployments in Japan, with multiple operators now embracing the benefits of combining the higher spectrum with the sub 6 GHz bands.

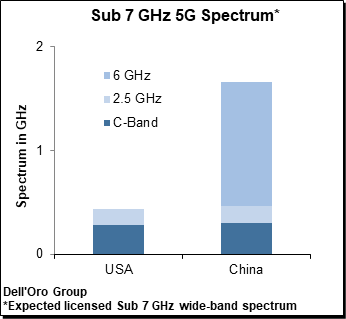

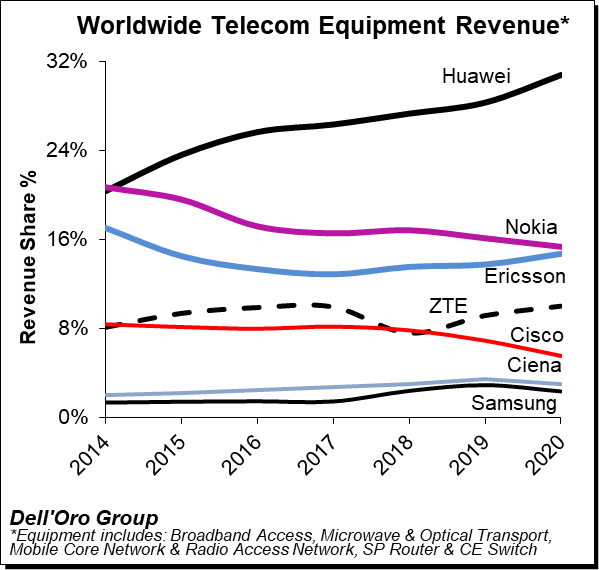

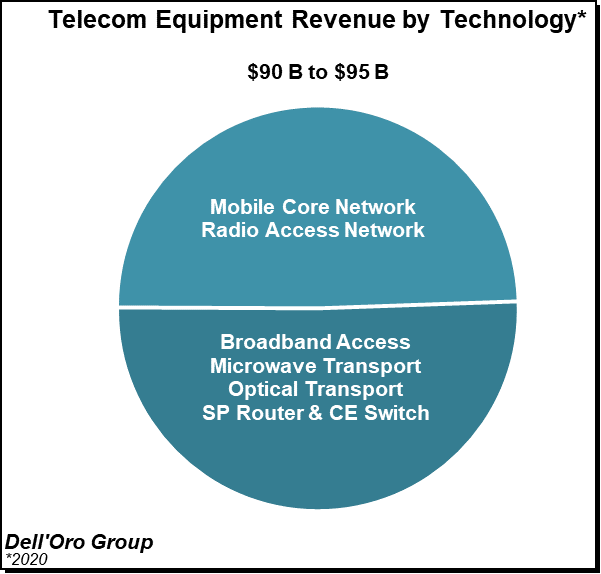

The traditional top 5 RAN vendors (Huawei, Ericsson, Nokia, ZTE, and Samsung) are dominating the $10 B+ Massive MIMO RAN market, however, Open RAN proponents remain optimistic the recent uptick in O-RAN related announcements will eventually lead to an improved supplier landscape. Predicated on the assumption that the shift towards wider bandwidths will be a catalyst for 5G SA, the asynchronous availability of the upper mid-band spectrum offers a window of opportunity for new entrants.

In other words, even if the Massive MIMO market is relatively mature and highly concentrated, it is not too late for suppliers with weaker RAN shares to use O-RAN combined with SA to enter this segment. And the number of suppliers that want to seize on this opportunity to bolster growth is increasing with multiple smaller non-top 5 RAN suppliers – including Airspan, Fujitsu, Mavenir, and NEC – announcing the availability or upcoming GA of O-RAN Massive MIMO antenna systems. And with the silicon providers also ramping up investments to accelerate the shift towards advanced Open RAN radios, we do expect this non-top 5 supplier O-RAN Massive MIMO list to evolve over time.

Since more operators are suggesting performance parity with “traditional systems” is expected, new Massive MIMO entrants know what they need to deliver in terms of IBW, weight, size, TRX configurations, power consumption, and spectral efficiency. In other words, the bar is high and it will continue to rise. So no one is under the impression this will be a trivial task. But at the same time, the Open RAN community has received the message loud and clear – broader Open RAN adoption is to some degree hinging on the success of Massive MIMO.

With the strong showing in the first quarter, we are adjusting the short-term outlook upward and now project total Open RAN revenues to nearly double in 2021. And while we are not revising the long-term Massive MIMO Open RAN projections at this time, we will of course continue to monitor the situation closely to better understand how the growing ORAN ecosystem will impact the overall vendor dynamics.

For more information about the Open RAN and Virtualized RAN forecast and assumptions, please visit our Open RAN page or please email us at dgmedia@delloro.com or dgsales@delloro.com.