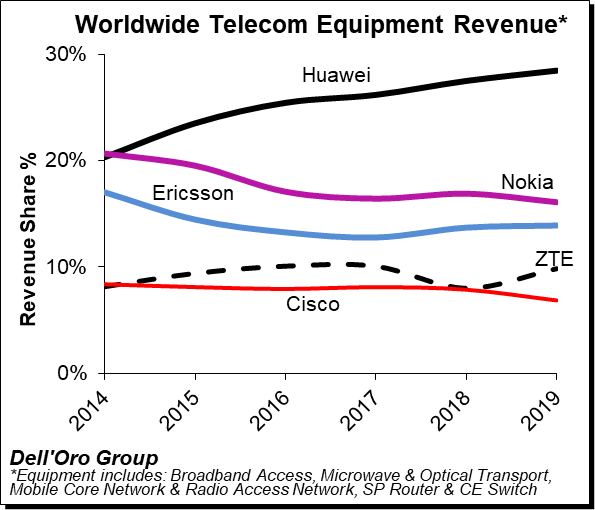

Huawei and ZTE increased their revenue shares while Nokia and Cisco’s revenue shares declined for the full year 2019 telecom equipment market.

We just wrapped up the 2019 reporting period for all the Telecommunications Infrastructure programs covered at Dell’Oro Group. Preliminary estimates suggest the overall telecom equipment market – Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & CE Switch – advanced 2% during 2019, recording a second consecutive year of growth.

Full-year 2019 revenue shares relative to 2018 revenue shares for the top five suppliers – the latter indicated here in parenthesis – show that Huawei, Nokia, Ericsson, ZTE, and Cisco comprised 28% (28%), 16% (17%), 14% (14%), 10% (8%), 7% (8%), respectively.

Full-year 2019 revenue shares relative to 2018 revenue shares for the top five suppliers – the latter indicated here in parenthesis – show that Huawei, Nokia, Ericsson, ZTE, and Cisco comprised 28% (28%), 16% (17%), 14% (14%), 10% (8%), 7% (8%), respectively.

Additional key takeaways from the 4Q 2019 reporting period include:

- Following three years of declining revenues between 2014 and 2017, the overall telecom equipment market advanced for a second consecutive year in 2019, validating the message we have communicated for some time now, namely that there are reasons to be excited about the telecom market.

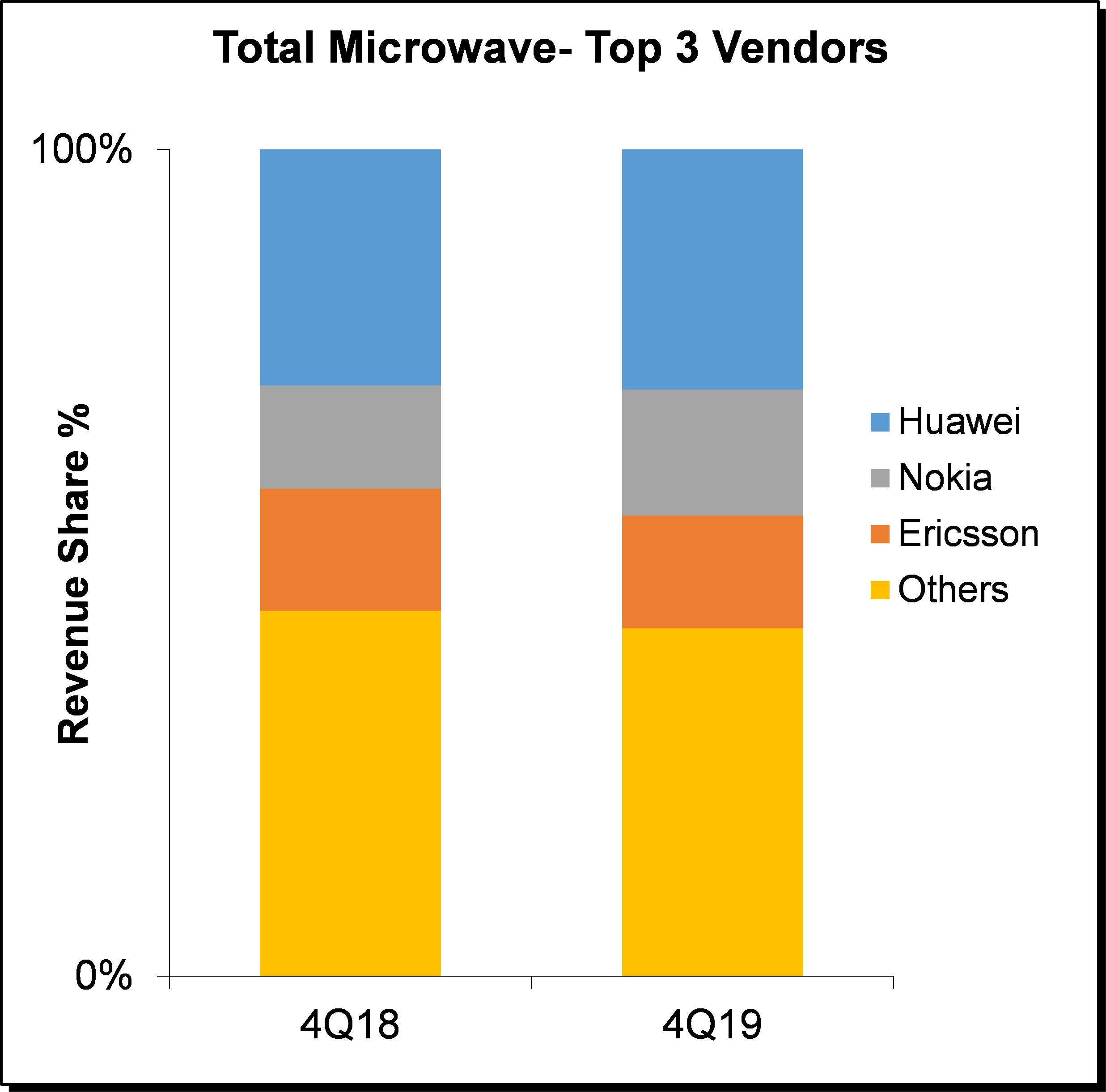

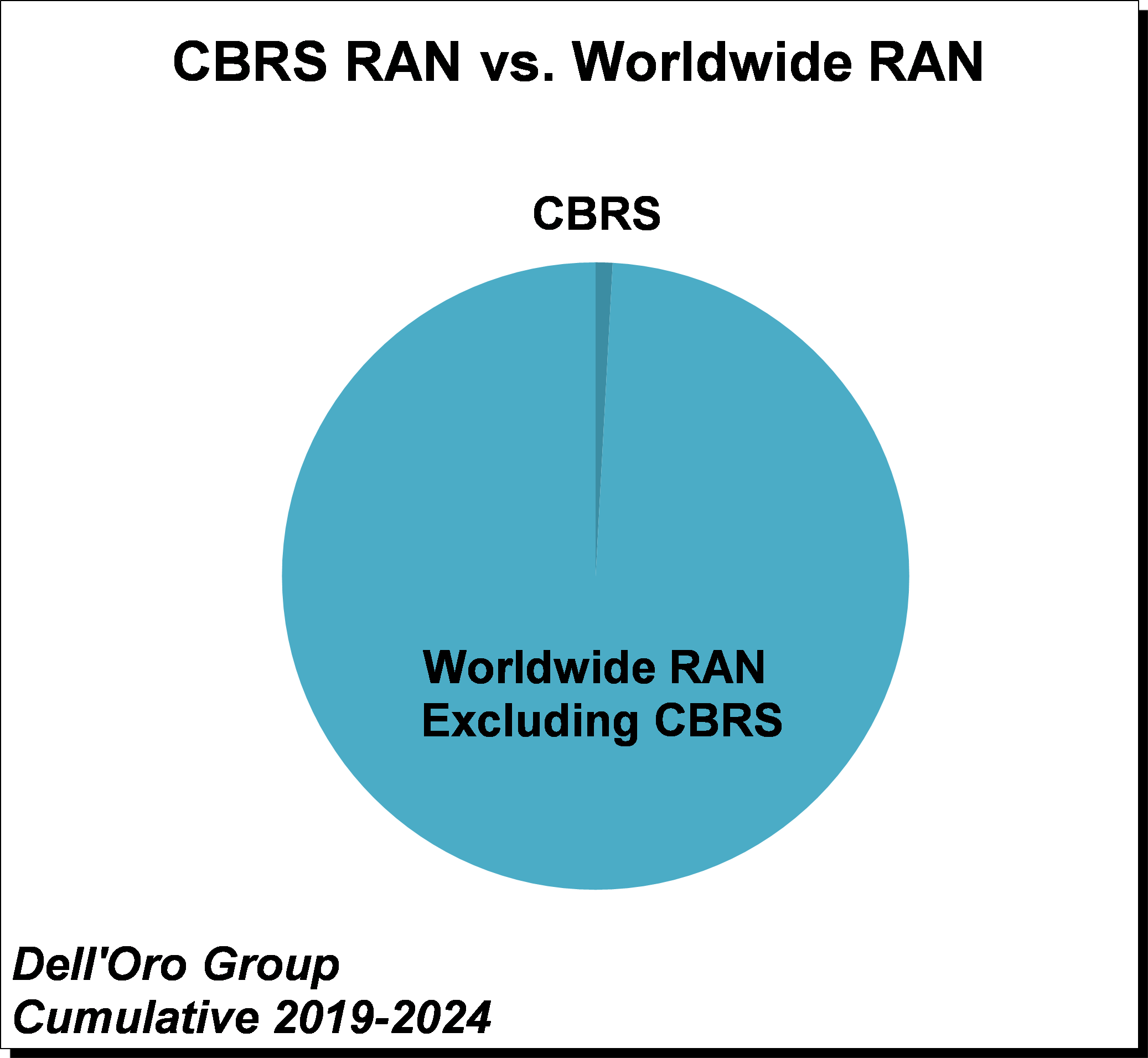

- Within the technology segments, mid-single digit growth in Optical Transport and RAN was more than enough to offset weaker demand for Microwave Transport and Broadband Access equipment. The two largest equipment markets in the year were Mobile RAN and Optical Transport, together accounting for about 55% of the overall telecom equipment market.

- The RAN market surprised on the upside and performed better than expected in 2019, propelled by 5G RAN growth that continued to accelerate throughout the year at a torrid pace.

- The worldwide Optical Transport market continued to expand for a fifth consecutive year, recording the highest growth rate in nearly a decade. Helping to drive this acceleration is robust growth for WDM.

- Stable demand for PON equipment was not enough to offset declining investments in Cable and DSL, pushing the overall Broadband Access Market to a fourth consecutive year of declining revenues.

- The efforts by the U.S. government to curb Huawei’s rise has so far had mixed results – we estimate Huawei’s overall telecom equipment share continued to improve in 2019, but the pace of the 2019 share growth was weaker than its average 2014-2019 share growth.

- ZTE’s revenue share improved by about 2 percentage points in 2019, reflecting a robust recovery since the U.S. ban during 1H18.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Mobile Radio Access Network (RAN), Optical Transport, Service Provider (SP) Router & Carrier Ethernet Switch, and Telecom Capex.