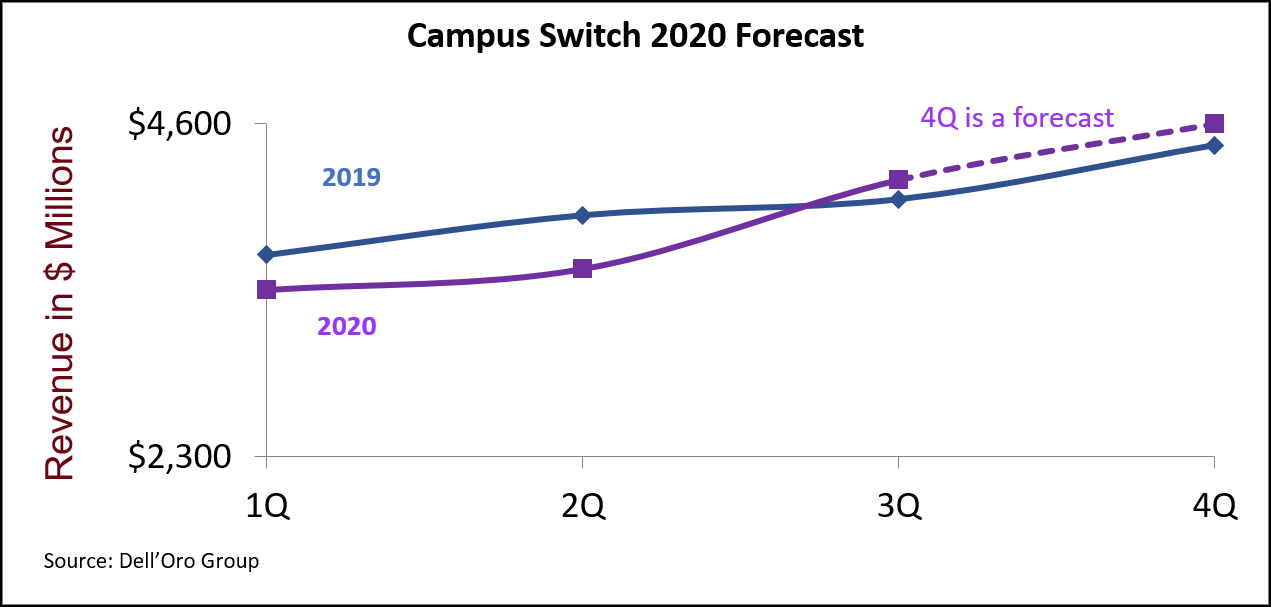

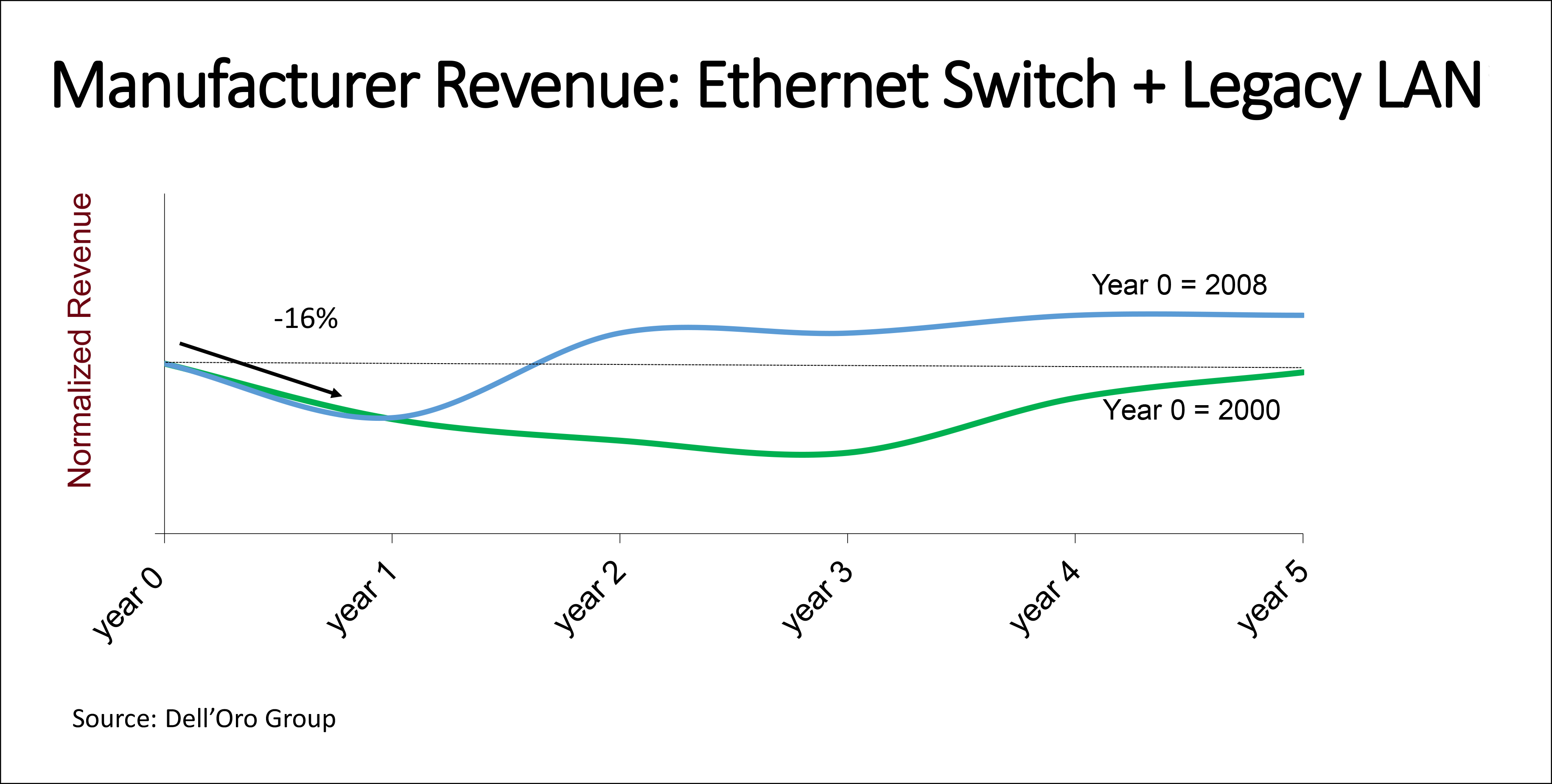

Campus switches are used for the purpose of connecting users and devices to the corporate Local Area Network (LAN). With the Work from Home or from Anywhere predicted to become a permanent aspect of the future of work, one of the fundamental questions is whether there is room for growth in the campus switch market. And if so- where will this growth come from?

We just published the latest edition of our 5-year forecast for the campus switch market. In the report, we discuss some of the negative impact from the pandemic such as the following:

-

- Downward pressure on the number of campus switch ports needed to be installed: A more distributed workforce, working remotely either from home or from smaller distributed office spaces, will negatively impact the number of switch ports needed in those campuses. Initial data on commercial real estate, for example, suggests that prices are expected to fall significantly in 2020 and 2021 as demand for new office buildings is suppressed, which will in turn affect demand for campus switches.

- Further cannibalization from WLAN: We expect WLAN to become more favorable for user connectivity than wired Ethernet, as it supports features and services that help businesses comply with re-opening guidelines, such as contact tracing, people counting, and other location-based services. Additionally, our interviews revealed that companies need to provide real mobility to the employees working from home. When these employees return to their offices, even in smaller numbers, their companies want to connect these users via Wi-Fi, as well, so as to maximize use of office space.

Despite the potential downside risk from COVID-19, we expect that the pandemic will also have some upside impact that will drive the market recovery, as detailed below:

-

- Accelerated pace of digital transformation initiatives: Our interviews revealed that customers may be putting many budgets on hold, except for automation. We also learned that the timeline of some of these automation and digital transformation projects has been pulled in by about one to two years. Although the majority of IoT devices will be on wireless, some devices such as security cameras, industrial lighting or some sensors are expected to remain on wired Ethernet.

- A greater portion of higher-priced PoE devices: We expect IoT devices to drive an increased portion of the higher-priced PoE ports. We expect this trend to help boost market average selling prices (ASPs).

- Accelerated pace of the campus switch refresh cycle: We expect the adoption of digital transformation to accelerate the pace of the campus switch refresh cycle. In order to enable digital transformation, the network must undergo numerous changes. Automation, security, visibility, and analytics/intelligence are several added functionalities that IT managers need for the new digital era.

Any other impact from the pandemic on the campus switch market?

The pandemic is also expected to accelerate the adoption of Cloud-managed switches to accommodate the distributed workforce. Additionally, our interviews with end-users, system integrators, and VARs revealed an increased interest in Network as a Service (NaaS) during the pandemic, an interest that is expected to persist even after the pandemic ends.

If you need to access the full report to obtain revenue, units, pricing, relevant segmentation including regions and vertical markets, etc., please contact us at dgsales@delloro.com.

About the Report

|

About the Report

About the Report