More stability is expected in 2026. After two steep years of declines that erased roughly $8–9 B of RAN revenue between 2021 and 2024, preliminary findings indicate that market conditions continued to stabilize in the third quarter. This supports the flat-growth thesis we have been communicating for some time and reflects both the maturation of the 5G network and the limited RAN upside beyond traditional consumer-driven MBB, including FWA, private wireless, and premium MBB.

Reflecting on the year and the expectations outlined for 2025, it appears that the high-level message that RAN conditions are improving is mostly correct, though with some regional caveats. Europe, the Middle East, and Africa (EMEA) is performing better than initially expected, in part due to currency exchange rate fluctuations. At the same time, 5G activity in India is coming in below expectations, partly due to coverage delays with the smaller carriers.

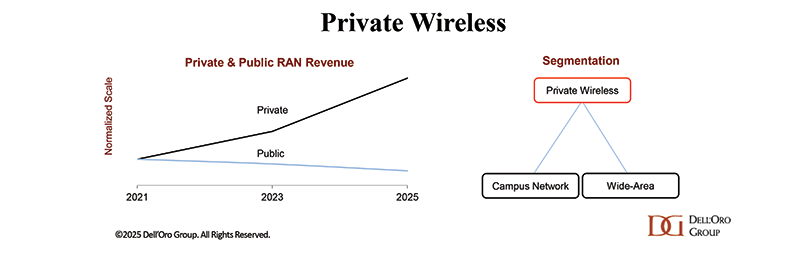

The results are mixed across the emerging RAN segments. Private wireless growth is in line with expectations. Preliminary findings from the recently updated Private Wireless report suggest that the positive momentum driving the roughly 40% increase in 2024 extended into 1H25, with worldwide private wireless RAN revenue accelerating rapidly in the first half. And even though Open RAN is stabilizing, growth is still landing at the low end of the 5% to 10% target for the year, in line with market conditions in the U.S. and Japan and the pace of adoption in Europe.

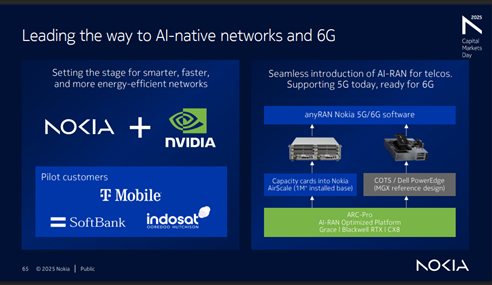

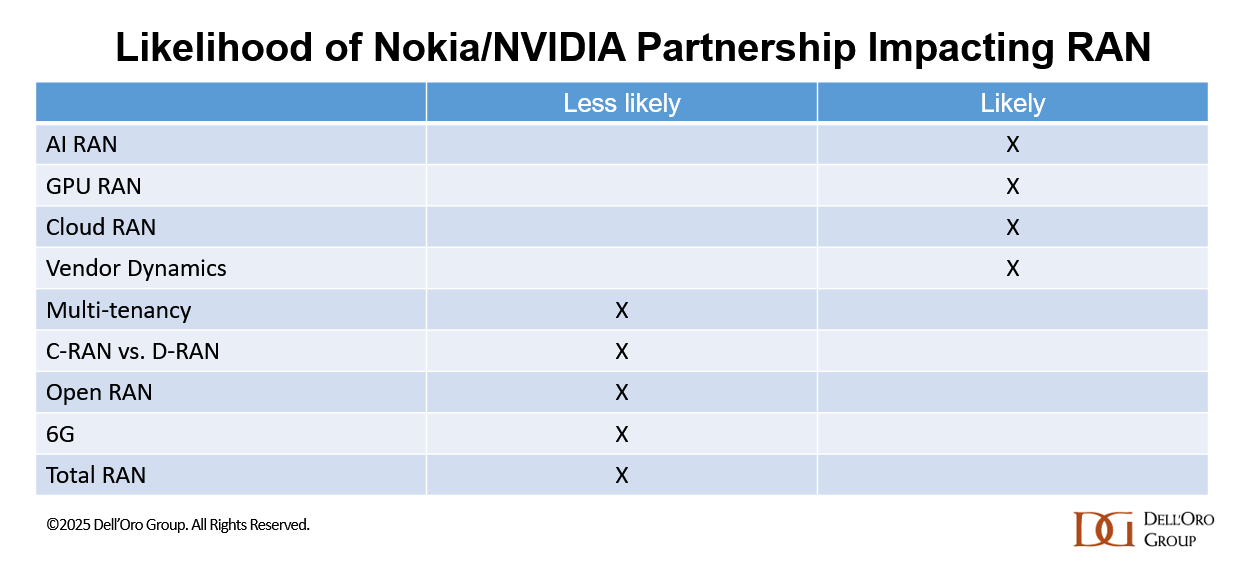

Looking ahead to 2026, we expect more of the same with stable overall investments dominated by regional MBB variations. At the same time, growth prospects will remain favorable with select RAN segments, including 5G, AI RAN, Open RAN, Cloud RAN, and Private Wireless.

Stable RAN in 2026

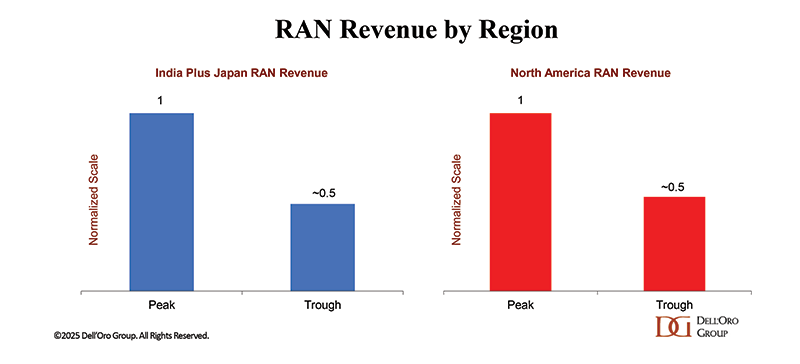

We have not made any material changes to the short-term outlook and continue to expect both wireless capex and RAN to remain mostly stable in 2026. Although the underlying drivers shaping the RAN market—slower 5G coverage expansion and mobile data traffic growth/capacity investments, ongoing monetization challenges, and limited upside from growth vehicles—are unlikely to change, regional variations should even out next year as growth in North America and APAC outside of China helps to offset weaker investments in China. While there is still uncertainty around the optimal steady-state capital intensity levels in the post-peak 5G phase, we remain cautiously optimistic that growth prospects in markets with steep peak-to-trough setbacks will remain more favorable in 2026.

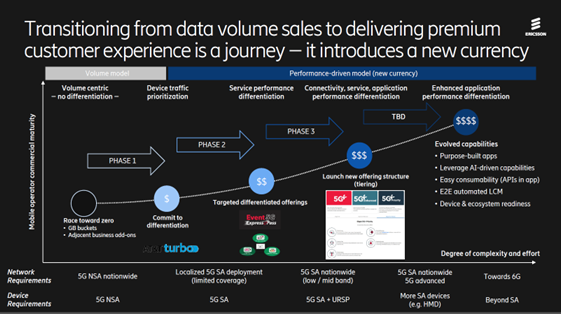

Suppliers are cautiously optimistic that the improved momentum around 5G SA and premium MBB could improve RAN growth prospects as operators move beyond the coverage/capacity-driven capex and focus more on performance improvements to enable differentiated services while also addressing different UL/DL ratios.

While the networks need to evolve to support changing end-user trends and evolving performance-driven models, we are not forecasting any performance differentiation-driven capex boost in 2026.

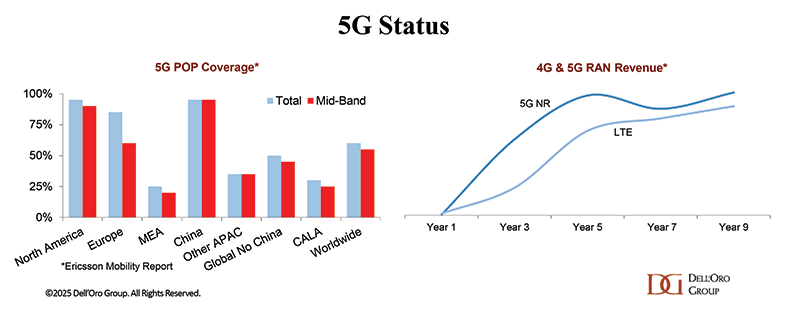

5G is still growing

5G has made significant progress, but further investment is needed to improve coverage, capacity, and overall performance. According to Ericsson’s latest Mobility Report, 5G now reaches roughly 60% of the global population. We estimate that the installed base of 5G macro gNBs represents only about half of the eventual end-state target when accounting for all frequency variants. At the same time, year-over-year comparisons are becoming more challenging, which will weigh on growth prospects. Even so, global 5G RAN growth is expected to remain healthy in 2026, expanding at a modest pace across both macro and small-cell deployments. The overall RAN market, however, is expected to remain stable, as sharply declining 4G investments offset the gains in 5G.

Private Wireless Campus Network to top $1 B

The overall private wireless market remains on track to outpace public RAN growth, increasing by roughly 20% in 2025, supported by both wide-area and local deployments. Looking ahead, private wireless adoption is expected to continue advancing at a healthy pace. Although the overall private wireless RAN growth rate is projected to moderate slightly in 2026—rising 10% to 20%—private wireless campus network RAN revenue is forecast to surpass $1 B. This outlook is underpinned by 1) increased availability of local and shared spectrum, 2) growing enterprise awareness of private cellular benefits, and 3) improved TCO and simplified solutions.

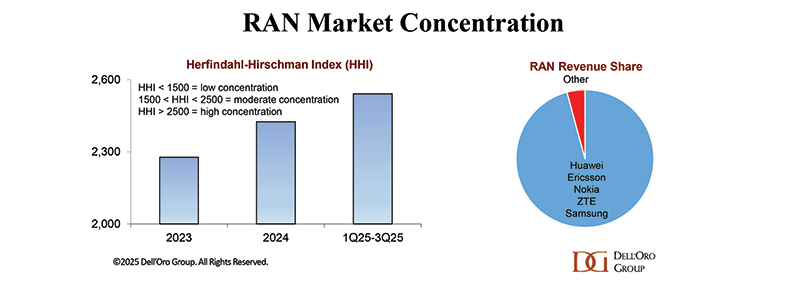

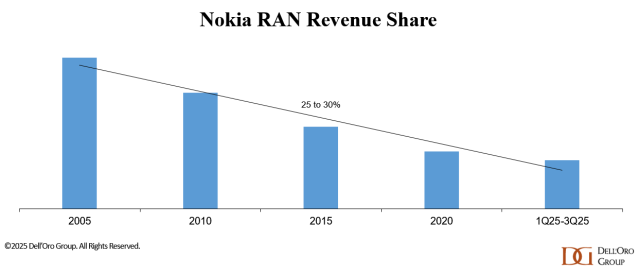

RAN Concentration to remain stable/increase

RAN is becoming more concentrated and divided. Preliminary findings suggest the top five RAN suppliers accounted for 96% of the 1Q25-3Q25 RAN market, up from 95% in 2024. The rise in concentration reflects the status of the smaller suppliers and the share developments among the top suppliers. Given current contract swap visibility and the lack of progress with the smaller suppliers to change the status quo in greenfield settings, the base case is for RAN concentration to remain stable, with a possible increase in 2026.

In summary, the RAN market is adjusting to a post–5G peak-rollout environment characterized by slower data traffic growth and few catalysts likely to alter the flat-growth outlook. Global RAN projections remain essentially unchanged, with the market expected to hold steady in 2026. Beneath the flat topline, however, several segments—including private wireless, 5G, Open RAN, Cloud RAN, AI RAN, and small cells—are still poised for growth. In other words, while overall revenue growth will be muted, 2026 should nevertheless be an eventful year.