At the end of each year, I like to reflect on the key trends that I believe will drive the products, purchasing, and messaging in the year ahead. I review the past year’s meeting notes and marvel, once again, at my good fortune in speaking frequently with intelligent people. Then, I try to read between the lines to figure out if anything I learned in those meetings foreshadows what’s to come.

I then balance my insights and predictions with the noise from CES as it opens a new year of trade shows. With my inbox full of new product announcements, I can’t help but wonder if products showcased at CES will set the tone for the rest of the year. Will the latest WiFi router, gaming console, and series of IoT devices be the next game changers? Or will they fall flat like so many other consumer products?

This year, I believe that one of the biggest trends we will see is a fundamental shift in how consumers and service providers think about home networking. A confluence of technologies reaching the market at the same time will have a positive impact on the capabilities and management of home networks, including:

-

- WiFi 6: For many years, the evolution of WiFi has been focused on improving two key technical attributes: speed and range. WiFi 6, however, is the first iteration to take a holistic view of wireless technology that encompasses improvements in speed and range as well as network intelligence, analytics, and power efficiency. WiFi 6 also has the capacity to dramatically improve how service providers will be able to provision, manage, troubleshoot, and analyze their in-home networking services. It provides options for remote, zero-touch provisioning of devices and services as well as automatic adjustment of WiFi channels to ensure peak performance.

- 6GHz Spectrum and WiFi 6E: With so many new connected devices competing for available channels and bandwidth on both the 2.4GHz and 5GHz frequency bands, the WiFi Alliance is introducing WiFi 6E, which uses the unlicensed 6GHz band. In 2020, we expect that many countries will provide access to the 6GHz band. This means that a huge chunk of unused spectrum will become available for the growing number of residential and enterprise WiFi devices. More importantly for cellular operators rolling out 5G networks, the 6GHz spectrum band will allow the provision of seamless handoffs to mobile devices in homes and offices where their networks might have had difficulty penetrating walls and treated windows. There has been much discussion about the pending boom in AR (Augmented Reality) and VR (Virtual Reality) applications for a number of years. With the availability of the 6GHz spectrum, those applications can be delivered, in theory, without fear of latency due to channel contention. 6GHz will provide fourteen additional 80MHz channels and seven 160MHz channels. These will be needed for the intense, high-bandwidth applications.

- Simplified Control: If you were to compare the user interfaces (UIs) of home gateways and routers from just two years ago to those available today, you’d be hard-pressed to find an area that has seen more positive evolution. But 2020 will see even greater transformation in an effort to give subscribers total and intuitive control over their broadband subscriptions. Voice control of broadband services is one of the areas that we expect will see the most growth. Google’s Nest WiFi mesh systems now include voice control and allow users to verbally turn on a guest network, reboot the system, and initiate parental controls and speed tests. Quietly – and just before the end of last year – Amazon announced Alexa-enabled voice control of its eero routers as well as those from ARRIS/Commscope, Asus, Belkin, Netgear, and TP-LINK. The feature is called Alexa WiFi Access. We expect to see this service integrated across a wider range of devices during the year, including integration into service provider-supplied gateways, particularly those from U.S. cable operators.

These technology developments, coupled with the ratcheting up of competition between service providers and consumer electronics companies for home network dominance, will allow consumers to have substantially better control of their WiFi networks in 2020.

Fast-Tracking DOCSIS 4.0, DAA, and 10Gbps

It seems like just yesterday when details emerged surrounding DOCSIS 4.0, which combines two next-generation technology options for cable operators — Extended Spectrum DOCSIS (ESD) and Full Duplex DOCSIS (FDX) — into a single standard with the aim of delivering 10Gbps services to all customers. CableLabs started drafting the specifications last year. Just this week, the company confirmed that the draft version will become available in the first half of 2020.

At the same time, cable operators are expected to launch their first 10Gbps services this year. However, these deployments are not expected to be tied to the DOCSIS 4.0 specification. Instead, they will rely on 10G EPON from remote OLTs located in traditional optical node housings. While focused on Full Duplex DOCSIS to support the mass market delivery of 10Gbps services to existing residential customers, Comcast is also sprinkling in 10G EPON in greenfield deployments, particularly in regions where it competes with fiber-based ISPs. Other cable operators are following a similar path. But instead of Full Duplex DOCSIS, they will rely on ESD. In both cases, outside plant spectrum will be increased to 1.8GHz.

Regardless of which DOCSIS 4.0 technology path a cable operator decides to follow, a precursor to these deployments will be the rollout of distributed access networks. With the DOCSIS 4.0 standard establishing a clear path forward, cable operators can now move ahead with their remote PHY and remote MACPHY deployments to solve immediate headend space and power consumption issues. At the same time, they can feel confident that any DOCSIS 4.0 technology decision they make will start them on the path toward 10Gbps services.

In 2020, we expect cable operators to ramp up their spending on upstream channel capacity in an effort to improve the subscriber experience with services such as online gaming, as well as reducing the time it takes to upload videos to the cloud. A number of operators have already moved to, or are in the process of moving to, mid-split architectures as they pull fiber deeper into their networks. Mid-split architectures allow cable operators to increase upstream capacity from 5-42MHz to 85MHz, providing a theoretical maximum of around 300Mbps of upstream bandwidth. Like DAA, moving to mid-split is another step on the path toward DOCSIS 4.0. With the implementation of 1.8GHz of spectrum, mid-split will allow an upstream path to span up to 684MHz, a nearly 10x improvement over today’s prevailing upstream rates. More importantly, the move to 1.8GHz will allow operators to flexibly operate on six different upstream path splits, resulting in multi-gigabit services.

Other Trends to Watch

In addition to these trends, we expect to see a significant jump in virtualized access platform deployments. The second half of 2019 saw a major ramp in virtual CCAP deployments. Once again, this growth was largely driven by Comcast, as it continues to expand its R-PHY deployments. We expect this trend to continue both within Comcast and among its peers, particularly Cox Communications and Videotron in Canada.

Outside of cable, we expect to see AT&T make headway in its virtual OLT rollout using XGS-PON. In September, the operator said that it expected to have 100% of its core network traffic controlled by SDN. This was step one in its long-term CORD vision. Access platforms, such as OLTs, will receive the virtualization focus in step two. Though we don’t expect to see any pure white box OLTs in AT&T’s production network in 2020, we do expect to see announcements of SDN control of a good portion of the operator’s access network by the end of the year.

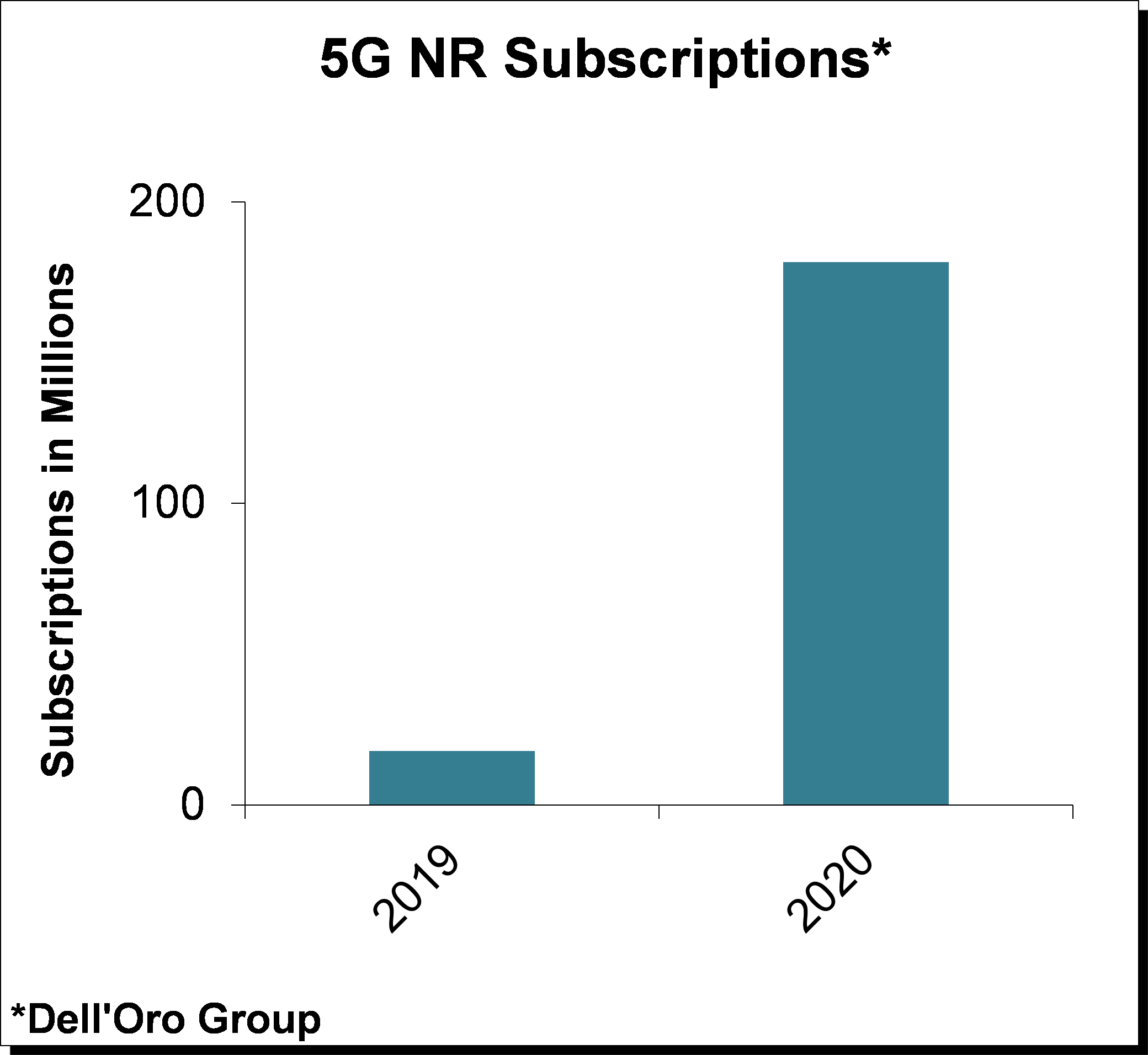

The end-user ecosystem is developing at a rapid pace with multiple chipsets, devices, and phones supporting both NSA and SA for the low-, mid-, and mmW- spectrum now commercially available. While TDD has dominated mid-band and mmW deployments to date, FDD-based 5G NR phones became a reality in 2H19 and will proliferate in 2020.

The end-user ecosystem is developing at a rapid pace with multiple chipsets, devices, and phones supporting both NSA and SA for the low-, mid-, and mmW- spectrum now commercially available. While TDD has dominated mid-band and mmW deployments to date, FDD-based 5G NR phones became a reality in 2H19 and will proliferate in 2020.