2019 Broadband Access Market Outlook: Part 3 of 4

Very few subscribers will ever praise their service provider’s customer service. Improving customer service has always been a challenge for major operators, regardless of the service. But with advances in AI and tools for network automation, operators can fundamentally change the customer experience. Major operators–including AT&T Inc., Comcast, and Bell Canada–will implement a combination of AI and network automation as part of their overall network virtualization efforts.

2019 will see the roll out of AI capabilities for the express purpose of providing proactive data management as operators move toward full network automation. For operators, the following use cases and applications will see the light of day this year:

- Machine learning and proactive network maintenance, or PNM, to regularly poll active electronics and detect and troubleshoot issues before they impact end subscribers.

- Software-defined networking (SDN) and network functions virtualization (NFV) will provide far more visibility into individual and collective network elements. They will proactively alert network operations centers (NOCs), about potential hiccups.

- Virtualization of customer premises equipment (CPE) to allow for customer self-installation and management without contacting customer service to initiate a new service.

- Monitoring of traffic flows and data usage combined with algorithms to automate speed boosts when customers increase their data consumption.

Comcast, via its X1 service and platforms, is beginning to roll out a number of these capabilities in its effort to reduce truck rolls and improve the overall customer experience. 2019 will see the expansion of these efforts across a much broader range of network operators, including AT&T, Verizon Communications Inc., NTT DOCOMO, British Telecom, and others.

In Part 4, I will examine the ways that operators continue to push further into the home.

Related blogs:

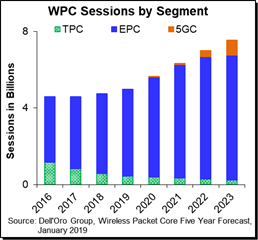

“Initial 5G New Radio (5G NR) network launches are being implemented with 5G Non-standalone (5G NSA) architectures that utilize the 4G Evolved Packet Core (EPC); therefore we have pushed out by one year (from 2019 to 2020), our expectations of when we will see the first commercial deployments of 5G Core,” said Dave Bolan, analyst with the Dell’Oro Group.

“Initial 5G New Radio (5G NR) network launches are being implemented with 5G Non-standalone (5G NSA) architectures that utilize the 4G Evolved Packet Core (EPC); therefore we have pushed out by one year (from 2019 to 2020), our expectations of when we will see the first commercial deployments of 5G Core,” said Dave Bolan, analyst with the Dell’Oro Group.