In this blog, Sameh Boujelbene, Senior Research Director for Data Center Switch Ethernet, will share two key takeaways from the OCP Global Summit’22 event related to SONIC adoption and high-speed optics.

At the end of April, Nokia, a fairly new entrant to the data center switch space, made the groundbreaking announcement that the company will be supplying its 7250 IXR networking gear to Microsoft, the third-largest Cloud Service Provider (SP).

As I noted in my 2022 prediction blog published earlier this year, I have been anticipating a fair number of new switch vendor insertions at the large hyperscalers in 2022, as the 400 Gbps upgrade cycle starts to materialize outside of Google and Amazon. Silicon diversity would be one of the major reasons for these potential changes in the vendor landscape, as these hyperscalers need to keep pricing pressure on Broadcom, the dominant merchant silicon supplier to date. Supply challenges further accelerated the need for silicon diversity. However, what is intriguing is that Nokia’s 7250 IXR is based on Broadcom’s merchant silicon, not Nokia’s FP5 proprietary chips. So what will Nokia bring to the table?

What’s in it for Microsoft?

Although Nokia is a fairly new entrant in the data center switch space, the company is among the leading vendors in the router market and in several other Telecom SP segments. Clearly, Nokia has significant experience in systems design, which – as we learned from the company’s spokesperson – allowed it to achieve power savings at a system level. As a reminder, as network speeds move to 400 Gbps and beyond, power consumption becomes one of the most constraining factors that limits what Cloud SPs can build and deploy in their data centers. In fact, Microsoft already faced this challenge with its 400 Gbps deployment, as it had to wait for Broadcom’s Jericho 2C+ chips that consume less power than their prior generation of Jericho 2 counterparts.

Furthermore, Nokia has made significant contributions to the SONIC ecosystem. (SONIC is the open-source software built by Microsoft that runs in its data center networks.) We view this Microsoft data center win as a reward for the company’s contribution. In fact, this quid pro quo relationship expands well beyond the data center win into several other areas. For example, Nokia is also working with Microsoft on developing 4G LTE and 5G private wireless for the enterprise segment. This collaboration brings together Nokia’s virtualized radio access network (vRAN) and multi-access edge cloud (MEC) with the Azure Private Edge platform.

Additionally, Nokia has the potential to leverage its coherent optics technology; which the firm obtained with its Elenion acquisition to drive cost and power savings at a system level for data center interconnect (DCI) applications.

Last, but not least, although Nokia’s 7250 IXR is built on Broadcom’s silicon which does not satisfy the silicon diversity requirement, it will nonetheless provide Microsoft with another route to access Broadcom chips, which is critical in a supply-constrained environment.

Where will Nokia’s 7250 IXR be deployed?

The initial deployment of Nokia’s modular switches will occur in the spine, which Microsoft refers to as Tier 2, but may expand to DCI applications at a later stage. As a reminder, Microsoft has been deploying predominantly Arista in Spine/DCI but has also recently qualified Cisco (with its silicon one-based 8000 chassis). Nokia will also supply fixed form factors for Top-of-Rack (ToR) applications. It is worth noting that Microsoft has always had a multi-vendor strategy for its ToR applications, where volume is high but the margin is thin. So far, the company has deployed a mix of Cisco, Dell, and Mellanox (Nvidia).

What does this mean for incumbent vendors?

While we view this announcement as a major win for Nokia and as validation of its competitive positioning in the data center switch market, we believe that Microsoft will strive to keep its existing suppliers happy and provide them with enough motivation to compete for its business. Our interviews revealed that Arista is expected to remain the preferred supplier for spine/DCI applications at Microsoft during the 400 Gbps upgrade cycle. Additionally, we expect Microsoft to go through major expansion and upgrade activities this year and that its data center spending will be strong enough to benefit all vendors – incumbents as well as new entrants.

For more details and insights on cloud service providers’ data center network design and a list of suppliers, please contact us at dgsales@delloro.com.

We’ve just wrapped up the 4Q21 reporting period for Dell’Oro Group’s enterprise network equipment programs, which include campus switches, enterprise data center switches, SD-WAN & enterprise routers, network security, and Wireless LAN. Enterprises include businesses of all sizes as well as government, education, and research entities. The equipment tracked in these programs can be used for wired or wireless data communication in private and secure networks.

Sales Hit Record Level in 2021

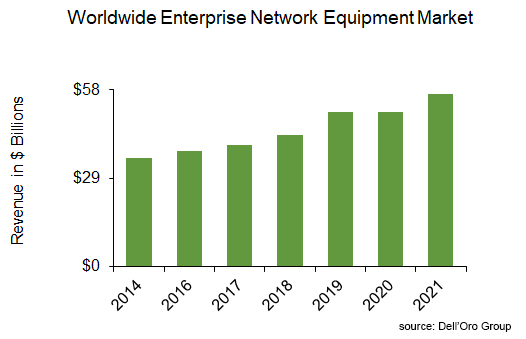

Despite a macro-economic environment that continues to be defined by supply constraints, our reports showed a strong rebound in the overall Enterprise Network Equipment market in 2021, following some stagnation in the prior year. Sales jumped 12% year-over-year (Y/Y), propelling the market to a record- level in 2021.

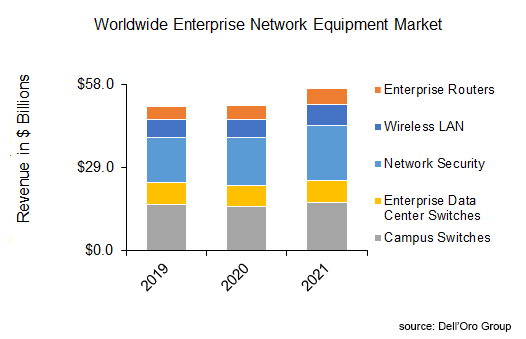

The strong performance was broad-based across all technology segments. Enterprise Routers, Wireless LAN, and Network Security were all up double-digits. In the meantime, Campus and Enterprise Data Center Switches were up mid-to-high single digits. All technology segments hit record-revenue level in 2021.

We have calculated that spending on enterprise network equipment rose by nearly $6.0 B in 2021. Security accounted for 40% of the increase in spending, while campus switches accounted for a quarter of the increase.

We attribute this broad-based recovery to the following:

- Continuing improvement in macro-economic conditions.

- Continuing government spending and stimulus around the world.

- Network upgrades in preparation for workers returning to the office full or part-time.

- Digital transformation initiatives, accelerated by the pandemic, are driving new network requirements and putting pressure on IT managers to upgrade their networks and add different security layers.

- Orders pulled in from future quarters, to mitigate ongoing supply challenges that are adversely affecting product availability, lead times, and prices.

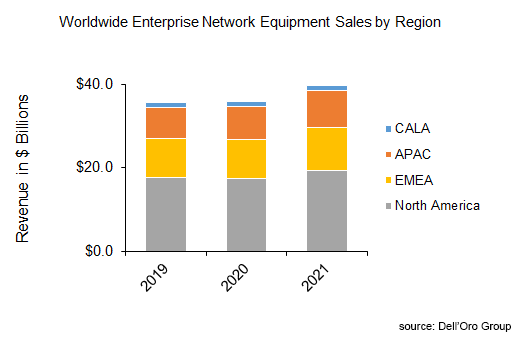

The 2021 robust performance in the Enterprise Network Equipment market was broad-based across all regions, except the Caribbean and Latin America, which was flattish (although showing a significant improvement from the high-single-digit decline registered last year).

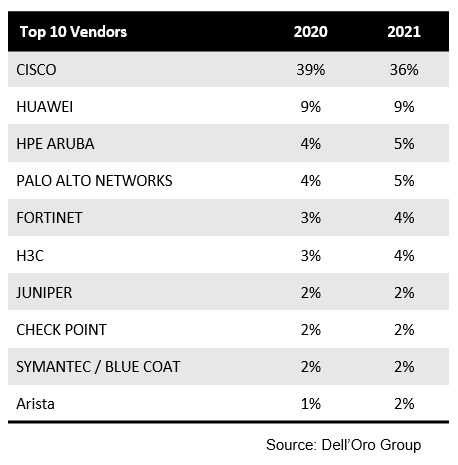

Cisco Loses Some Ground — Still Leads the Enterprise Network Equipment Market

The analysis shared in our reports showed no major change in vendors’ ranking. Cisco remains the only vendor with more than 10% share in the market, although the firm lost three points of revenue share in 2021. This share loss was broad-based across all technology segments, except WLAN. In the meantime, HPE Aruba, Palo Alto Networks, Fortinet, H3C, and Arista, gained one point of revenue share, each.

Nevertheless, we would like to note that the vendor landscape continues to be defined by a challenging supply environment and that some of the share shifts witnessed in 2021 may not be necessarily reflective of competitive displacement, but rather the timing of order fulfillment.

Robust Market Outlook for 2022

Despite a challenging supply environment that is expected to persist through most of 2022, Dell’Oro analysts are projecting strong double-digit revenue growth in the Enterprise Network Equipment market in 2022. This optimism is underpinned by healthy outlooks provided by most vendors as a result of increased visibility and robust backlogs. Additionally, ongoing supply challenges will continue to encourage customers to place advance orders, which will have a positive effect on bookings first, then a few months later, on revenues, depending on lead times.

Dell’Oro Group Enterprise Network Equipment research programs consist of the following: Campus switches, Enterprise Data Center Switches, SD-WAN & Enterprise Routers, Network Security, and Wireless LAN.

At the beginning of each year, we analysts like to look backward and reflect on our predictions for the prior year to review what we got right and what we got wrong, and then look forward in order to predict how the new year may unfold and what technology trends may shape our forecast.

In reviewing my 2021 predictions, published a year ago, I’m delighted to report that the 2021 data center switch market unfolded pretty much in line with my expectations, with sales up high single-digit-to-double digits. Growth was broad-based across the Cloud segment (up by double digits) as well as the non-Cloud segment (up in the mid-single digits). Note that the growth in the non-Cloud segment was mostly driven by large enterprises (comprised mainly of the Fortune 2000 companies).

The Data Center Switch Market Spotlight Will Continue to Shine in 2022 if Supply Permits

We are currently projecting that the data center switch market will grow by double digits in 2022, with the Cloud segment growing almost at twice the rate of the non-Cloud. Although the panic purchasing behavior fueled by ongoing supply challenges is one of the major drivers for such a robust market forecast, there are also some fundamental catalysts behind the strong demand we expect to remain in the market. For the Cloud segment, we expect increased network spending propelled by the following:

- accelerated adoption of 200/400 Gbps at Microsoft and Facebook, as explained later in this blog

- expansion cycles at some of the large hyperscalers, further fueled by new AI (artificial intelligence) workloads

- ongoing pent-up demand at Tier 2/3 Cloud Service Providers (SPs)

As for the non-Cloud segment, we expect the demand to be fueled by an accelerated pace of digital transformation.

Despite our optimism, supply constraints may continue to threaten market performance. As a reminder, despite the robust sales growth witnessed last year, supply fell short of demand. Based on our interviews with system and component vendors, as well as some of the Value Added Resellers (VARs) and System Integrators (SI), we do not expect the supply situation to improve until the second half of this year.

200/400 Gbps adoption to Accelerate Beyond Google and Amazon

Although 2021 market performance was pretty much in line with our predictions, 200/400 Gbps shipments fell short of our expectations. 200/400 Gbps shipments have been so far consumed mostly by Google and Amazon, and we have been predicting that deployment at Microsoft and Meta (Formerly known as Facebook) should start to accelerate in 2H21. However, while shipments were on track with our predictions, recognition of the revenues from some of those shipments has been deferred due to a pending qualification cycle. Hence, we did not reflect these 200/400 Gbps deployment at Microsoft and Meta in our reports. We expect revenue from these shipments to be recognized this year, and project the 200/400 Gbps ports to more than double in 2022.

800 Gbps Shipments May Debut at Google

While 200/400 Gbps shipments have barely started to take off at Microsoft and Meta, we expect Google to deploy 800-Gbps this year. 800-Gbps deployment will be propelled by the availability of 800-Gbps optics, which provide significantly lower cost per bit than two discrete 400-Gbps optics (about 25–30% lower cost). Additionally, 800 Gbps enables lower cost per bit at a system level. With the availability of 100 G SerDes technology, switch chip capacity will essentially double, from 12.8 Tbps to 25.6 Tbps. 800 Gbps ports will allow those chips to be configured in 1 U fixed factor as 32 ports of 800 Gbps (with each port potentially configured as 2×400 Gbps or as 8×100 Gbps).

Silicon Diversity Will Become More Pronounced

Silicon diversity at large Cloud SPs’ networks has been a theme over the past few years, fueled by the need to put pressure on Broadcom, which has dominated the merchant silicon space to date. We expect the increased number of viable merchant silicon suppliers such as Cisco and Marvell/Innovium—along with industry-wide supply constraints—to further accelerate this trend in 2022. As a reminder, in 2021, Marvell announced the acquisition of Innovium, giving the latter access to more engineering and financial resources, and at OCP 2021, Cisco announced that it will be supplying Meta with its Silicon One chips on the Wedge400C for Top of Rack applications.

AI-Driven Workloads to Continue to Shape Data Center Network Infrastructure

Dell’Oro Group projects that the spending on accelerated compute servers targeted to AI workloads will reach double-digit growth over the next five years, outpacing other data center infrastructure. However, AI applications are power- and bandwidth-hungry, and may require different ways to architect the network. We expect these requirements to drive faster adoption of high-speed networks and, in some cases, even some proprietary type of network architecture, which may not necessarily be Ethernet-based.

For more detailed view and insights on the data center switch market, please contact us at dgsales@delloro.com

Last week’s 2021 OCP (Open Compute Project) Global Summit marked its tenth anniversary. Fittingly, the vendor and partnership announcements were significant.

Meta (formerly known as Facebook) once again dominated the show’s headlines with product, architecture, and partnership announcements that will have a far-reaching impact on switch vendors and component suppliers. As the fourth-largest cloud service provider (SP), Meta accounts for a significant portion of total network and IT spend. Thus, the supplier ecosystem always pays close attention to upcoming changes in Meta’s data center architecture or procurement strategy.

Meta continues co-development efforts with Arista with the minipack 2 chassis design

Historically, Meta has mostly used white-box vendors in its Top of Rack (ToR) applications, running Meta’s home-grown Network Operating System (NOS) called the FBOSS, whereas in the leaf, spine, and data center Interconnect (DCI) layers, this cloud SP has mostly deployed Arista’s switches with Arista’ EOS. There has been, however, a recent concern that this relationship is in decline, as Meta’s spending with Arista has been weak in recent quarters. Some thought that white-box suppliers are muscling in on Arista’s share. However, based on multiple industry checks, we, at Dell’Oro Group, thought the softness in Meta’s contribution to Arista’s revenue was due to an interim pause in Meta’s data center capex spend.

Arista is expected to ship its recently announced 7388X5 switch to Meta in 2H21. This chassis is compliant with the minipack2 design and will support both Meta’s FBOSS and Arista’s EOS. We expect that Meta will run mostly the latter.

Meta partners with Cisco on Wedge400C for Top of Rack applications

In December 2019, Cisco announced its entry into the routing and switching merchant silicon market by allowing its latest Silicon One chips to be consumed both internally, in Cisco’s systems like Cisco 8000, and externally by customers who want to use the chip to build their own systems. The goal of this development is to help win a new footprint at the major cloud SPs, where Cisco has been losing share to white-box switch vendors. For some time, Cisco has alluded to its strong, early traction at the hyperscalers with its Silicon One chips. Yet this was the first major public announcement highlighting the new switch chip footprint at one of the top-four Cloud SPs—Meta.

Silicon diversity at large Cloud SPs networks has been a theme over the past few years, fueled by the need to put pressure on Broadcom, which has dominated the merchant silicon space to date. The increased number of viable merchant silicon suppliers—such as Cisco and Marvell/Innovium—along with industry-wide supply constraints—have further accelerated this trend.

The new Wedge400C switch is expected to be deployed in the ToR layer at Meta’s data center network, using Cisco’s Silicon One chips inside a white-box switch supplied mostly by Celestica and running Meta’s FBOSS.

How big is this opportunity for Cisco and what does it mean?

Based on our estimates as well as industry checks, we estimate the size of this opportunity will represent only less than $50 M in 2022. This move, however, will be very strategic for the firm, as we expect Cisco to penetrate other data center network tiers (leaf, spine, and DCI), where we anticipate expansion will accelerate when Meta starts to adopt some form of co-packaged optics. When this occurs, it will be crucial to dual-source network chips as well as optics. Optics represents a much greater opportunity for Cisco because it accounts for more than half of the networking spend at 200 Gbps speeds and higher.

For more details, insights on cloud service providers’ data center network design, and the list of suppliers, please contact us at dgsales@delloro.com