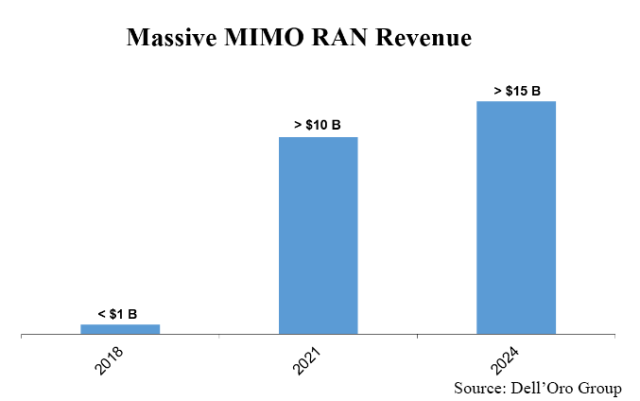

Preliminary findings suggest Massive MIMO RAN revenues reached new record levels in 2022. At the same time, year-over-year comparisons are becoming more challenging and the implications are that growth is slowing. With Massive MIMO revenues expanding at a low-single-digit rate in 2022, the timing is right to review market status and near-term expectations.

Market Status

For a technology that was initially viewed as being mostly fit for high-traffic locations, Massive MIMO has come a long way in just a few years, ramping at a much faster pace than initially expected. Our most recent analysis suggests global Massive MIMO RAN revenues, which includes baseband and radio revenues for large-scale antenna systems featuring > 8T8R sub-6 GHz LTE and NR radio configurations, increased more than 20-fold between 2018 and 2022, propelling total Massive MIMO revenues to reach new record levels.

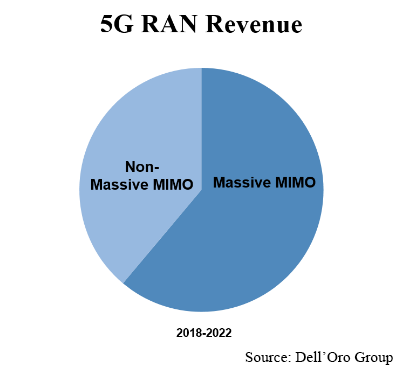

Helping to drive this output acceleration is the fact that Sub-6 GHz Massive MIMO combined with larger swaths of upper mid-band spectrum delivers superior coverage, capacity, performance, energy per bit consumption, and TCO tradeoffs relative to both the low-band and mmWave spectrum. Consequently, the Massive MIMO vs. Non-Massive MIMO ratio is typically high in the upper mid-band.

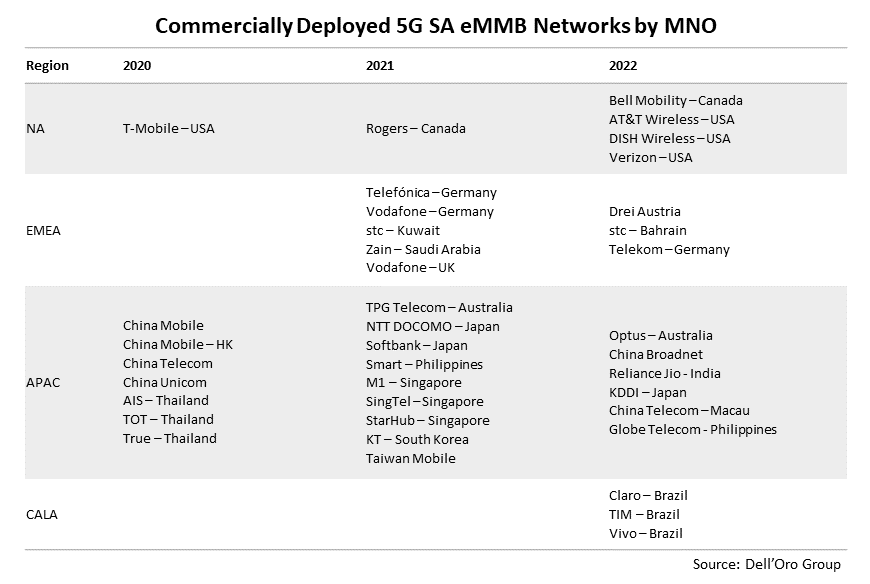

Regional adoption has been fairly broad based, driven by synchronized upper mid-band rollouts in especially the Asia Pacific region. Wide-band 5G deployments are now ramping up in Europe and North America. But as Ericsson recently pointed out, upper mid-band coverage in Europe is still just around 15% to 20%, significantly lagging the global average.

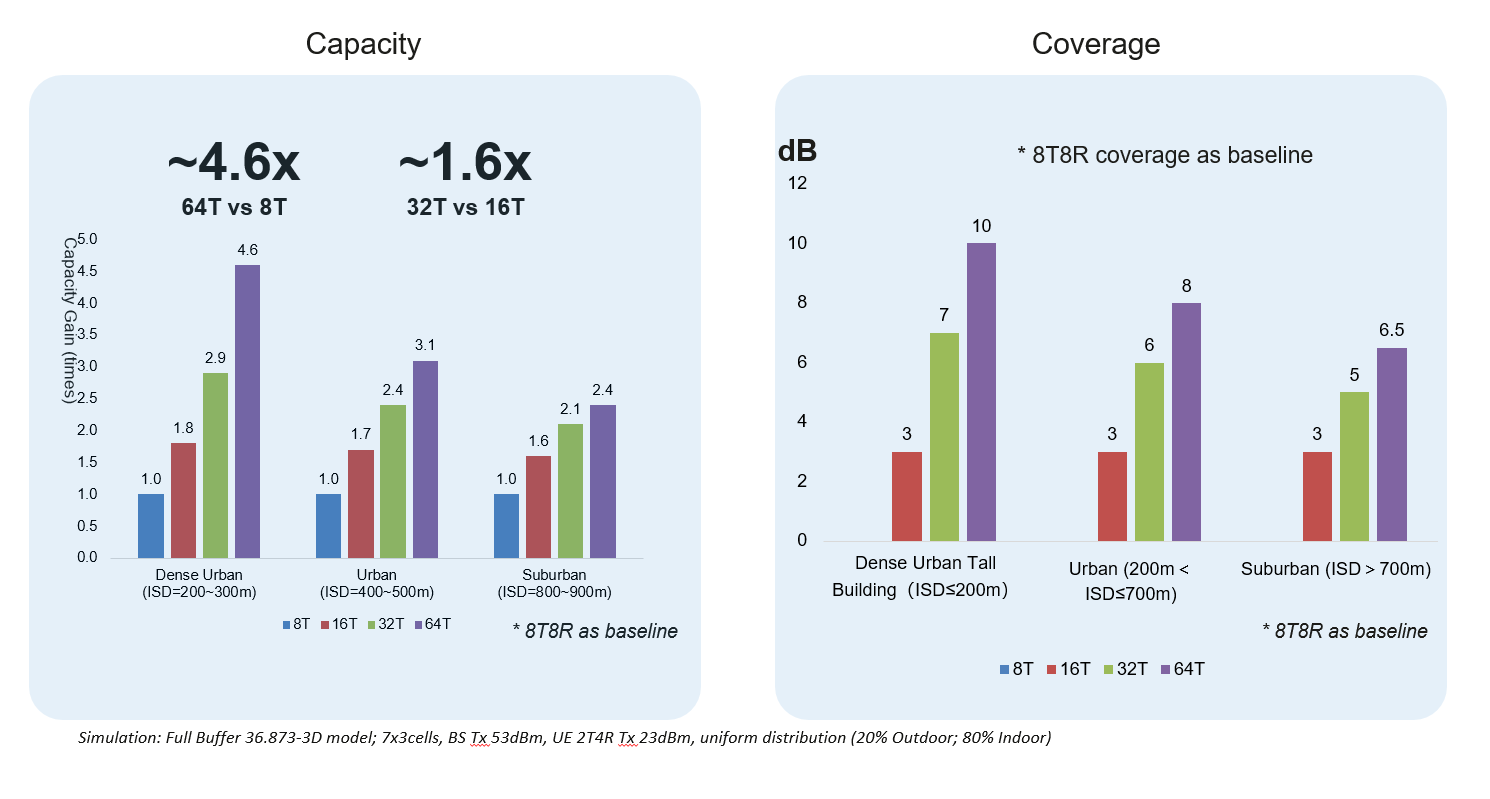

Most initial modeling was focused on the incremental capacity upside with Massive MIMO. But as we now understand, it is actually the coverage benefits with Massive MIMO and the ability for operators to leverage their existing site assets and realize nearly equivalent 5G coverage with the upper mid-band as with 4G that has been the most important attribute of Massive MIMO in this initial deployment phase.

In addition to the economic benefits, the ability to leverage the existing macro grid is also reducing the time required for network construction, which generally follows a similar pattern with operators addressing high-traffic areas first before transitioning towards less dense populations. Larger countries can realize nationwide coverage in around ~3 years while smaller countries are able to upgrade the first base layer in 1 to 2 years.

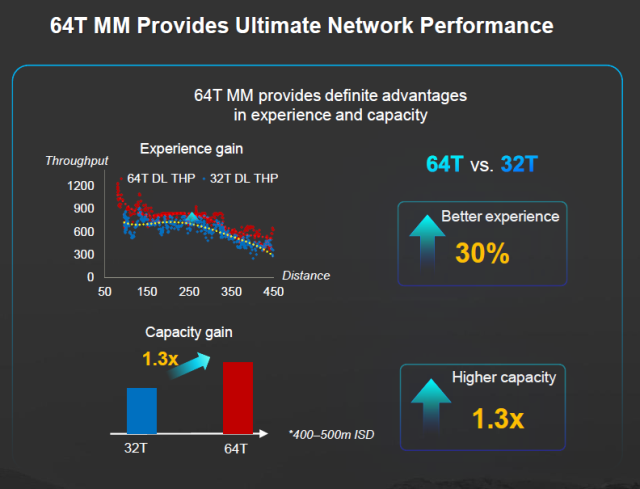

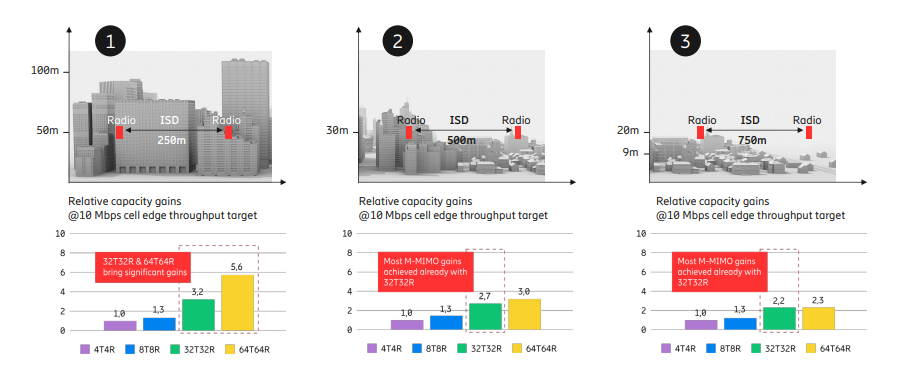

Although Massive MIMO requirements and performance will vary depending on a confluence of factors including the inter-site distance (ISD), traffic characteristics, and vertical user spread, operators in China have so far been favoring the capacity, coverage, and performance benefits with the 64T64R configuration while the 32T32R configurations have been favored outside of China, though continued innovation will likely change how operators think about this mix. One of the Korean operators is reporting performance and capacity gains in the order of 30% after upgrading the radios from 32T32R to 64T64R. And with RAN still accounting for around 15% of the overall site opex and wireless capex, the price premium with the 64T64R is justified in most scenarios with ISDs of 500m or less.

As the ISDs are increased, the relative gains slow – Per Ericsson’s Massive MIMO handbook, the relative cell-edge throughput gains with 64T64R vs. 32T32R are in the single digits as the ISD approaches 750m, boosting the business case for the 32T32R configuration.

At the same time, the 64T64R business case for greater ISDs is expected to evolve over time as technology advances and prices improve. And in some cases, vendors believe this reality is already here. Huawei recently released data suggesting the coverage and capacity gains between the 64T64R and 32T32R can already be justified in some 700m ISD scenarios.

Forecast

Following the surge in global Massive MIMO investments between 2018 and 2021, preliminary findings suggest growth slowed in 2022, in part because of the state of upper mid-band 5G and more challenging comparisons in the more advanced markets such as China, South Korea, and the US. As we look forward, Massive MIMO investments are expected to remain elevated, however, global growth is projected to soften as output acceleration in Europe, North America, and parts of APAC will be offset by slower growth in the advanced markets. Taken together, we are forecasting Massive MIMO revenues to increase by nearly 20% by 2024, relative to 2021 levels.

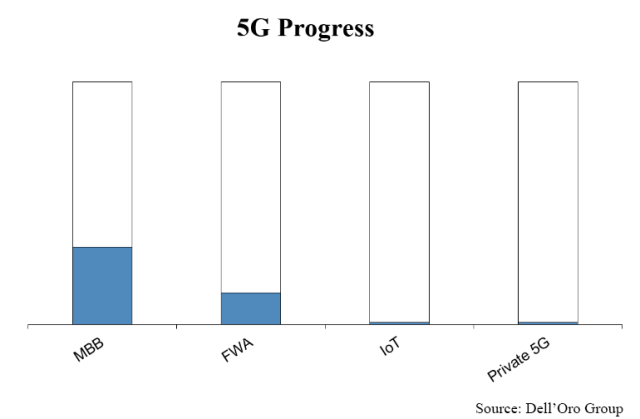

In addition to MBB, FWA will also play an important role in the broader broadband toolkit as operators figure out the right balance between the capacity requirements and the overall profitability for the various FWA segments. Huawei estimates that the improved coverage with its latest MetaAAU product can have a material impact on the FWA business case.

Next, Massive MIMO will also play a role in supporting 2 GHz FDD. This spectrum is more challenging, however, the vendors are doing everything they can to improve the form factor. And while the 2 GHz FDD Massive MIMO market will not be as large as the upper mid-band TDD market and likely be confined to hotspot scenarios, it is worth pointing out that Huawei has already deployed 20 K+ FDD-based Massive MIMO AAUs.

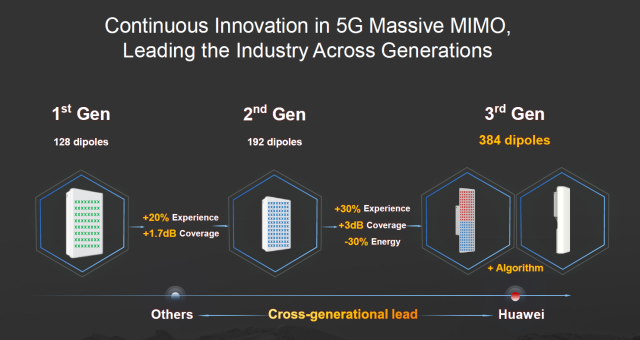

Finally, continuous product improvements are expected to shorten the lifespan relative to the standard RRU products – some operators are already swapping out Massive MIMO radios deployed just two years ago for newer more efficient, and higher-performing radios.

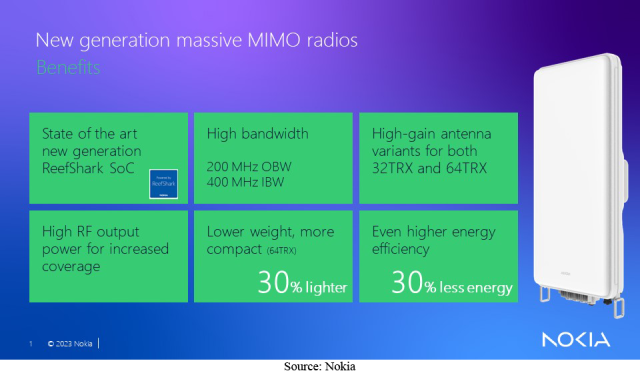

Preliminary MWC announcements suggest Massive MIMO remains a priority from an R&D perspective as the products are evolving rapidly with incremental advances improving the form factor, weight, power output, performance, bandwidth, cost, and price.

Not surprisingly, the form factor has improved rather significantly with leading vendors now offering 64T64R radios weighing just 17 kg to 20 kg, down from the 40 kg+ range just a few years ago. And both Ericsson and Huawei are now offering 32T32R AAUs weighing 12 kg and 10 kg, respectively, ideal for footprint-optimized capacity. Nokia is offering a 400 MHz BW 32T32R AAU weighing 17 kg.

Even though the Massive MIMO concept is relatively new, some vendors are already releasing 3rd generation products – Huawei’s latest MetaAAU utilizes 6 dipoles per radio chain. So compared with the traditional 192 array AAU, the extremely large antenna array (ELAA) uses 384 dipoles.

Also, Ericsson recently also announced a new range of ultra-wideband Massive MIMO radios with IBW spanning 600 MHz in a 30 kg form factor. Similarly, Nokia also announced its next generation Massive MIMO Habrok powered by ReefShark radios.

|

|

|

In short, Massive MIMO will continue to play a pivotal role with both 5G and 5G-Advanced, and the competitive landscape will remain fierce. The days of exponential growth are in the past but there is still more upside ahead to support TDD MBB expansions in the less advanced markets, FDD hotspot deployments, FWA, and TDD product refresh.