[wp_tech_share]

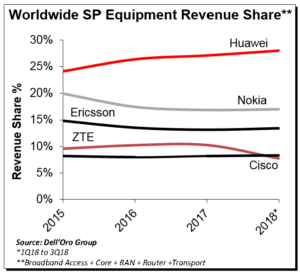

Below is a shortened version of some RAN related key takeaways from Huawei’s Mobile Broadband Backhaul (MBB) event, Ericsson’s Capital Market Day, and Nokia Global Analyst Forum. For access to the full blog, please contact Daisy@delloro.com

Forecasts are being adjusted upward

Based on some of the findings below, revised vendor projections, and the fact that the market recovery has become broader and stronger (RAN revenues accelerated at the fastest pace in 3Q18 since 2014), it is increasingly likely we will adjust total RAN (2G+3G+4G+5G) and 5G NR projections upward in conjunction with the January 5-Year RAN Forecast Report.

5G MBB business case is clear

With mobile data traffic still growing at an unabated pace—per Ericsson’s latest Mobility Report, mobile data traffic increased close to 79% YoY in 3Q18, recording the strongest growth since 2013—one of the overarching themes from multiple analyst events is that the 5G NR eMBB business case is obvious. Even the more conservative operators are now on board with regard to the 5G business case for eMBB applications—no one is asking anymore whether there is a business case for using more spectrum and utilizing it more efficiently.

5G MBB momentum is accelerating

Not only is 5G ready sooner than anyone expected, the momentum is still accelerating. In addition to the early adopters in Australia, China, Japan, Korea, U.S., and the Nordic countries, there are multiple signs that even the larger European carriers are planning to deploy 5G NR at a faster pace than originally envisioned. And with the trials in China being so large already, the Chinese operators will be able to accelerate commercial deployments rapidly when they are given the green light.

To be clear, 5G NR for MBB is materializing at a faster pace than most everyone expected. At the same time, 5G for Critical IoT / Ultra-Reliable Low Latency Communications (URLLC) is progressing in line with or at a slower pace than initial expectations.

Mid-band to drive MBB, mmW is on the rise

C-band and the 2.6 band are emerging as the global mid-bands.

Millimeter wave (mmW) technology has gone through different phases, with the general industry sentiment shifting from being very optimistic about 5G mmW four to five years ago, followed by increased skepticism and dampened projections for a couple of years, and now in 2018 it appears that the expectations for mmW are rising again. We also adjusted our mmW projections upward in conjunction with the July 5-year forecast update. There is a confluence of factors behind the renewed mmW optimism…

The business case for mid-band Massive MIMO is improving

Deploying 5G NR in the mid-band spectrum using the existing macro grid will yield the best ROI for operators seeking to increase the capacity and improve the average speeds for MBB applications. Given the different…

FWA RAN is growing—but still small relative to total RAN

With more than 200 networks worldwide using LTE to connect the unconnected, Huawei estimates about…

People are needed to deploy the equipment

While AI and automation will play an important role in managing the increased site complexity, a human being still has to climb the tower and install the equipment. According to Ericsson…

Excitement for IoT is growing

Massive IoT (mMTC) is driving the lion’s share of the IoT market today. But there is excitement forming over the Critical IoT (URLLC) use case which includes Industry 4.0. Vendors are forming partnerships and creating special BUs to prepare for this opportunity.

While there is no shortage of IoT and URLLC skeptics, vendors and operators are excited about the fact that the industry is moving from talking about various use cases to solving real problems. Nokia recently announced that it is working with ABB to demonstrate how URLLC can help to clear faults quickly for medium-voltage distribution networks. The leading suppliers are teaming up with operators and car manufacturers to carry out C-V2X demonstrations. The list of course goes on—Ericsson estimates there are more than…

Build it and they will come

This was a phrase Huawei used during its MBB summit, and since we agree with the general concept we thought it is appropriate to reuse. The underlying premise here is that we have now talked about the various 5G use cases for some time. And as much fun as it is to use Excel and PowerPoint to model the business cases for the unknown IoT use cases that are nearly impossible to predict, the technology is now ready and the time has come for action. Just like the operators are able to use their LTE MBB networks to minimize and justify the investments for NB-IoT and LTE-M, operators can leverage their NR MBB networks to minimize URLLC investments. One of the challenges with the URLLC networks is…

RAN product announcements to accelerate rapidly in 2019

There is no one-size-fits-all solution. On the contrary, the sites are getting more complicated because they not only need to support the new 5G NR systems, but they also need to coexist with existing legacy base stations. The C-band spectrum will vary by country. Site and load requirements will also vary depending on the country, but in general it is safe to assume that operators will need more capacity, wider bandwidth radios, smaller form factors, lighter products, and more energy efficient systems. Based on various announcements, the accelerating shift toward 5G, and the fact that the existing macro site will yield the best ROI, it is safe to conclude that RAN product announcements will accelerate at an explosive pace in 2019:

- During Huawei‘s MBB Summit, the vendor announced a massive number of new products, spanning across its entire RAN portfolio, aimed at giving customers the capacity and RF performance they need while at the same time addressing the site challenges discussed above.

- Ericsson announced during its capital market day that it is planning to introduce more than 100 radio products in 2019—that is not a typo, more than 100 radios.

- Nokia’s ReefShark chipset remains on track for the Massive MIMO antennas, digital front ends, and the baseband resulting in smaller antennas, improved power and cost optimization, and flexible baseband.

We just wrapped up the 3Q 2018 reporting period for all the Telecommunications Infrastructure programs.

We just wrapped up the 3Q 2018 reporting period for all the Telecommunications Infrastructure programs.