During the Huawei AirPON Commercial Release Conference last week, Huawei formally introduced its AirPON solution, a combination of a blade OLT (Optical Line Terminal) and Digital Quick ODN (Optical Distribution Network) equipment designed specifically to be deployed at existing cell sites. Though Huawei is first out of the gate with a blade-based OLT designed to deliver FTTH from distributed, non-cabinet locations, we fully expect to see other vendors address this space in the near future. The target market for the AirPON solution and those expected from competing vendors is existing mobile carriers looking to expand their service portfolio by adding FTTH (Fiber-to-the-Home) access by taking advantage of their existing cell sites and fiber infrastructure.

These distributed solutions aim to capitalize on the trend towards fixed-mobile convergence among global operators that have only recently been accelerated by the COVID-19 pandemic. The pandemic has shown that universal access to premium broadband services is absolutely critical, and operators are responding by ensuring they can provide premium broadband services across both their fixed and mobile networks. Additionally, the proliferation of national broadband plans or subsidized broadband expansion efforts include both fixed and mobile network options to speed the availability of broadband throughout entire countries.

AirPON Specifics

At the heart of the AirPON solution is an OLT on a blade that can be deployed either on a pole or the wall of a building. The unit can be installed alongside an existing cellular BBU (Baseband Unit) and either draw from an existing DC or AC power source or be deployed with a new power source. The blade OLT is environmentally hardened to withstand extreme temperatures and wind. The unit itself weighs less and is smaller than current strand- or pole-mount OLT nodes, because typical antenna installations on building rooftops are quite a bit smaller in diameter when compared with traditional utility poles.

The blade OLT a maximum of 1,024 subscriber connections, depending on the split ratio the operator selects and how much bandwidth they want to deliver. For mobile operators beginning to offer fixed broadband services, this range is ideal for addressing buildings where either cable, DSL, or 3G/4G fixed wireless connections were only available or where no fixed connections existed previously.

During the online event, Peter Lam of Hong Kong Telecom (HKT) noted that the AirPON solution allows them to deliver fiber services to over 700 villages in remote islands and rural areas of Hong Kong. For HKT, the AirPON solutions solve two significant issues: limited access to existing fiber and the typically high costs associated with delivering FTTH access. The vast majority of HKT’s FTTH offerings are via OLTs located in central offices. However, in remote areas, those central offices are often limited in their reach and limited in their ability to deliver FTTH connectivity.

In a similar presentation, Joel Agustin of the Philippines’ Globe Telecom, which is the country’s largest mobile network operator, noted that the AirPON solution allows the company to deliver residential broadband services, where it is estimated that the penetration rate remains near 20%. Some of the challenges that have hindered operators’ ability to deliver universal fixed broadband services in the Philippines include extremely long fiber spans, owing to an insufficient number of central office locations, particularly in suburban and rural areas, and extremely long times for civil works projects to be completed.

The historically long lead times to complete fiber deployment projects pushed Globe to consider using its existing base station locations as distributed central offices where they could co-locate the AirPON OLTs to reduce the time and cost required to roll out FTTH services. In the Philippines, the typical ODN distance for a CO-based OLT was 7km. By moving to a more distributed architecture using the AirPON solution, Globe was able to increase the number of distributed OLTs and reduce the ODN distance to 1-2km. The reduction in the distance reduces the total fiber infrastructure while also making it easier to secure right-of-way access to add in additional fiber strands to the individual OLT locations. Finally, the approvals and construction process is reduced significantly because Globe doesn’t need to set up additional cabinets to deploy the OLT. Instead, the blade OLT can be placed on the existing rooftop site, taking advantage of existing power supplies and optical backhaul cables.

From the OLT, the feed fiber connection can be dropped directly to an optical distribution point located either on a utility pole or in the MDU to then distribute fiber connections to individual subscriber homes. Globe is taking advantage of advances in ODN equipment and connections to be able to quickly turn up new subscribers while also identifying and isolating faults, such as fiber impairments. The new ODN equipment eliminates the need for fiber splicing using pre-connectorized cable, while also eliminating the need for the technician to open up the optical distribution point unit when connecting a new feeder cable.

Distributed solutions for FMC will continue to grow

The AirPON solution and other vendors expected to enter the market are targeted initially at mobile operators in the Asia-Pacific region who face similar network or geographic constraints as HKT and Globe Telecom, where the re-use of existing rooftop antenna sites for the blade OLT makes economic sense. Countries in Southeast Asia are particularly ideal candidates for the solution, assuming they have determined that the competitive environment and ROI make it feasible to begin rolling out an FTTH service.

Beyond Southeast Asia, these solutions can be applied to operators in Central and South America, as well as parts of Europe, the Middle East, and Africa. Again, with operator consolidation occurring more frequently and with mobile and fixed technologies and architectures beginning to merge, solutions that distribute traditional CO-based platforms are certainly viable technology options. In many cases, there is simply no cost-effective way to deliver FTTH services to rural areas without a distributed platform that allows the operator to build out an FTTH service incrementally. The additional benefit of the AirPON solution and others that will enter the market is that operators can also re-use their existing investments in rooftop antenna locations to help further improve the ROI and overall business case of deploying FTTH.

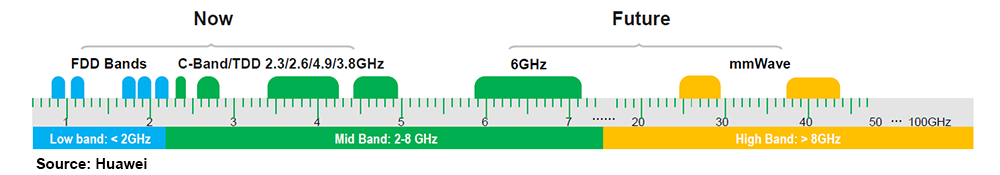

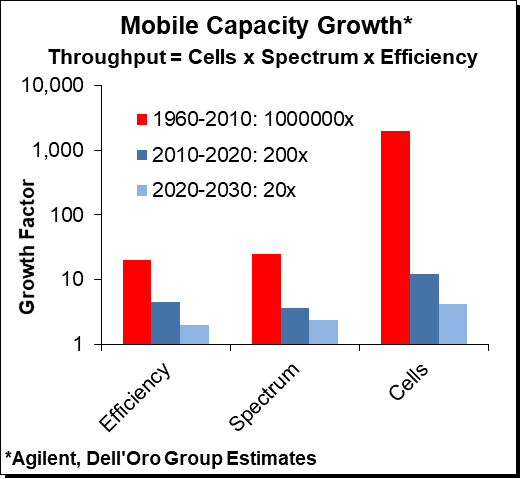

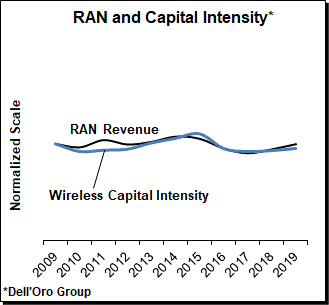

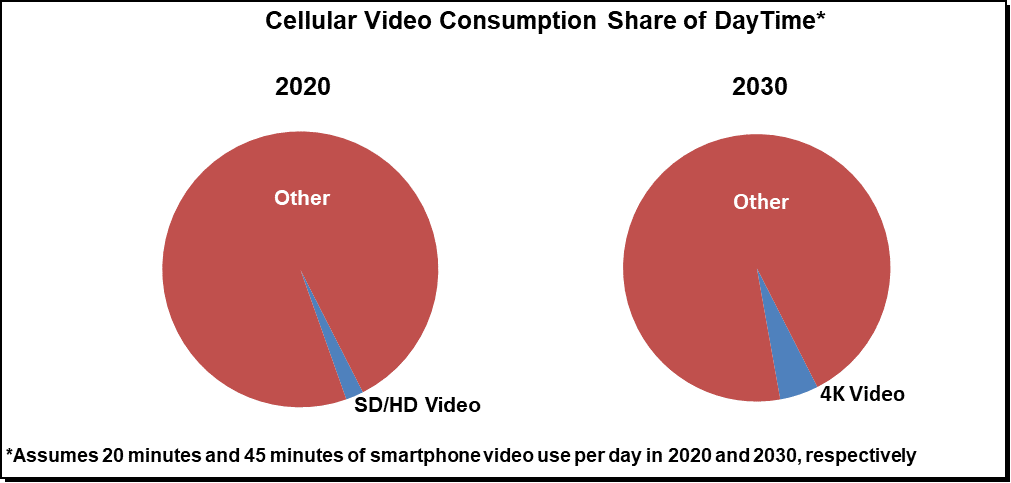

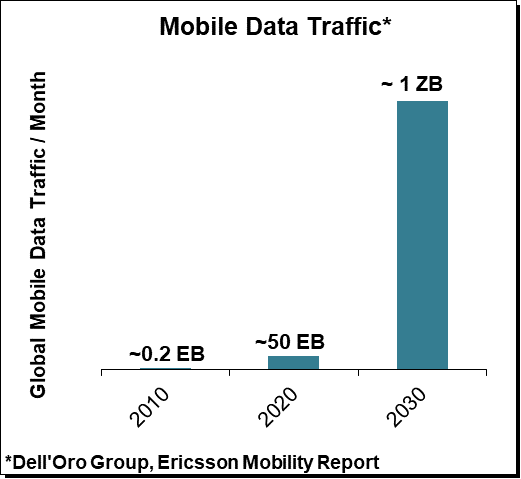

With 5G now being deployed at full speed in the sub 6 GHz spectrum utilizing both the low-band and the upper mid-band, the focus is shifting to the next spectrum frontier. Even if the upper mid-band in conjunction with Massive MIMO has been a tremendous success story both from an economic and technical perspective providing far more aggregate capacity and throughput upside at a much lower capex than initially envisioned, the baseline scenario suggests mobile data traffic is projected to advance another 15x to 25x over the next decade, surpassing 1 Zettabyte (ZB) per month by 2030. While Massive MIMO and the sub 6 GHz spectrum will go a long way delivering another 5x to potentially 15x of upside, it will likely not be enough to meet the capacity demands of the next decade given the economic constraints the operators are facing.

With 5G now being deployed at full speed in the sub 6 GHz spectrum utilizing both the low-band and the upper mid-band, the focus is shifting to the next spectrum frontier. Even if the upper mid-band in conjunction with Massive MIMO has been a tremendous success story both from an economic and technical perspective providing far more aggregate capacity and throughput upside at a much lower capex than initially envisioned, the baseline scenario suggests mobile data traffic is projected to advance another 15x to 25x over the next decade, surpassing 1 Zettabyte (ZB) per month by 2030. While Massive MIMO and the sub 6 GHz spectrum will go a long way delivering another 5x to potentially 15x of upside, it will likely not be enough to meet the capacity demands of the next decade given the economic constraints the operators are facing.